Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

The embattled firm is offering financial incentives in an effort to kick-start lending, but compliance-focused banks have been slow to respond.

By Kevin WackAugust 9 -

Lending Club announced the resignation of its chief financial officer while reporting an $81.4 million quarterly loss due largely to fallout from the scandal that rocked the firm in May.

By Kevin WackAugust 8 -

The scandal-plagued marketplace lender is set to report earnings Monday, and the results aren't likely to be pretty. The big question going forward is how quickly can it reverse the damage and win back the trust of investors.

By Kevin WackAugust 5 -

Green Dot profits more than doubled to $8 million in the second quarter as revenues rose slightly and expenses ticked down.

By Kevin WackAugust 5 -

Green Dot profits more than doubled to $8 million in the second quarter as revenues rose slightly and expenses ticked down.

By Kevin WackAugust 4 -

During a conference call with analysts on Thursday, executives at Ally Financial sought to dispel concerns that losses may soon rise in the lender's $63 billion retail auto loan portfolio.

By Kevin WackAugust 4 -

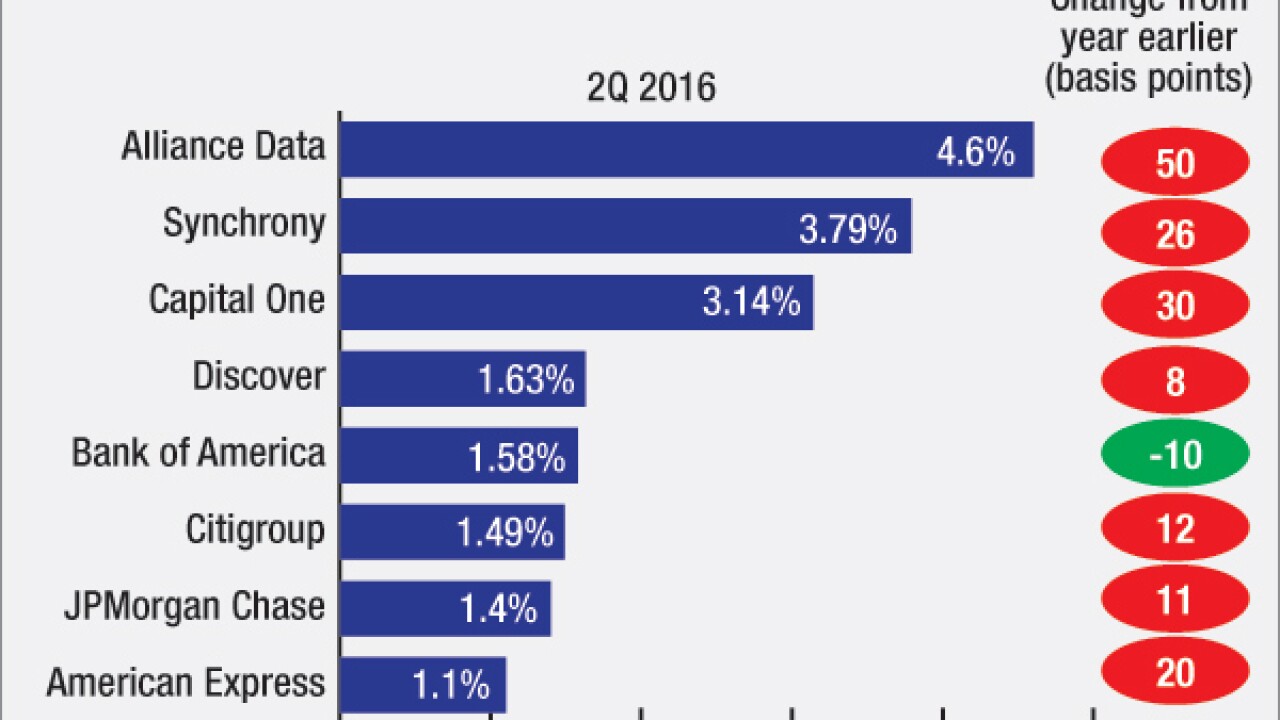

Some big banks are venturing further down the risk spectrum after a long period of unusually strong credit performance.

By Kevin WackJuly 22 -

Synchrony Financial enjoyed strong loan growth in the second quarter, but gains in interest income were more than offset by a larger provision for losses.

By Kevin WackJuly 22 -

Profits rose by 9% at Capital One Financial during the second quarter thanks to strong growth in the firm's credit card and commercial banking businesses.

By Kevin WackJuly 22 -

Profits rose by 9% at Capital One Financial during the second quarter thanks to strong growth in the firm's credit card and commercial banking businesses.

By Kevin WackJuly 21