Mary Wisniewski is deputy editor of BankThink. She also writes on a variety of subjects as part of American Banker's bank tech team. Previously, she was a blogger and editor at Bank Innovation. She also served as a fashion editor for National Jeweler, where she reported on fashion shows and jewelry news. Her work has also appeared in Billboard, Cracked and a number of business media outlets. Mary grew up in the Michigan suburbs and now lives in L.A. with a maltipoo, two record players and an espresso machine. Mary is endlessly curious and follows anything that grabs her. Current interests include fintech, literature, travel, good conversation, Cat Stevens and Gidget.

-

Many bank executives share a vision of revamped branches stocked with tablets for sales and service purposes, according to a new report. But first, institutions must overcome numerous IT obstacles.

October 7 -

BB&T has rolled out a digital banking platform that lets customers customize which features appear once they log in. It saves the bank having to decide what to show and what to hide on devices with different screen sizes.

September 30 -

A Nevada firm is trying to make debt collections easier, friendlier and more interesting on a smartphone app designed for the underbanked. The new app, called PaySwag, is being marketed to banks and other companies to foster a more proactive approach to collections.

September 24 -

The bank's new audio series typifies a growing trend of bank brands thinking differently to get consumers' attention and telling stories on ever-more digital mediums as branch traffic keeps declining.

September 21 -

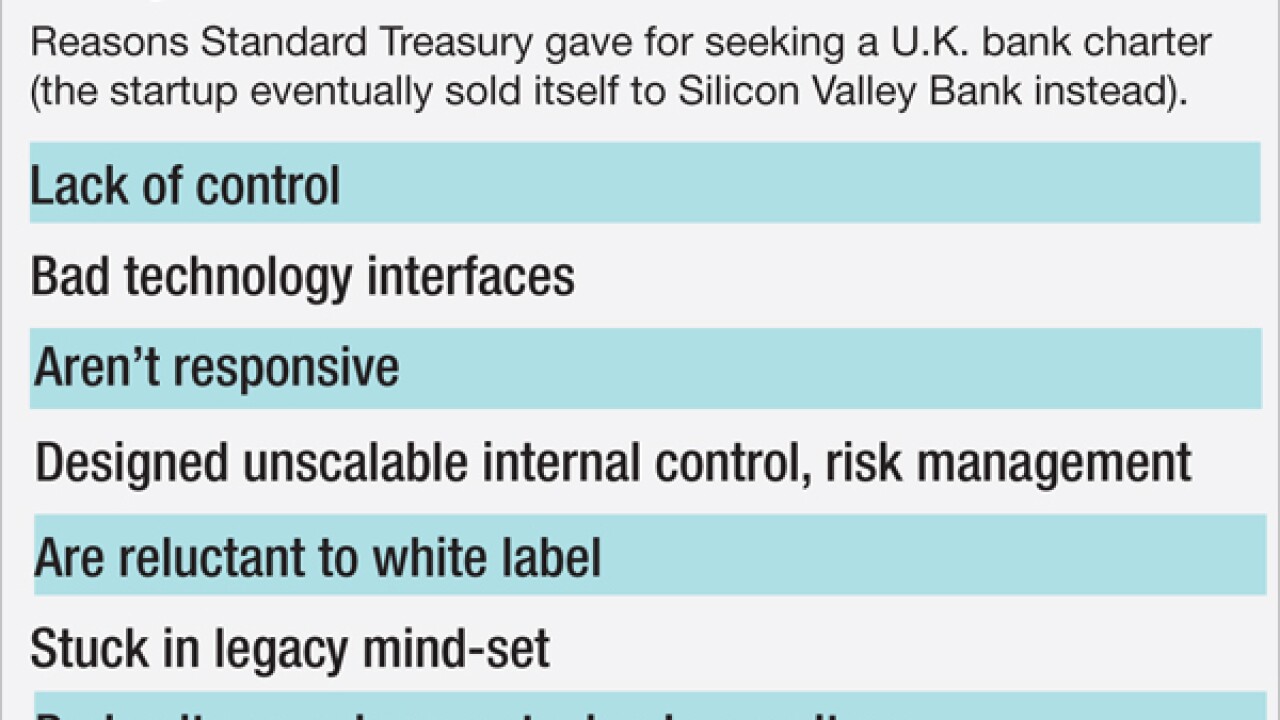

Among other reasons for seeking their own charters, the U.K.'s so-called challenger banks say they need to avoid being beholden to older institutions that can slow down the creative process.

September 16 -

Apps that help people manage their money on a day-to-day basis are all the rage among millennials. Here are the most effective of the bunch.

September 10 -

Graduate business students some of whom previously worked at traditional financial services companies have been organizing fintech clubs at universities to explore the dramatic changes in banking and to find potential employers.

September 8 -

Lead Bank in Kansas City, Mo., is poised to open a special branch designed for millennial entrepreneurs. Not only can these commercial customers bank in the techie, garage-like space, but they can actually work there, too.

September 2 -

Old-fashioned banks and neobanks are both finding the battle for acquiring customers to be treacherous. So BankMobile, a mobile-first banking service, has launched an innovation lab-like division seeking new tech that could attract thousands of new customers per month.

August 28 -

A growing number of fintech startups are appealing to the sensibilities of millennials by meeting social missions and, in some cases, by tying the amount of business they generate to the amount they give back to charity or to their customers.

August 26