Penny Crosman is Executive Editor, Technology at American Banker and its publisher, Arizent. Prior to taking on this role, she was Editor in Chief of Bank Technology News. She has held senior editorial roles at Bank Systems & Technology, Wall Street & Technology, Intelligent Enterprise, Network Magazine and Imaging Magazine.

-

Banks that work with the data aggregator will tell it when account updates are ready, so it can refresh fintech (or bank) apps immediately.

September 1 -

Caitlin Long, a former Morgan Stanley and Credit Suisse managing director, is starting a special-purpose depository institution that will provide payment and custody services to institutional investors and corporate treasurers.

August 31 -

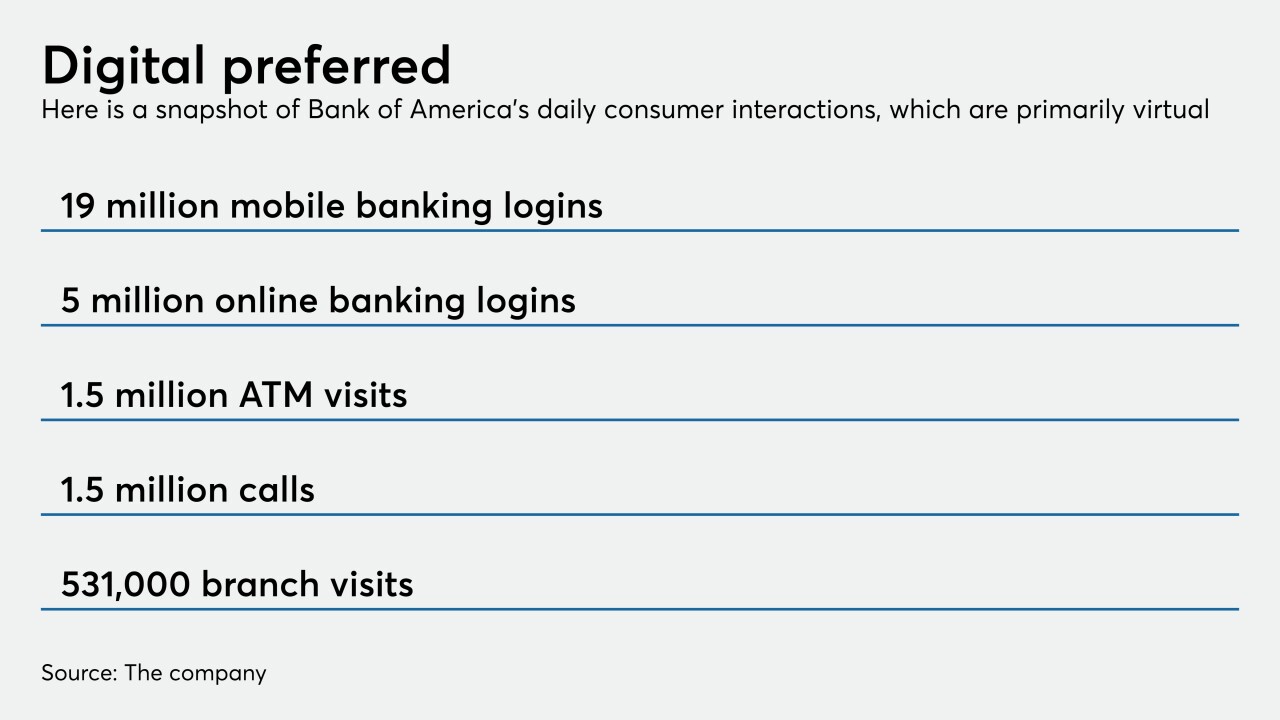

The bank is making continuous improvements, including integrating Merrill Lynch accounts into its banking app and adding a security feature to Zelle.

August 31 -

Betsy Cohen, formerly of The Bancorp Bank, and venture capitalist Ryan Gilbert have created a vehicle to raise hundreds of millions of dollars, purchase a technology company and expand it.

August 27 -

"It's on-demand capital for us," Optus Bank's CEO says of the payment company's deposit. The funds are part of PayPal's broader effort to confront race and income inequality.

August 26 -

"It's on-demand capital for us," Optus Bank's CEO says of the payment company's deposit. The funds are part of PayPal's broader effort to confront race and income inequality.

August 26 -

The bank will outsource future development of Quorum to the software firm.

August 25 -

The former SoFi chief’s latest startup, Figure, has created what it says is a transparent marketplace for buying and selling assets. Some banks have embraced the technology, but other blockchain projects have stalled because lenders don't want rivals to see their data.

August 25 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24 -

T-Mobile Money is now being offered to the 150 million customers of the combined wireless carriers, which merged this spring.

August 24