-

CEO-designate Gunjan Kedia said payments growth is critical to the Minneapolis-based regional's overall success. Dealmaking will take a back seat to organic growth for the time being, she added.

February 11 -

The largest U.S. bank will likely record lower net interest income and higher expenses in 2025 than Wall Street had forecast, a top executive said Tuesday.

September 10 -

The New York-based company saw assets under custody and management jump, driving strong increases in both fees and overall revenues for the quarter ending June 30.

July 12 -

The top 200 publicly traded banks with less than $2 billion of assets capitalized on their strong loan portfolios and interest income. But given a shift in the economic environment and banking industry, performance challenges are expected to intensify through 2023.

June 12 -

Click here for an overview of No. 1-10 on American Banker's annual list of the highest-performing banks with less than $2 billion of assets and a full breakdown of all the banks on the roster.

May 17 -

The Wisconsin company’s growth initiative, expected to be unveiled by mid-September, will fund both a bigger commitment to online banking products and a push to expand in new and existing markets.

July 23 -

The best-performing banks' revenue rose at nearly twice the rate of expenses thanks to mortgage refinancing and the Paycheck Protection Program.

May 14 -

The Pennsylvania company will offer commercial loans and treasury management services after hiring bankers in Dallas and Orlando.

May 12 -

The purchases of Truck Insurance Specialists and Hometown Insurance are expected to help the company expand its dealings in transportation and agriculture.

May 4 -

The community banks join a growing list of banking companies closing locations as customer preferences shift to digital channels.

April 28 -

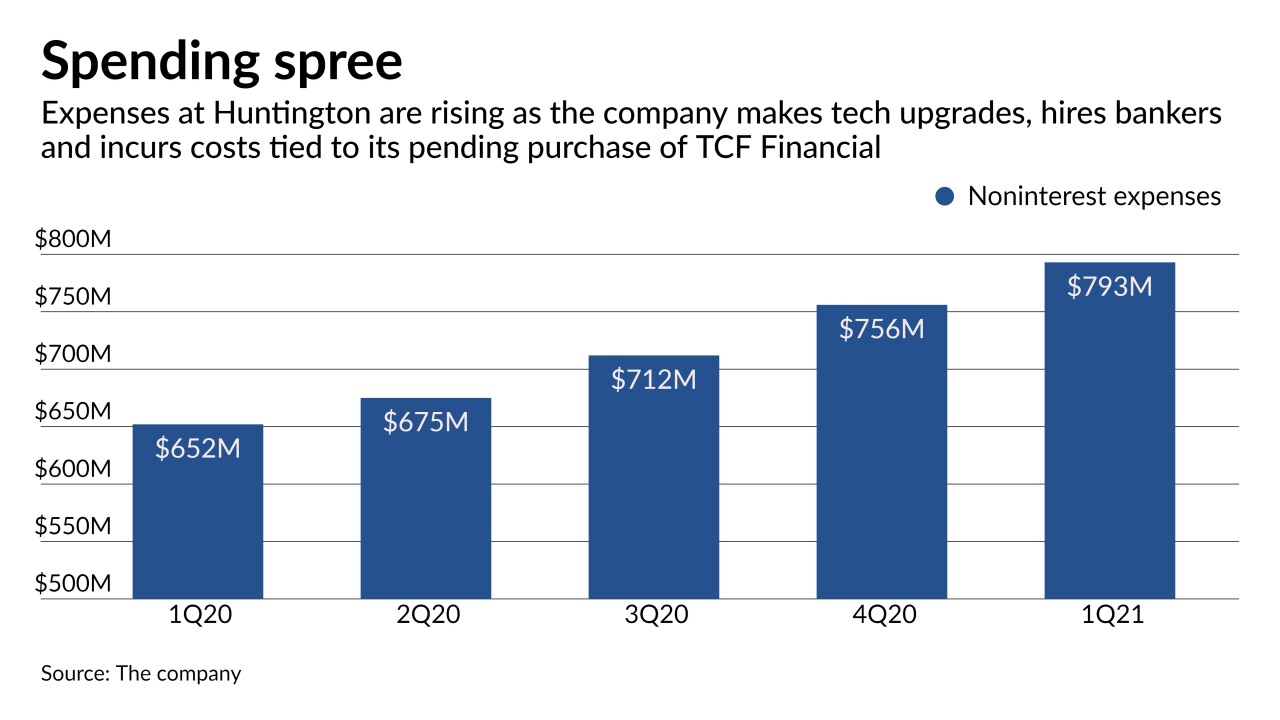

The Ohio regional took advantage of an unexpected boost in interest income in the first quarter to upgrade its digital platform and recruit bankers in wealth management, capital markets and Small Business Administration lending.

April 22 -

The Tennessee company says it has been pitching specialty finance products inherited from Iberiabank to its own clients.

April 21 -

The San Antonio company will no longer charge fees on transactions of $100 or less that take checking account balances into negative territory, as long as the customer has a $500 monthly direct deposit set up.

April 15 -

Loan growth and wealth management revenue drove a 53% increase in the San Francisco bank's profit from a year earlier.

April 14 -

The Mississippi company has never done a deal this large. But buying Houston-based Cadence would take it into high-growth markets and reduce both companies' concentrations in sectors such as energy, dining and hospitality.

April 12 -

Valley National wanted to become more customer friendly, while Washington Federal needed more commercial clients. The leaders of those companies recently discussed the tough decisions they made to bring about much-needed change.

April 9 -

The Michigan company recently paid $70 million to close the books on a matter dating to the last financial crisis.

March 31 -

The economy is poised to rebound, meaning loan demand and hiring will pick up, some observers say. Others argue that banks have plenty of reasons to cut jobs given industry consolidation, the growth of digital banking and expectations that low interest rates will persist.

March 29 -

Fees from forgiven Paycheck Protection Program loans are providing a short-term lift, but balance sheets are shrinking and it isn't clear what will drive future growth.

March 21 -

The Indiana company said the move reflects a need to cut costs and customers' increased preference for digital channels.

March 15