Kate Fitzgerald is an Arizona-based senior editor for American Banker and longtime payments reporter. Fitzgerald began her journalism career at the San Diego Tribune, and has worked as a reporter and editor at several other publications, including Advertising Age and the Arizona Republic. She is a graduate of Lewis & Clark College and holds a master’s degree from Northwestern University’s Medill School of Journalism.

-

Mastercard launches service to fight instant-payment fraud, EU may green-light Apple's NFC-access plan, and more.

April 24 -

A new Citizens Bank survey suggests rising check-fraud incidents are driving middle-market companies to accelerate plans to fully adopt digital payments. But 70% of all businesses will continue to rely on checks for years to come, according to recent data from the Association for Financial Professionals.

April 23 -

Powered by younger, affluent cardholders, American Express saw a 6% increase in billed business during the first quarter, while weak growth still plagues its small-business segment.

April 19 -

Amid healthy first-quarter loan growth and improving credit quality, Discover Financial Services slashed its profits by $800 million to offset remediation costs from a 16-year period when it overcharged certain merchants.

April 18 -

U.S. customers who have previously used Sweden-based Klarna's buy now/pay later financing — and paid off their loans in full — will be prequalified for interest-bearing loans through a new version of the Klarna Visa card rolling out later this year.

April 17 -

Ant Group's Alipay is linking to Pakistan's NayaPay as part of a push to support tourism to China, Revolut has obtained a license from Mexico's National Banking and Securities Commission, and more.

April 17 -

When its broad-spectrum payment card fraud-detection filters generated too many false alarms, FIS implemented AI to help banks prioritize which types of fraud to investigate first, in part by muting lower-risk notifications.

April 16 -

With the cruise industry gaining steam after the pandemic, it no longer made sense to force passengers to sign up for a credit card with paper forms. The new process allows applicants to obtain credit they can use in any port — including Carnival's upcoming private island in the Bahamas.

April 12 -

Mastercard established a new structure for businesses focused on card acceptance and transaction processing, new payment flows and value-added services. Separately, the Federal Reserve Bank of New York is joining several countries' central banks in a test of tech to support cross-border transactions.

April 10 -

To help historic restaurants facing dramatic losses when COVID struck, American Express rolled out grants to 25 needy restaurateurs. Four years later, the program is reaching twice as many establishments and the card network's investment has more than doubled.

April 8 -

The credit and debit card-issuing giant's Chase Media Solutions will help fund new loyalty programs to offset downward pressure on card-swipe fees and the potential erosion of card spending volume from the rise of faster payments and open banking, experts say.

April 4 -

Visa is working with Thunes; LemFi and Western Union to expand its reach; Swift has completed testing of 38 global digital currencies, and more.

April 3 -

Ambitious women who feel trapped in their roles sometimes find themselves competing against others with the same goals. An effective way to advance may require stepping off the most obvious path, according to executives sharing their personal experiences at American Banker's Payments Forum.

April 2 -

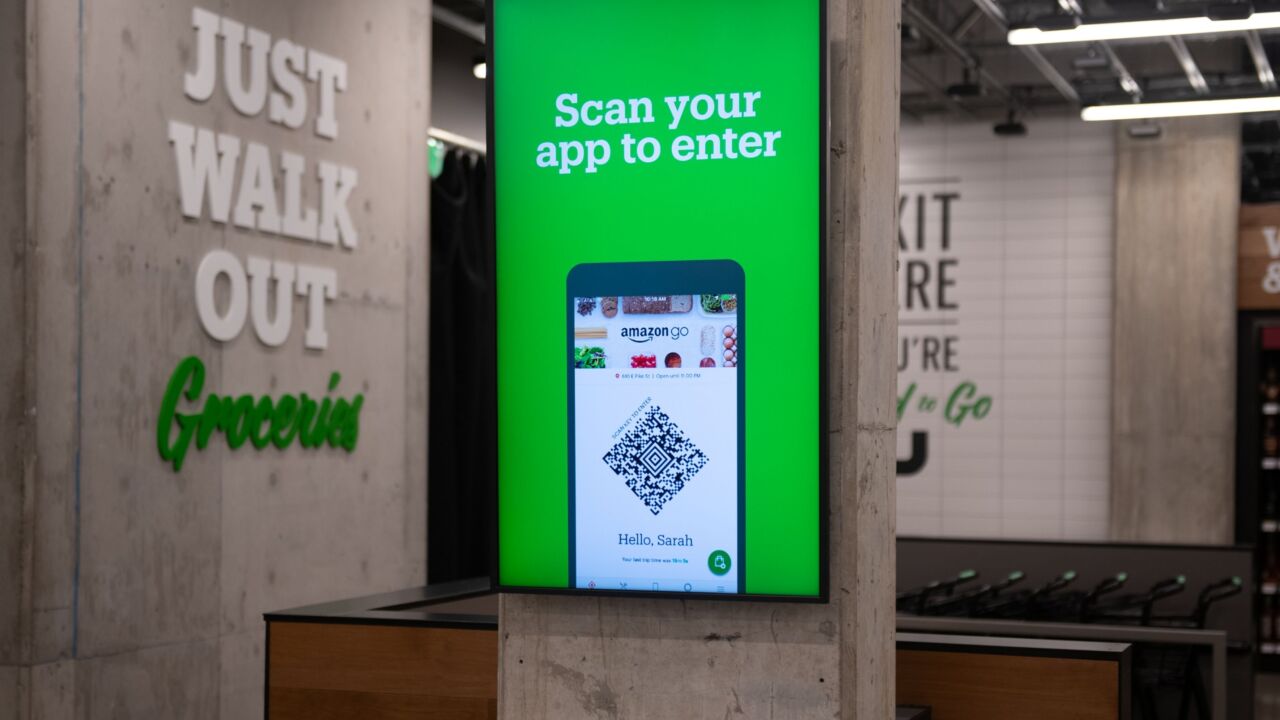

Amazon is working with Stripe to expand its Just Walk Out retail stores in Australia and Canada; Safaricom is working with Onafriq to support remittances sent via M-Pesa to Ethiopia; and more.

March 27 -

A new crop of AI-powered products from Visa tackles scams beyond the company's network to include account-to-account payments and digital wallets.

March 27 -

Criminals who buy and sell consumer data on the dark web are perpetrating increasingly complex credit and debit card fraud schemes, according to the card network's latest threats report.

March 21 -

The fast-food chain is analyzing the cause of an issue that affected payments in multiple countries. Separately, dLocal, a payments processor in Uraguay, is making changes at the top.

March 20 -

Despite fresh waves of online fraud and scams, czars of social media platforms, peer-to-peer networks and blockchain products have renewed ambitions to marry financial services with social apps.

March 18 -

The pandemic reduced the number of daily mass-transit commuters, but the accompanying surge of contactless payments is expanding and diversifying transit systems' demographic reach, according to data from the card network.

March 14 -

The U.K. is considering a bill that would let banks and payment service providers put suspicious-looking peer-to-peer payments on hold for up to four days to conduct security reviews; Giesecke+Devrient is working with Brazil's central bank to develop an offline payment approach to a central bank digital currency; and more in global payments news this week.

March 13