Michael Moeser is an Austin, Texas-based senior content strategist for Arizent. He has over 25 years of payments and consulting industry experience working in executive roles at Visa, Capital One, McKinsey, Javelin Strategy, and Ondot Systems. He has an MBA in Entrepreneurship from DePaul University’s Kellstadt Graduate School of Business and a BBA in Finance from University of Michigan’s Ross School of Business.

-

The Zelle network processed 116 million transactions during the July-September 2018 timeframe with a total value of $32 billion in payments.

October 23 -

Societe Generale launched a contactless biometric payment trial in France for a debit card with a built-in fingerprint reader.

October 22 -

Indian wallet provider Paytm has entered the Japanese market in a joint venture with SoftBank Group and Yahoo Japan.

October 22 -

Mastercard is making the first move among the card networks, again, on moving away from the signature requirement — completely removing the space for a signature from its cards.

October 18 -

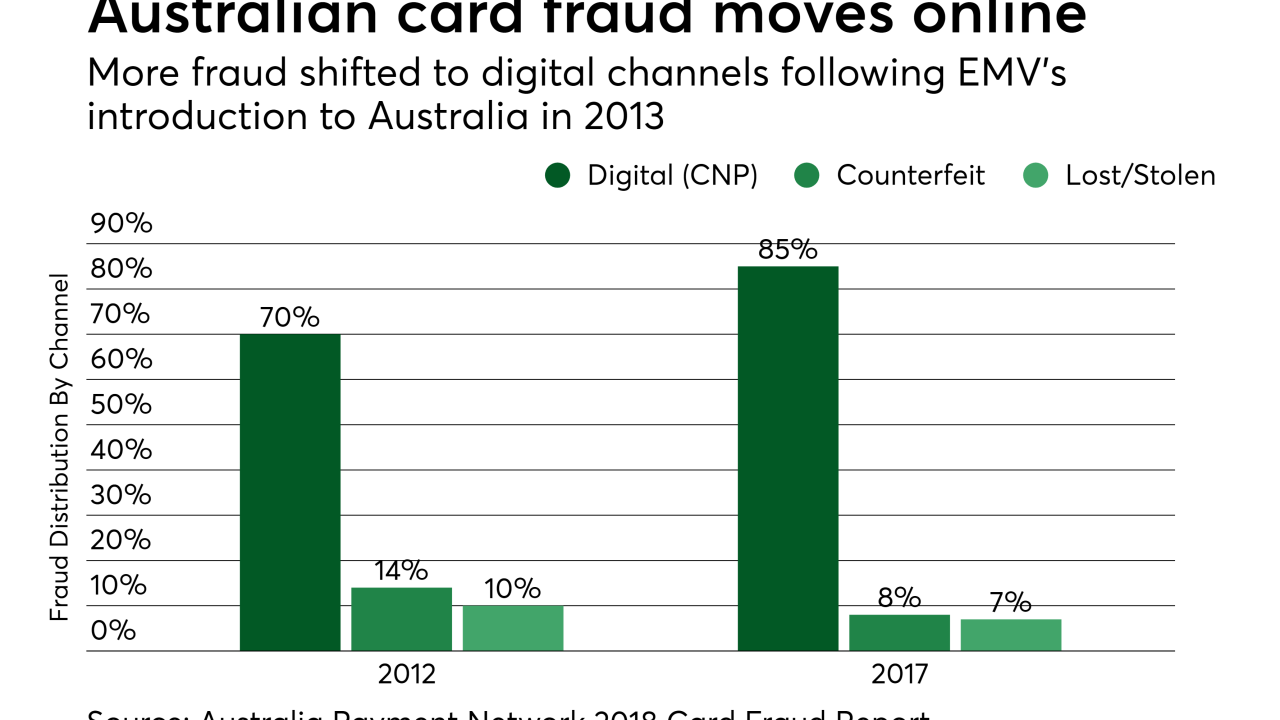

The vast majority of card fraud in post-EMV Australia affects digital payments, a trend that has prompted government action, expedited security projects, and financial pressure on banks from retailers.

October 18 -

This week marks the official start of Canada’s legalized recreational cannabis industry — and American Express, Visa and Mastercard are ready to handle the new market's payments, in a stark contrast to their stance in the U.S.

