Michael Moeser is an Austin, Texas-based senior content strategist for Arizent. He has over 25 years of payments and consulting industry experience working in executive roles at Visa, Capital One, McKinsey, Javelin Strategy, and Ondot Systems. He has an MBA in Entrepreneurship from DePaul University’s Kellstadt Graduate School of Business and a BBA in Finance from University of Michigan’s Ross School of Business.

-

Payhawk, a European paperless expense management provider, has raised €3 million (about $3.3 million) in a seed funding round led by Earlybird Venture Capital.

March 18 -

The South African Reserve Bank is warning the public of a scam currently underway in the country where fraudsters are collecting banknotes and coins because they claim they may be infected with the coronavirus.

March 18 -

RTP Global and HV Holtzbrinck Ventures led an €18.5 million ($20.3) Series B round in Penta, a Berlin-based small business bank.

March 17 -

TransferWise has partnered with Alipay to expand money remittance options for its users to instantly send Chinese yuan to friends and family in China.

March 17 -

Mastercard is working with Samsung to launch its Pay on Demand platform in emerging markets to drive financial inclusion.

March 13 -

Amazon's dominance of the smart speaker segment makes it well positioned to turn an increasingly work-from-home culture into a voice-shopping powerhouse.

March 11 -

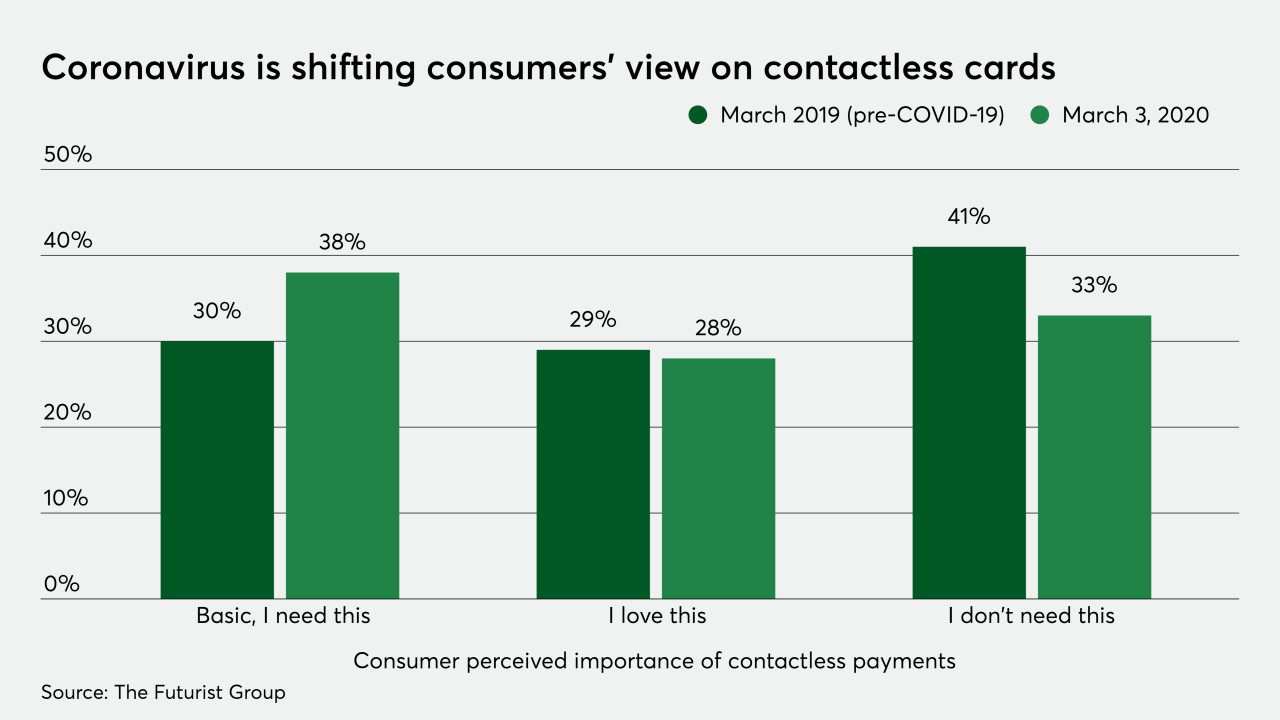

Contactless cards are a potential refuge for consumers who fear plastic and cash are carrying COVID-19.

March 10 -

If a checking account doesn’t come with checks anymore, can it still be called a checking account? It’s a valid question that the financial services industry should be asking itself.

March 9 -

As part of its financial inclusion campaign, Mastercard has partnered with Moneytrans to launch remittance-linked checking for migrant workers with a goal of obtaining 1 million users by 2025.

March 5 -

Advance wage access company Branch has partnered with Cardtronics’ Allpoint ATM network to provide surcharge-free cash access at all Allpoint ATMs across the U.S. to its customers.

March 5 -

India's 2018 ban on banks servicing traders and businesses dealing with cryptocurrencies has been overturned by the country's Supreme Court, opening the door for bitcoin and Facebook’s Libra.

March 4 -

Operational efficiency has long been the key to selling AP automation, but a growing payment fraud problem and new risk exposures are giving businesses new reasons to digitize payments.

March 3 -

Coronavirus, also called Covid-19, is wreaking havoc on the stock market, with a heightened effect on the travel industry. It could also cause a drastic change in payment habits, as consumers shift to digital channels to reduce their risk of infection from handling cash.

March 2 -

Afterpay has found an opening in the U.S. by targeting the millennials who don't have a credit card to use at the point of sale.

February 28 -

The growth and monetization of Square’s Cash App boosted the company's quarterly earnings, along with the sale of its food delivery unit Caviar.

February 27 -

Small World Financial Services is addressing a gap in its cross-border network by making a deal to buy French money transfer agent MoneyGlobe.

February 25 -

Banco Santander’s global digital transformation has led it to Mexico, where the bank has agreed to acquire U.S. Bancorp’s Elavon Mexico merchant acquiring unit for about $84 million.

February 25 -

BBVA and venture capitalist Anthemis Group are providing seed funds to U.K. fintech Wollit that will offer a subscription-based cash flow product for gig economy workers.

February 21 -

The savings and credit building startup Self Financial has raised $20 million in a Series C funding round to help fuel its expansion to serve financially struggling consumers.

February 21 -

The Bank of England issued a new polymer £20 note into general circulation at a time when consumers are increasingly eschewing cash in favor of digital payments.

February 20