Melissa Angell is a reporter for Credit Union Journal in New York City. She graduated from the University of Virginia where she studied Cognitive Neuroscience and Media Studies. She's also an alumna of the Dow Jones News Fund, where she previously covered healthcare equities for TheStreet.

-

Car loans make up about a third of credit unions' total lending portfolio, and any drop in that sector could resonate across the entire industry.

April 6 -

CUs in the Eastern European nation were originally shuttered out of fears they could further the spread of COVID-19 but have been allowed to resume operations provided certain safety precautions are met.

April 3 -

Limiting access to branches because of the pandemic has forced executives to re-examine whether they offer enough mobile and online services.

April 3 -

South Jersey Gas Employees Federal Credit Union will merge into Jersey Shore Federal Credit Union on June 1.

April 2 -

The industry still grapples with stopping corrupt employees — the failure of CBS Employee FCU last year highlights that — and now that could become even harder with the pandemic.

March 31 -

A host of industry events have been rescheduled due to the outbreak, with postponements now stretching into mid-May.

March 30 -

The credit union regulator will hold off in-person examinations until at least May and has already pushed back at least one comment deadline as the pandemic worsens.

March 30 -

In contrast, grocery stores and pharmacies saw a jump in spending during the coronavrius outbreak, according to credit union member data examined by the CUSO.

March 27 -

NAFCU and CUNA wrote to the regulator asking for a variety of measures to help credit unions weather the pandemic, including not implementing the CECL standard until at least 2024.

March 26 -

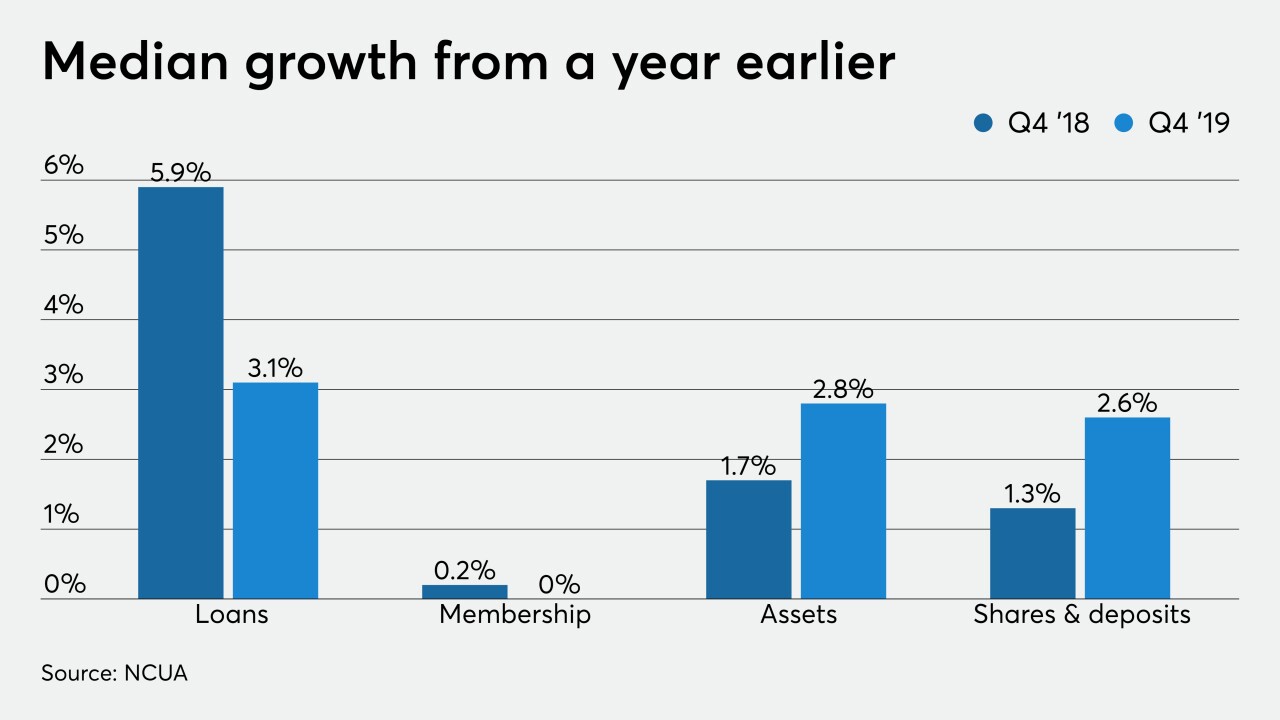

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25