Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

The Federal Savings Bank is trying to persuade a judge to look beyond its CEO's alleged complicity in a fraud perpetrated by President Trump's former campaign chair.

By Kevin WackNovember 29 -

The card is being launched in partnership with U.S. Bancorp, which will handle the underwriting and provide the credit.

By Kevin WackNovember 28 -

His knack for public policy, dedication to technological improvements once considered the province of big banks, and willingness to tear up a business model that he and his father built make him our top Best in Banking honoree.

By Kevin WackNovember 25 -

Unlike online lenders, banks are focusing primarily on consumers with solid credit scores. But unsecured loans to prime borrowers have a limited track record, so it’s hard to predict how they’ll perform when the economy inevitably weakens.

By Kevin WackNovember 22 -

Adults ages 18 to 29 may have a hard time getting a mortgage, but they are not shying away from other forms of consumer debt, according to a report by the New York Fed.

By Kevin WackNovember 16 -

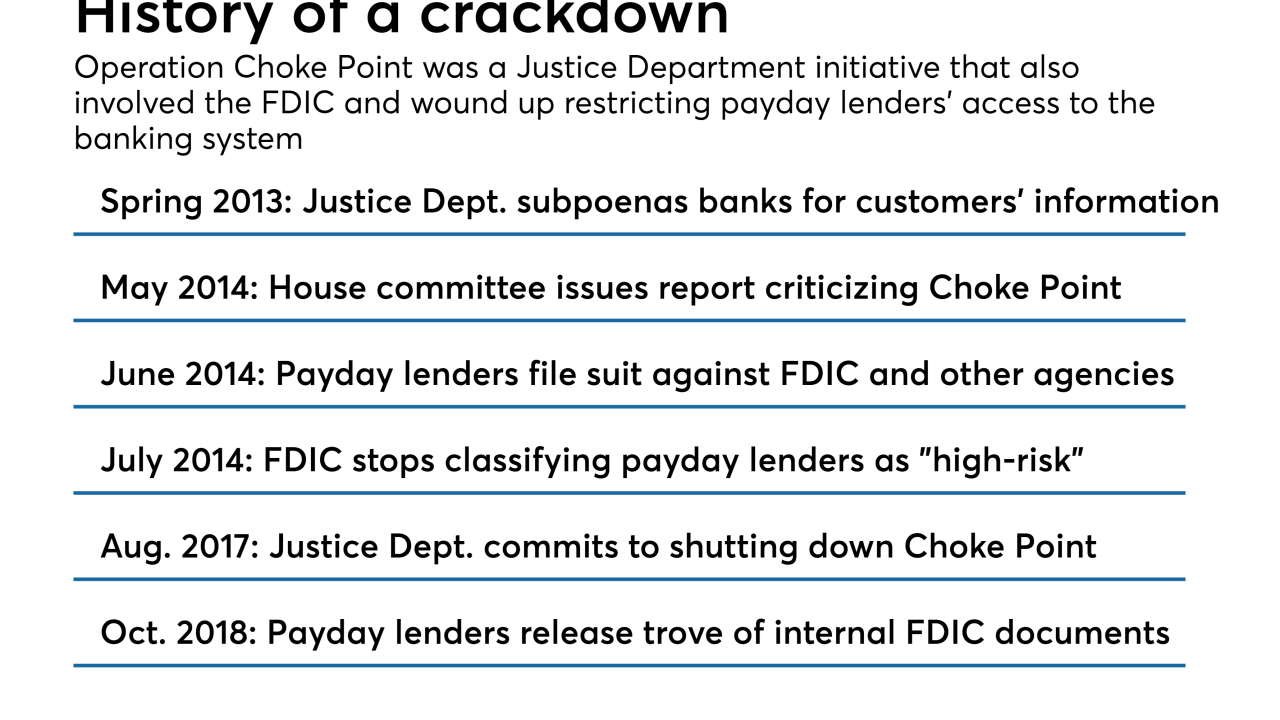

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

By Kevin WackNovember 16 -

The bank recently notified an upstate New York man that he was wrongly denied a mortgage modification, and enclosed a $25,000 check. But details of what went wrong have been hard to come by.

By Kevin WackNovember 13 -

Top executives at Advance America acknowledged that anti-money-laundering concerns at banks were likely the cause of account terminations, even as they publicly blamed a stealth regulatory campaign.

By Kevin WackNovember 12 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

By Kevin WackNovember 8 -

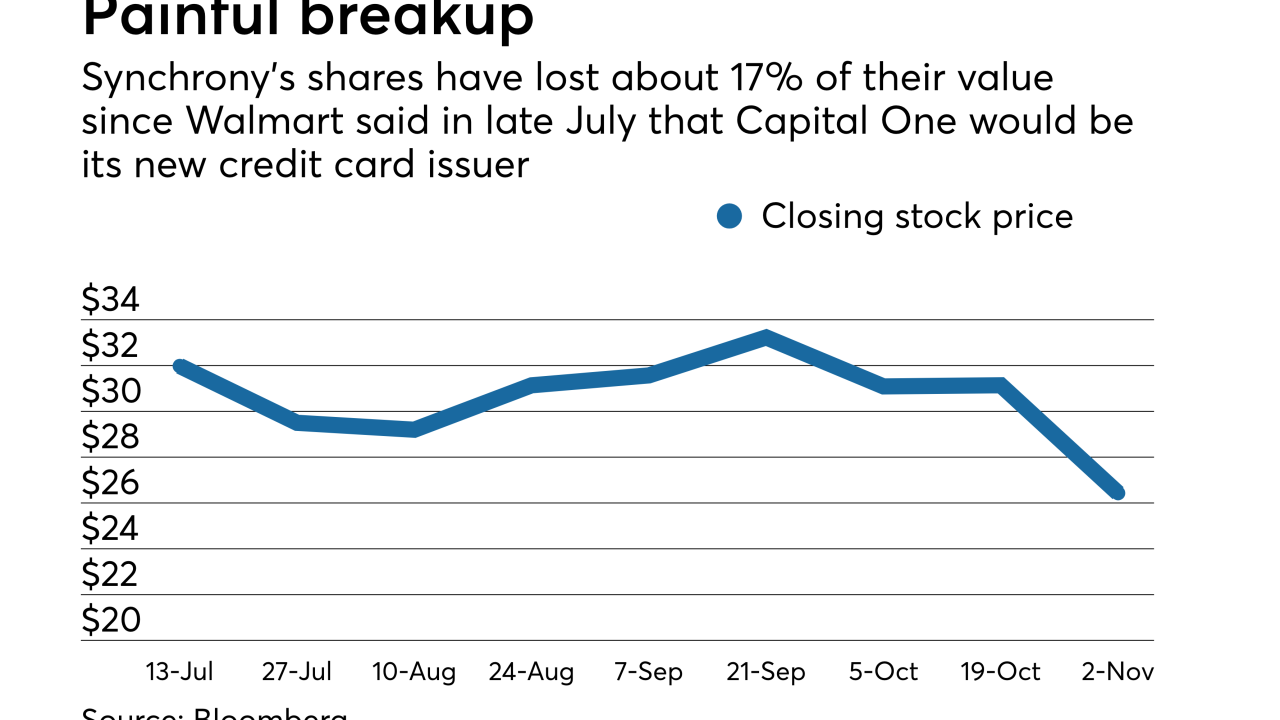

After the retail giant filed an $800 million lawsuit against its former credit card partner, shares in Synchrony plunged. Now analysts fear its relationship with Sam’s Club may be in jeopardy.

By Kevin WackNovember 7