-

A new report from McKinsey says that cost-cutting alone won’t make up for the steep revenue declines brought on by low interest rates and sluggish loan demand. “For some banks,” argues the report’s author, “mergers might be the best way out.”

By Jon PriorDecember 15 -

The Amarillo company is buying First National Bank of Tahoka, continuing the industry’s consolidation in the state.

By Jon PriorDecember 14 -

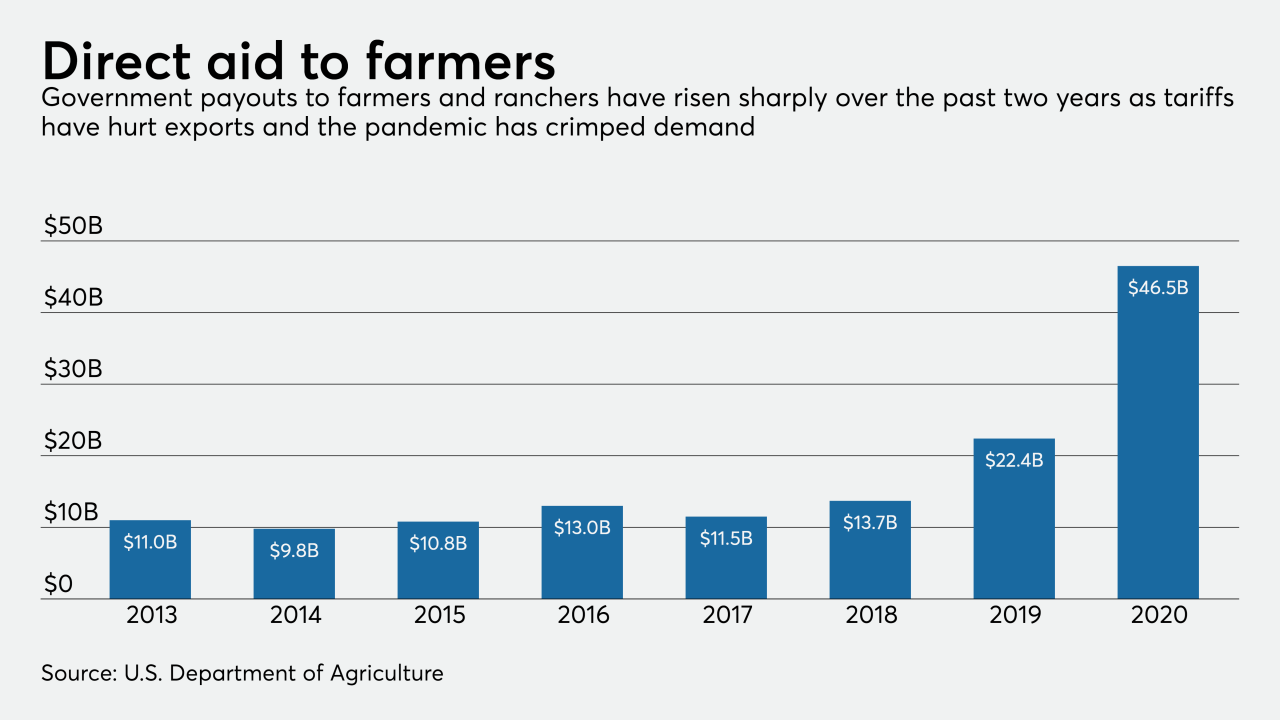

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

By Jon PriorDecember 10 -

Executives from U.S. banks continue to play down near-term expectations, but they say customers are growing more confident ahead of the rollout of coronavirus vaccines, and that key commercial lending segments could drive an economic rebound.

By Kevin WackDecember 8 -

As Congress moves to spur more coin production, banks and retailers are running campaigns urging consumers to empty their piggy banks to get more change into circulation.

By Jon PriorDecember 3 -

The Georgia lender has hired bankers away from Wells Fargo to build a new ag lending team that will look to capitalize on soaring lumber demand in its home state.

By Jon PriorDecember 2 -

Community banks that were pushed past key asset limits by the Paycheck Protection Program say they will be unable to shrink their balance sheets back to normal size by the 2022 deadline, especially if there is a new round of rescue aid.

By Jon PriorNovember 25 -

The Office of the Comptroller of the Currency says JPMorgan Chase’s fiduciary unit lacked sufficient controls to manage risk and avoid conflicts of interest.

By Jon PriorNovember 24 -

Participation in the Paycheck Protection Program and other emergency lending during the pandemic has swelled many small banks’ balance sheets. Federal regulators are giving them a temporary pass on supervisory requirements tied to their size.

By Jon PriorNovember 20 -

Just a few months after signaling that provisions for loan losses had peaked, many banks are planning to once again add to reserves to guard against pandemic-related defaults, according to a survey released by IntraFi Network.

By Jon PriorNovember 19