Mary Wisniewski is deputy editor of BankThink. She also writes on a variety of subjects as part of American Banker's bank tech team. Previously, she was a blogger and editor at Bank Innovation. She also served as a fashion editor for National Jeweler, where she reported on fashion shows and jewelry news. Her work has also appeared in Billboard, Cracked and a number of business media outlets. Mary grew up in the Michigan suburbs and now lives in L.A. with a maltipoo, two record players and an espresso machine. Mary is endlessly curious and follows anything that grabs her. Current interests include fintech, literature, travel, good conversation, Cat Stevens and Gidget.

-

Pairing up with corner stores, street teams and college students: all the ways fintech startups and tech savvy banks are trying to use the physical world to attract people to their digital products.

February 29 -

Mondo, a U.K. challenger bank, plans to make it easy for customers to use financial products and services from other companies. Rather than giving away the store, the bank says this approach will make it a marketplace.

February 18 -

Orrstown Bank launched several innovative Web initiatives in 2015, including a SMS two-way texting platform and a Zillow-like feature that displays housing listings on its Web presence.

February 9 -

Eastern Bank turned to YouTube videos as a way to connect with customers it picked up in a recent acquisition in New Hampshire. It even got a little help from Rob Gronkowski of the New England Patriots.

February 8 -

Rather than partner with a startup, 45-year-old Equitable Bank in Canada created a separate brand, EQ Bank, to acquire customers who are ready for an account without a debit card.

February 4 -

Moven, the digital-only "neobank," is partnering with online lenders as part of an effort to differentiate its services and become its users' go-to app for financial transactions of all sorts. Banks ought to pay close attention to this rebundling effort.

January 27 -

As a recent college graduate, I could have been more engaged with my longer-term financial health had I had today's fintech tools at my disposal.

January 15 -

A startup geared toward the prepaid market thinks it has found a way to effectively bridge the gap between high-touch onboarding and all digital experience: operating like a food truck.

January 13 -

A fintech startup is hoping that a pop-up branch approach will inspire consumers to replace check-cashing services and checking accounts with a mobile app that connects to a prepaid account.

January 11 -

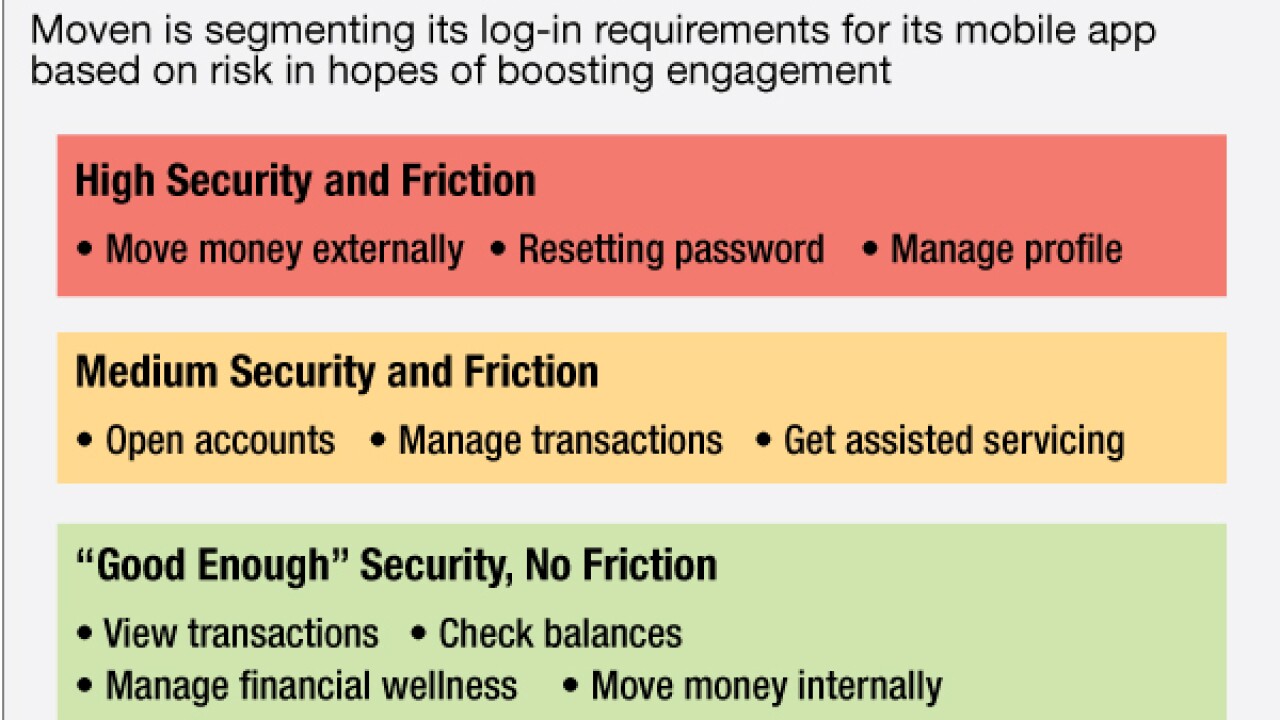

Moven will soon prompt its customers for usernames and passwords only for riskier transactions. By removing the login for most functions, the company aims to drive engagement in an app meant to be used on the go.

December 17