Mary Wisniewski is deputy editor of BankThink. She also writes on a variety of subjects as part of American Banker's bank tech team. Previously, she was a blogger and editor at Bank Innovation. She also served as a fashion editor for National Jeweler, where she reported on fashion shows and jewelry news. Her work has also appeared in Billboard, Cracked and a number of business media outlets. Mary grew up in the Michigan suburbs and now lives in L.A. with a maltipoo, two record players and an espresso machine. Mary is endlessly curious and follows anything that grabs her. Current interests include fintech, literature, travel, good conversation, Cat Stevens and Gidget.

-

Big banks with innovation labs see them as a way to improve the customer experience and to test new ideas in an industry facing disruption. Skeptics see potential for waste.

July 15 -

As bank customers tastes turn away from branches and toward mobile devices, banks are trying to replace the customer standby, the 800-number, with more modern communication media like SMS text and WhatsApp.

July 10 -

Digital-only Atom Bank in the U.K. recently won a banking license a feat U.S. fintech entrepreneurs have either failed to accomplish or not bothered trying, instead partnering with established institutions.

July 7 -

As manufacturers increasingly equip automobiles with Internet access, bankers and technologists are envisioning a day when cars could be used to make payments, inform risk underwriting and deliver targeted offers.

June 30 -

Applying early for the web extension increases the odds of getting a preferred address in a business where "First National" is as common as "John Smith." Eventually, bankers hope .bank gains widespread recognition as a mark of trustworthiness.

June 25 -

A growing number of startups and banks are trying to design digital experiences that train users to manage their money more responsibly, starting with small amounts in mundane situations.

June 23 -

Credit unions arent the only financial services firms reaching out to millennials. A new social media campaign by Fifth Third offers recent college graduates free one-on-one career counseling. The initiative is part of a trend of banks allocating marketing dollars to unusual perks and charitable giving to differentiate their brands.

June 16 -

A new Fifth Third social media campaign offers recent college graduates free one-on-one career counseling. The initiative is part of a trend of banks allocating marketing dollars to unusual perks and charitable giving to differentiate their brands.

June 16 -

A call to improve customers' digital-banking experience was the top theme during SourceMedia's Digital Banking Summit. Banks should imitate the Apples and Googles of the world, not each other, experts said.

June 12 -

Citi was one of the first banks to open its application programming interfaces to outside developers, leading a movement that's picking up momentum. For this and other efforts, Bank Technology News has chosen Heather Cox as its top 2015 Digital Banker of the Year.

June 9 -

WSFS Bank has teamed up with ZenBanx, a fintech startup founded by a pioneer of direct banking, Arkadi Kuhlmann. WSFS will be the first in the U.S. to power a mobile account that lets users park money in up to five currencies and send remittances. The partnership is the latest example of a traditional bank trying to inject innovation into its culture.

June 3 -

A specialized Wells Fargo branch in Des Moines and the nonprofit Digital Finance Institute are part of a small but growing movement to improve access to financial services for emigres who have escaped war or persecution.

May 29 -

Namu is trying to solve a problem facing all banks that vie for millennials' attention: how to make the mobile banking experience more appealing. Its app refreshes users' memories of transactions with images illustrating what they bought.

May 27 -

A handful of banks are upgrading their apps with Siri-like "virtual assistants" that understand spoken questions at a time when most institutions don't even let digital customers do typed keyword searches of their transaction data.

May 20 -

As banks compete for tech talent against the Ubers and Amazons of the world, a new startup called untapt offers algorithmic matching of workers and bank tech jobs.

May 13 -

Wells Fargo and other banks are testing the use of mobile devices to authenticate consumers in the drive-through lane. The pilot, designed to expedite service and improve security, serves as the latest example of a growing trend: preordering banking services via digital devices.

May 7 -

After the early exuberance surrounding Apple Watch, banks and vendors are ramping up testing of bank apps on other wearable devices and everyday objects, preparing for a day in which most everything is connected to the Internet.

May 5 -

Citigroup and other banks are increasingly looking to startups to help them compete in a world in which Google, Apple and other tech firms are rapidly becoming potential threats.

April 30 -

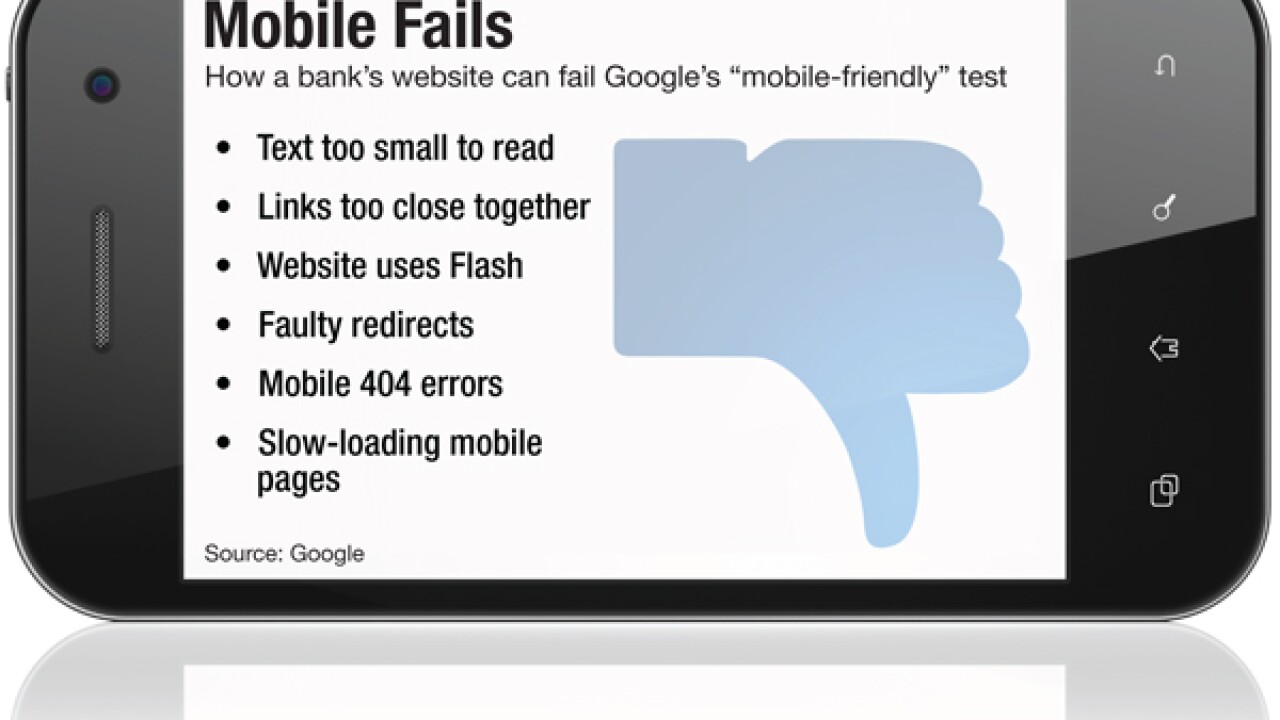

Many banks will need to invest in making their websites render nicely on smartphones after Google started to favor "mobile-friendly" pages in determining what content comes up first on its search pages.

April 28 -

Many credit unions will need to invest in making their websites render nicely on smartphones after Google started to favor "mobile-friendly" pages in determining what content comes up first on its search pages.

April 28