October 17 -

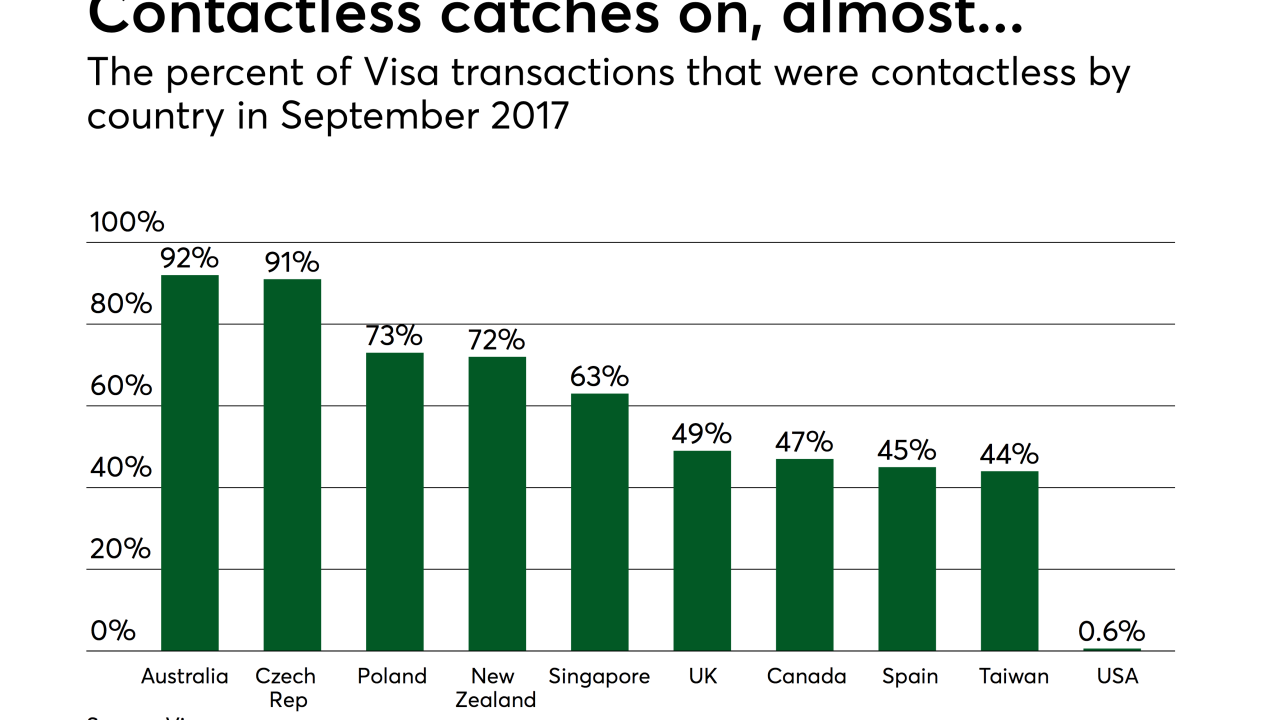

The U.K. market has reached a tipping point where consumers are conducting more in-store transactions using a contactless form of payment (card or phone) instead of a process that requires the card to be inserted into a POS terminal.

