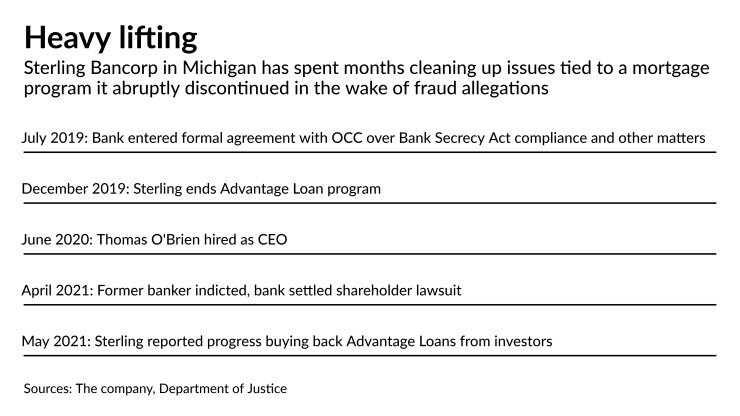

Sterling Bancorp in Southfield, Michigan, is closer to turning the corner from lingering issues tied to a defunct mortgage program.

The $3.7 billion-asset company, which has been dealing with fallout from alleged fraud in what once was its biggest business line, earned $2.3 million in the first quarter after losing about $27 million over the prior five quarters.

Sterling, under CEO Thomas O’Brien, has also announced a few branch sales and the resolution of a

The developments have provided some optimism for those who cover the company.

“Following a couple quarters of [losses], the first-quarter’s positive results were a welcome sight,” Ben Gerlinger, an analyst at Hovde Group, wrote in a Monday client note.

“We believe Sterling is sitting on its starting blocks for what is likely to be a 12-month leg of” improved investor returns, Gerlinger added.

O’Brien, who

Settling the shareholder lawsuit “puts one more impediment in the rear-view mirror,” O’Brien said Monday during a conference call. He said a review of past transaction activity, mandated as part of a

“That’s been an expensive proposition for the bank and the company,” O’Brien said.

Sterling’s legal and professional fees for the first quarter totaled $8.8 million, or 41% of noninterest expenses. Those fees totaled $32.6 million last year.

“It’s our expectation that the second half [of 2021] will start to see the gradual diminution of these extraordinary expenses,” O’Brien said.

Sterling, which had roughly $1.1 billion of cash on its balance sheet on March 31, should have more chances to redeploy deposits. The company built the liquidity to support buybacks of Advantage Loan mortgages from outside investors.

The company

Sterling expects to repurchase a block of Advantage Loans, ranging from $150 million to $160 million, this quarter and a smaller $30 million portfolio next year. The company bought back $88 million of mortgages last year.

“Those who were taking us up on our [buyback] offer have pretty much raised their hands,” O’Brien said.

Repurchased Advantage Loans have performed in line with Sterling’s other mortgages, O’Brien said.

“There might be some slow pays and there might be, obviously, just regular performing loans,” O’Brien said. “For the most part, the nonaccrual percentages have been no worse than what we've seen at the bank.”

With the outlook on the defunct mortgage program improving, O’Brien is focusing more on Sterling’s $448 million of construction and commercial real estate loans. He said increased charge-offs in that portfolio are “undoubtable,” though the company’s $72 million loan-loss allowance should be sufficient to cover any losses.

The legal focus tied to the Advantage Loan program also seems to be shifting away from the company and more toward former executives and employees.

The Department of Justice recently charged Sterling’s former managing director of residential lending with conspiracy to commit bank and wire fraud. The Justice Department claims that Yihou Han accepted falsified documents and financial histories that resulted in mortgages for individuals involved in money-laundering and tax-evasion schemes.

Han made nearly 1,300 Advantage Loans totaling $684 million between 2011 and 2019, generating $3.4 million in commissions, according to the indictment. Overall, Sterling made about $5 billion of Advantage Loans, according to court documents.

Han’s lawyer did not respond to a request for comment.

Though Han is the only Sterling employee identified in the indictment, the Justice Department implicated several former executives, including a claim that the bank’s “founder and majority shareholder … provided oversight over the management of [Sterling] including its residential loan programs.”

The indictment alleges that Han worked closely with other senior executives to develop and expand the Advantage Loan program. She became managing director of lending in 2018 and, around the same time, began attending sales meetings “during which the Advantage Loan program’s performance was discussed,” the indictment claims.

Scott Seligman founded Sterling Savings and Loan Association, a predecessor bank, in 1984. Family trusts tied to the Seligman family still own more than half of Sterling’s stock, even after selling $115 million of stock as part of the company’s 2017 initial public offering, according to regulatory filings.

While Seligman declined to discuss the Justice Department’s investigation, he said the Advantage Loan program was created to provide financing opportunities to the Chinese American community.

“We built a culture of trust and service with a minority community that had a language barrier and a cultural approach to debt … that made it difficult for them to get credit,” he wrote in a Thursday email. “This is a culture that generally abhors debt. The Advantage program allowed borrowers to compete with all-cash offers on terms that recognized the cultural preferences.”

Seligman said it comes as “no surprise” to him that Advantage Loans continue to perform well.

“When I was an advisor to the bank, defaults were virtually unheard of,” he wrote in the email. “I believe the foreclosure rate is literally zero.”

O’Brien, who said Sterling is cooperating with investigators, added in an interview that Han’s indictment document “speaks for itself.” He said during the conference call that the Justice Department “has begun to take action against certain individuals and we anticipate that effort will continue.”

Han’s indictment can be viewed as a sign that “the formal investigation has moved beyond the bank and squarely to the bad actors,” Gerlinger wrote in his note.

“While still fairly early, we continue to believe Sterling is likely to see a meaningful update regarding its government investigations” in the second half of 2021, Gerlinger added.