-

Coastal Financial's decision to report a material weakness won't impact previously disclosed bottom-line results, though it creates bad optics for the Everett-based company.

March 18 -

The Public Company Accounting Oversight Board staff released a report Monday on last year's banking crisis.

September 9 -

The ruling further complicates an already complicated area — the law's mandate around beneficial ownership information reporting.

March 5 -

-

Banks have been reclassifying their losses to avoid taking steep write-downs that could be helping them stay in business.

March 31 -

The central bank issued a proposal aligning recent stress testing changes with supervisory standards that are tailored to an institution's size and complexity.

September 30 -

Second-quarter figures from the credit union regulator paint a grim picture for many states across a variety of key earnings metrics.

September 17 -

Jelena McWilliams explains the agency's decision to enlist the help of tech innovators to modernize a reporting process that the coronavirus epidemic has exposed as outdated.

July 1 Federal Deposit Insurance Corp.

Federal Deposit Insurance Corp. -

The agency wants more timely information on the banks it supervises; investors filed a criminal complaint against Ernst & Young, calling their work “a disaster” for failing to expose the scandal.

June 29 -

The credit union regulator is adding line items to required quarterly reporting in order to better account for loan forbearance, CUs lending through the Paycheck Protection Program and more.

May 28 -

This is the first time since 2014 that the regulator won't penalize credit unions that file within 30 days of the deadline.

April 20 -

-

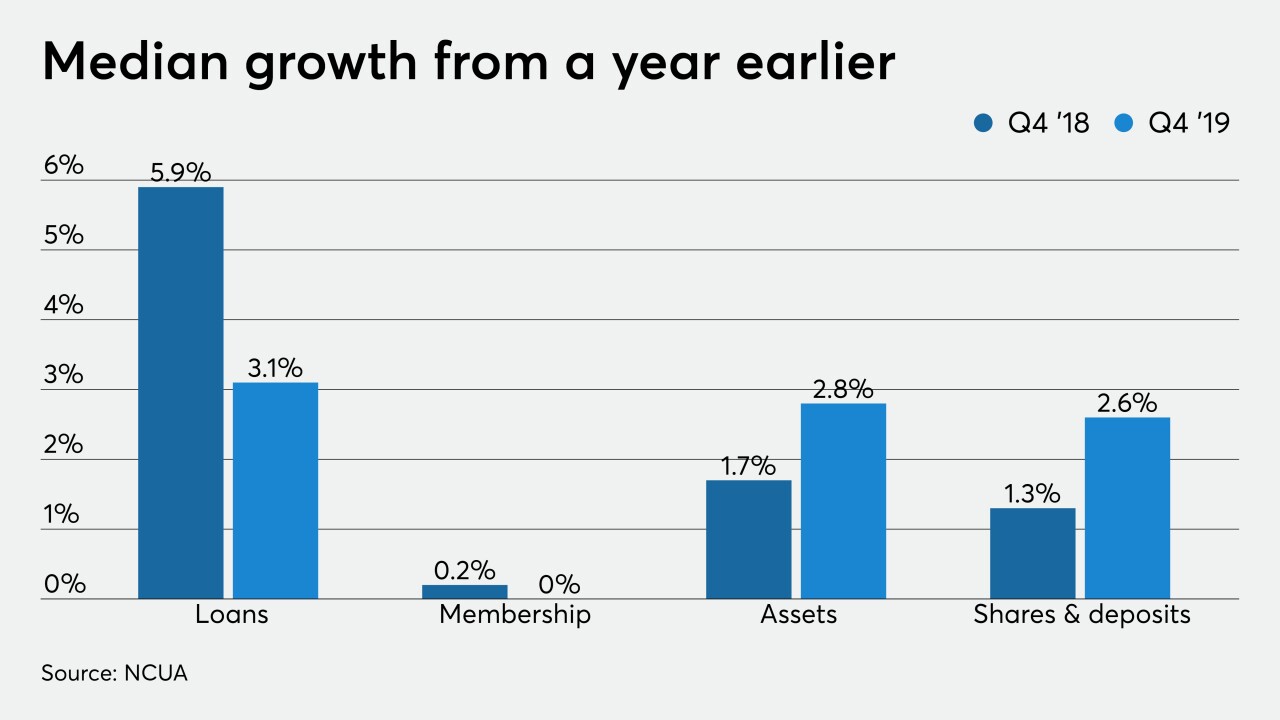

While loans continued to increase, growth was slower than one year previously and membership was flat.

March 25 -

Big picture the industry is doing well, but at the median, lending and membership are flagging even as deposits and assets rise.

December 18 -

From rising incomes and expenses at credit unions to an ever-widening gap between large and small shops, here's a look at how the regulator's third-quarter numbers break down.

December 9 -

This is the second time in five years the California-based credit union has issued a giveback, for a total of $38 million.

November 20 -

The National Credit Union Administration will meet this week to discuss its proposed budget while the Senate and House work to avoid a government shutdown.

November 18 -

The Wisconsin-based institution has returned more than $11.7 million to members over the past six years.

November 14 -

The credit union retains a strong net worth position and saw a nearly 5% increase in members during the first three quarters of this year.

November 8 -

The Honolulu-based credit union saw a nearly 7% increase in new members, thanks in part to an expanded branch presence in West Oahu.

November 7