October 17 -

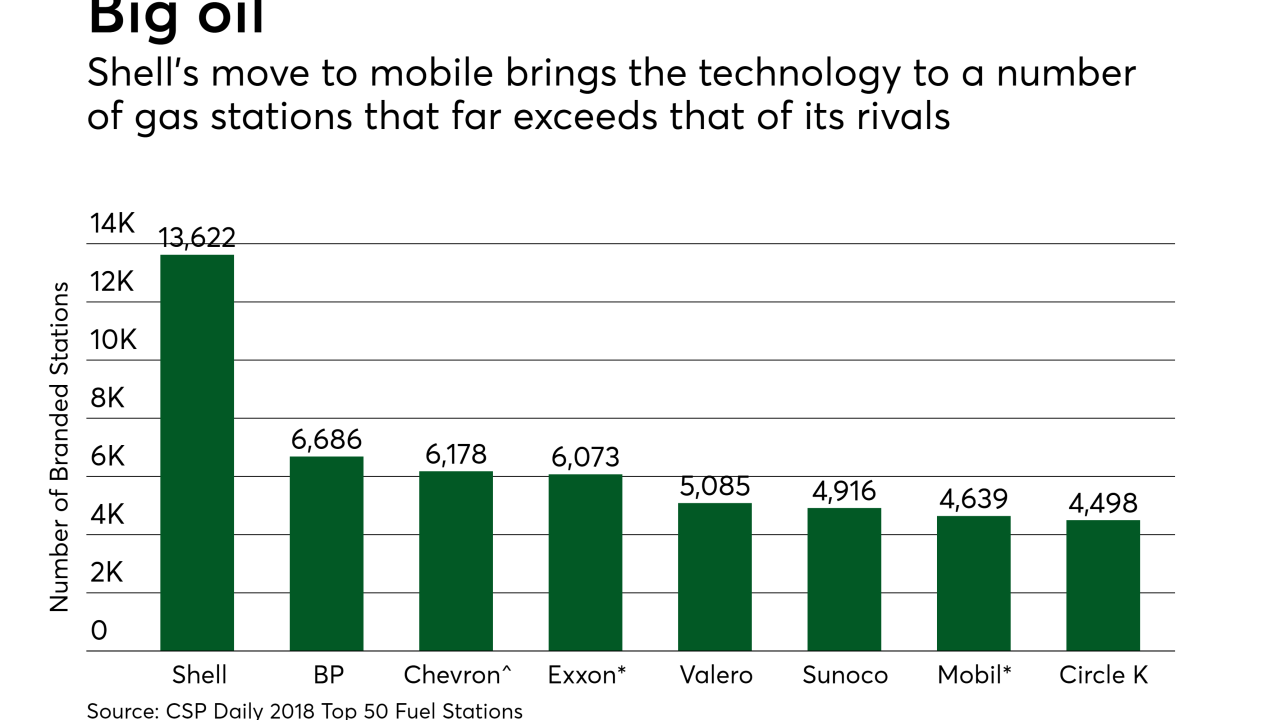

Shell has launched a new mobile app called Pay & Save, designed as a frictionless complement to the EMV-chip cards it must accept at its pumps by late 2020.

October 16 -

As Venmo does battle with Zelle and Square for consumers' P2P payments, one thing is clear: Innovation is not cheap.

October 15 -

The fintech wave has nearly devoured the entire point of sale industry, as lone major holdout Ingenico weighs an unsolicited bid from an investment bank’s payments group.

October 12 -

While businesses' ability to transact internationally has expanded, the act of settling payments has gotten more complex, expensive and time-consuming. That means opportunity for companies that can provide solutions.

October 11 -

Called Bill Pay Exchange, it will power instant bill pay for consumers from their bank or credit union accounts in a matter of seconds versus days when using the traditional bank bill pay ACH network.

October 10 -

Fleet card and corporate payment provider WEX has partnered with Melbourne, Australia-based fintech Payment Logic to support automated vehicle registration for fleet operators in Australia.

October 10 -

Amazon has signaled an interest in the French grocery market, spurring Casino's development of a high-tech concept store in Paris.

October 9 -

Singtel Group, owner of Singapore Telecom, launched a QR code-based cross-border mobile payments alliance with Thailand’s largest digital bank, Kasikornbank and Thailand’s largest mobile phone operator Advanced Info Service or AIS.

October 5 -

Worldpay is expanding its U.S. portfolio and has experience in sports betting to lean on.

October 5 -

In/PACT wants to encourage higher charitable donations by having donors use their banks’ online platforms instead of going directly to the charities.

October 5 -

PayPal launched a new merchant app called PayPal for Business, aimed at driving usage and adoption of its invoicing and payments services among freelance workers and small businesses in India.

October 4 -

Visa is working with the on-demand delivery network Postmates to deliver real time payments through Stripe’s Instant Payouts feature, running on its push payment platform, Visa Direct.

October 3 -

China’s Golden Week started on Monday and with it, global cities and merchants are boldly promoting Alipay in an effort to capture Chinese tourist dollars. At the same time, merchants are building out a competitive acceptance network that could someday rival the major payment card networks.

October 2