Lalita Clozel covers fintech regulation, anti-money-laundering, cybersecurity and the Federal Deposit Insurance Corp. in American Banker's Washington bureau.

-

The OCC might also open up an outpost "where the tech firms are," the Comptroller of the Currency said Tuesday.

June 14 -

The Federal Deposit Insurance Corp. was able to access emails between staff at the agency's Office of Inspector General in a possible violation of the watchdog agency's independence, the FDIC confirmed Monday.

June 13 -

WASHINGTON Ripple Labs obtained a virtual currency license from the New York State Department of Financial Services on Monday, making it the fourth company with a BitLicense.

June 13 -

WASHINGTON A House committee probing the Federal Deposit Insurance Corp.'s cybersecurity practices has accused the agency of accessing internal documents from the FDIC's inspector general.

June 10 -

Fintech companies are asking a federal regulator to create a specialized charter that would allow them to comply with federal rules instead of facing a state-by-state licensing framework.

June 10 -

Fintech companies are asking a federal regulator to create a specialized charter that would allow them to comply with federal rules instead of facing a state-by-state licensing framework.

June 10 -

Bankers are challenging the cost of a contentious Federal Deposit Insurance Corp. plan that would require banks to regularly update their insured deposit data, arguing it is much more expensive than the agency estimated.

June 9 -

The Federal Reserve Board and Federal Deposit Insurance Corp. on Wednesday gave the four systemically important foreign banks one additional year to file their living wills.

June 8 -

Federal regulators issued a statement Tuesday reminding banks how they can protect themselves from cyberattacks.

June 7 -

Federal regulators issued a statement Tuesday reminding credit unions and banks how they can protect themselves from cyberattacks.

June 7 -

The Financial Crimes Enforcement Network violated the U.S. Constitution by singling out a Tanzanian bank as a money-laundering concern without due process, the bank claimed late last week.

June 6 -

A lack of liquidity wasn't what caused most of the largest U.S. banks to fail their living wills test, a Federal Deposit Insurance Corp. official said Thursday.

June 2 -

The Federal Deposit Insurance Corp. has reached a $190 million settlement with eight large financial institutions over residential mortgage-backed securities claims as the receiver of five banks that failed during the crisis.

June 2 -

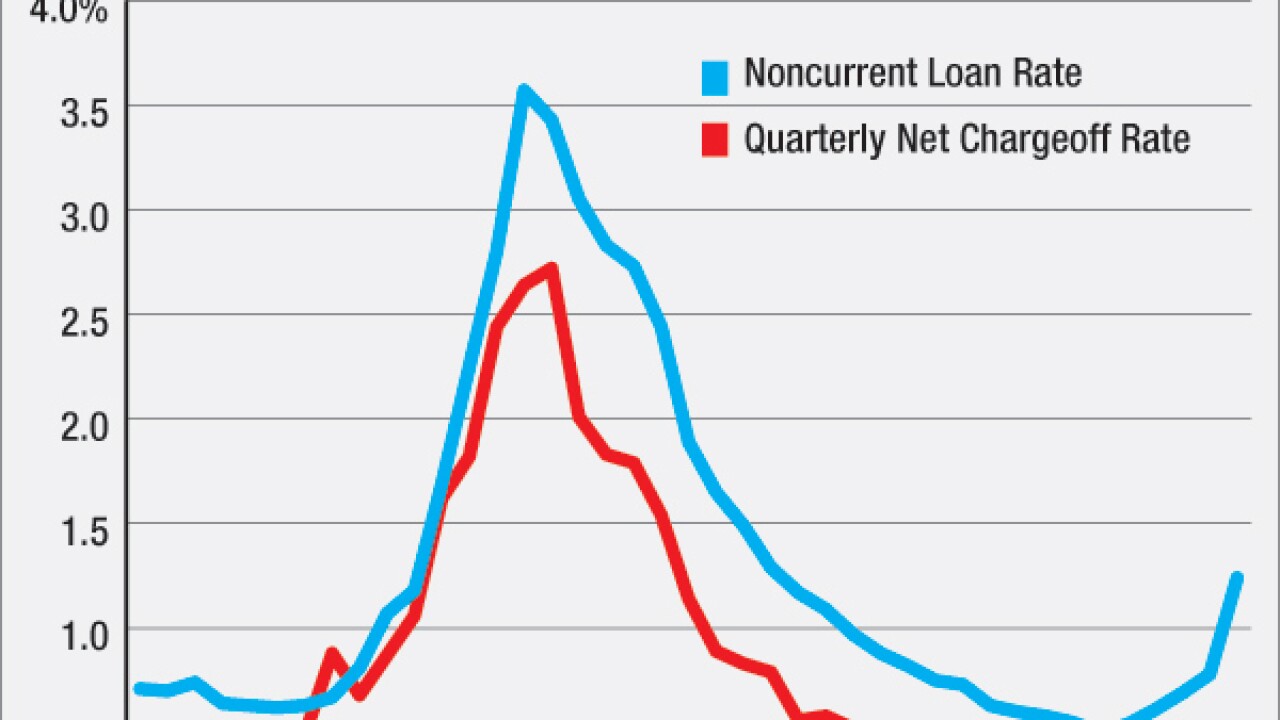

While there were positive signals like loan growth and improved interest margins in the Federal Deposit Insurance Corp.'s first-quarter report card, there were also signs of trouble for the future, including larger institutions' ongoing exposure to the energy sector.

June 1 -

Ties to the energy sector hurt the banking industry in the first quarter as earnings fell 1.9% to $39.1 billion compared with a year earlier, the Federal Deposit Insurance Corp. said Wednesday.

June 1 -

Allison Aytes, a former Federal Deposit Insurance Corp. employee in its Office of Complex Financial Institutions, is under investigation by federal authorities for allegedly stealing big banks' living will data on her last day of employment.

May 31 -

Smartphones are an important window into understanding underbanked customers, the Federal Deposit Insurance Corp. said in a report released Wednesday in conjunction with a meeting of the agency's advisory committee on economic inclusion.

May 26 -

WASHINGTON The Federal Deposit Insurance Corp. is set to release its Quarterly Banking Profile for the first quarter of this year on June 1.

May 26 -

Smartphones are an important window into understanding underbanked customers, the Federal Deposit Insurance Corp. said in a report released Wednesday in conjunction with a meeting of the agency's advisory committee on economic inclusion.

May 25 -

Regulators appear to have made the right call in failing most of the largest banks' living wills, but it's hard to tell given the dearth of publicly available information, a new government report suggests.

May 25