Mary Wisniewski is deputy editor of BankThink. She also writes on a variety of subjects as part of American Banker's bank tech team. Previously, she was a blogger and editor at Bank Innovation. She also served as a fashion editor for National Jeweler, where she reported on fashion shows and jewelry news. Her work has also appeared in Billboard, Cracked and a number of business media outlets. Mary grew up in the Michigan suburbs and now lives in L.A. with a maltipoo, two record players and an espresso machine. Mary is endlessly curious and follows anything that grabs her. Current interests include fintech, literature, travel, good conversation, Cat Stevens and Gidget.

-

WSFS Bank has teamed up with ZenBanx, a fintech startup founded by a pioneer of direct banking, Arkadi Kuhlmann. WSFS will be the first in the U.S. to power a mobile account that lets users park money in up to five currencies and send remittances. The partnership is the latest example of a traditional bank trying to inject innovation into its culture.

June 3 -

A specialized Wells Fargo branch in Des Moines and the nonprofit Digital Finance Institute are part of a small but growing movement to improve access to financial services for emigres who have escaped war or persecution.

May 29 -

Namu is trying to solve a problem facing all banks that vie for millennials' attention: how to make the mobile banking experience more appealing. Its app refreshes users' memories of transactions with images illustrating what they bought.

May 27 -

A handful of banks are upgrading their apps with Siri-like "virtual assistants" that understand spoken questions at a time when most institutions don't even let digital customers do typed keyword searches of their transaction data.

May 20 -

As banks compete for tech talent against the Ubers and Amazons of the world, a new startup called untapt offers algorithmic matching of workers and bank tech jobs.

May 13 -

Wells Fargo and other banks are testing the use of mobile devices to authenticate consumers in the drive-through lane. The pilot, designed to expedite service and improve security, serves as the latest example of a growing trend: preordering banking services via digital devices.

May 7 -

After the early exuberance surrounding Apple Watch, banks and vendors are ramping up testing of bank apps on other wearable devices and everyday objects, preparing for a day in which most everything is connected to the Internet.

May 5 -

Citigroup and other banks are increasingly looking to startups to help them compete in a world in which Google, Apple and other tech firms are rapidly becoming potential threats.

April 30 -

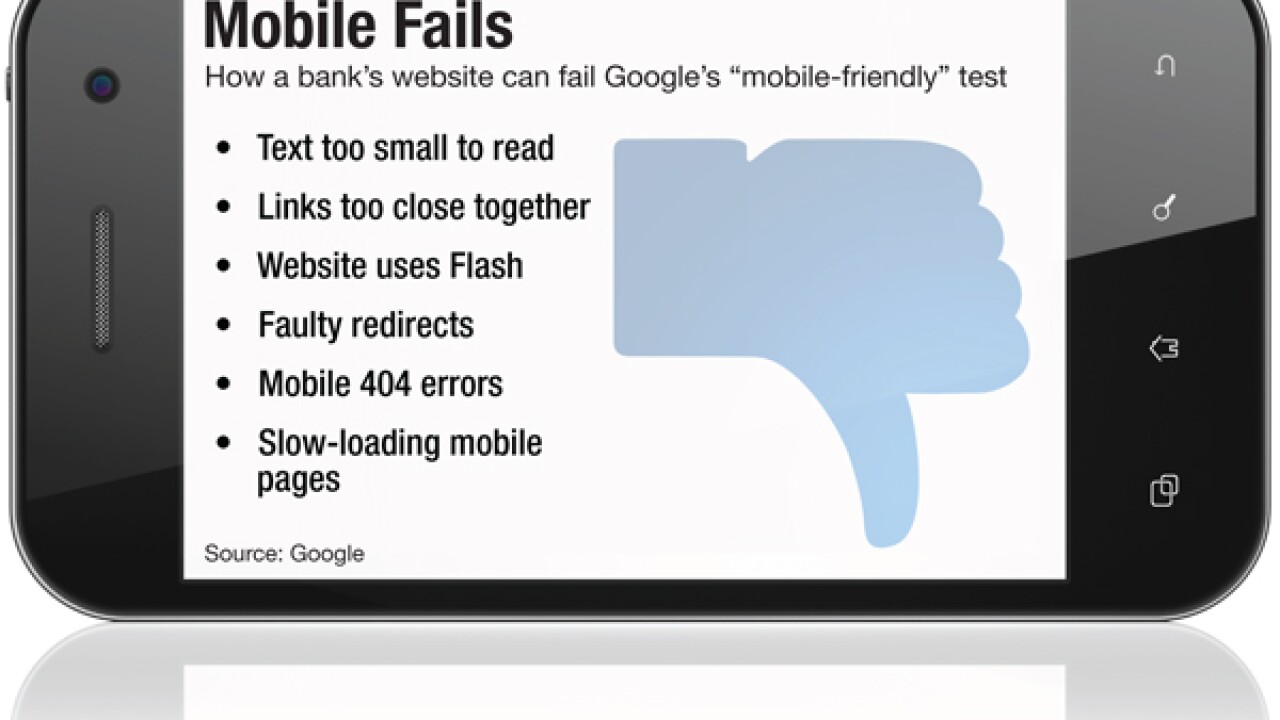

Many banks will need to invest in making their websites render nicely on smartphones after Google started to favor "mobile-friendly" pages in determining what content comes up first on its search pages.

April 28 -

Many credit unions will need to invest in making their websites render nicely on smartphones after Google started to favor "mobile-friendly" pages in determining what content comes up first on its search pages.

April 28 -

The San Francisco bank has added three more young technology firms to its accelerator program, which is aimed at adapting products from outside the financial services world for creative uses in banking.

April 22 -

As branch transactions continue to decline, banks are increasingly requiring expertise in an area they paid less attention to in the past: digital design. BBVA and Capital One's recent purchases of user-experience and design firms underscore the increasingly important trend.

April 20 -

The automated-teller-machine maker announced new software that it estimates can save up to 40% annually on ATM costs by reducing the agony of updating each box individually. The product targets the many banks that still need to upgrade their ATM fleets to Windows 7.

April 16 -

BBVA has acquired San Francisco user-experience firm Spring Studio, in a bid to improve the look and feel of its digital banking services.

April 16 -

When Apple releases its smartwatch next week, there will be apps available from at least five banks and four of them are community banks. Bankers see the apps as a way to get in early on a new platform, make banking more convenient and drive digital engagement.

April 13 -

Idea Bank in Poland aims to win over new small-business customers with an Uber-like service that orders cars equipped with ATMs and cash deposit machines to drive to them.

April 9 -

Idea Bank in Poland aims to win over new small-business customers with an Uber-like service that orders cars equipped with ATMs and cash deposit machines to drive to them.

April 9 -

Mobile game apps are emerging to expose young adults and children to financial concepts and to help solve problems money management apps may be overlooking.

April 7 -

FIS has designated a permanent area in its San Francisco office to test and showcase mobile banking and payment apps, highlighting the pressure on traditional vendors to stay current on emerging technologies and recruit young tech talent.

April 1 -

Alternative financial service providers that sell prepaid cards, bill pay, check cashing and other services to underbanked consumers are becoming more sophisticated with the ways they mine customer data.

March 27