-

The e-commerce giant, which is in the midst of a corporate downsizing, is discontinuing its Go and Fresh stores and One palm checkout while it repurposes the underlying technology.

January 28 -

The payment company is betting on agentic commerce to get its checkout tech in front of more merchants and consumers.

January 21 -

The payments firm is hoping that planting a flag in merchant stablecoin payments now will be accretive as stablecoins gain greater adoption.

January 19 -

The Ontario-based lender announced a partnership that represents the first dividend from its recent acquisition of a Minnesota-based community bank.

February 10 -

The BNPL industry is growing at a fast clip. Australia-based Zip's new CEO for U.S. operations is looking to carve out a place in what is becoming a crowded industry with expanded merchant partnerships and a Pay-in-8 product.

September 18 -

A criminal group called Prilex has stolen millions in a scheme involving fake repair people installing malware on point of sale terminals.

October 3 -

The banks that own the peer-to-peer payment network are reportedly considering a retail launch that could fend off rival payment methods — or simply cannibalize the sizable revenue issuers get from credit and debit cards.

April 7 -

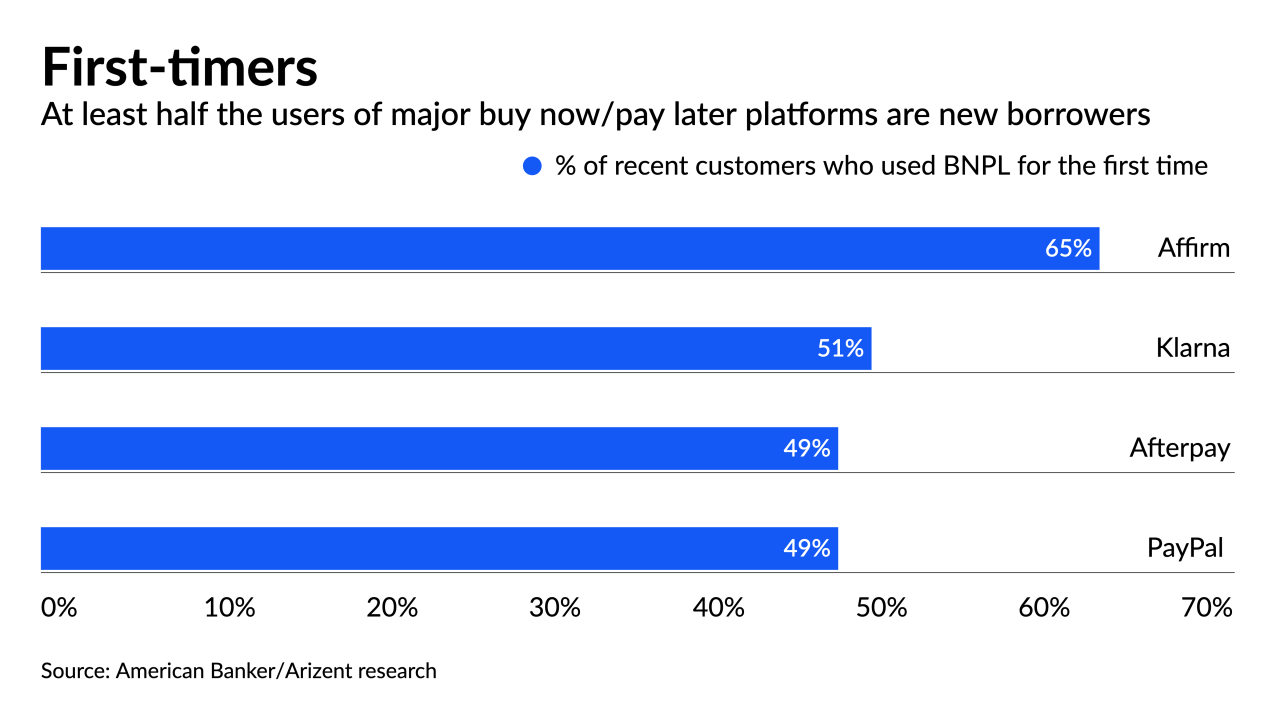

The data from these transactions could help millions of borrowers with thin or nonexistent credit files. But how the credit reporting industry collects and treats the data may matter more than the data itself.

March 9 TransUnion

TransUnion -

The deal is the latest example of a mainstream bank buying a point-of-sale lender focused on financing home improvement projects.

January 19 -

Best known as a website management company, GoDaddy began directly offering digital and offline payments after learning that its clients were getting those services from fintechs. The company is also now selling terminals for in-store payments.

October 18 -

The lender is building on a 20-year-old partnership with Fiserv to provide options such as revolving credit, with plans to add buy now/pay later.

October 14 -

Most people aren't spending bitcoin in stores, but major point-of-sale terminal makers are developing technology and business relationships on the belief that demand will build fast.

August 17 -

The bank’s decision to offer home improvement loans directly will not have a material impact on profits at the Atlanta-based fintech, according to GreenSky.

August 12 -

For years mobile wallets have been a solution in search of a problem – until now. COVID-19 has reframed the retail point-of-sale (POS) and with it, how consumers want to pay, giving wallets a new relevance for safer in-store payments.

August 12 -

The acquisition of Florida-based Service Finance Co. would expand the North Carolina bank’s presence in the point-of-sale lending business.

August 10 -

As tech giants rush into point-of-sale lending, the smaller companies that built the market are counting on acquisitions and partnerships with specialized vendors to defend their turf and pull in new borrowers.

August 9 -

The $29 billion purchase of the Australian installment lender would bring larger retail relationships, as well as a fast-growing product that has appeal to both consumers and merchants.

August 2 -

The $29 billion deal would enable Square to better compete with PayPal and Apple, and provide an opportunity to cross-sell other services to the Australian lender's global audience.

August 2 -

Persistent coronavirus fears have accelerated consumer interest in checkout-free retail options like Amazon Go, just as new technologies like 5G make such concepts more practical to implement.

July 28 -

The tech giant is entering a heavily competitive market led by large companies like PayPal and hot startups like Affirm and Afterpay.

July 16