Polo Rocha is a Mexico-based freelance reporter who worked at American Banker from 2021 to early 2025, covering consumer finance and national banking trends. He previously covered the Federal Reserve at S&P Global Market Intelligence and state politics at WisPolitics.com. He graduated from the University of Wisconsin-Madison and has a master's in finance degree from Johns Hopkins University.

-

The credit card issuer Synchrony Financial recently used FICO’s top competitor in a $1 billion deal. The choice is significant for VantageScore, but FICO remains the dominant credit score in the securitization market, according to analysts.

By Polo RochaJune 7 -

The two banks, which recently pushed back the deadline for their $2.6 billion merger, pledged Monday to ditch nonsufficient-funds fees, among other more consumer-friendly changes.

By Polo RochaJune 6 -

Edward Shin, the onetime CEO of Noah Bank in Pennsylvania, was found guilty of charges related to loans the bank made to businesses in which he held a stake.

By Polo RochaJune 2 -

The legislation blocked by John Bel Edwards, a Democrat, would have allowed consumer loans of up to $1,500 with triple-digit interest rates. Edwards wrote that the measure does not protect the public from “predatory lending practices.”

By Polo RochaJune 1 -

JPMorgan Chase CEO Jamie Dimon expressed even deeper concern Wednesday about the likelihood of an economic downturn than he has in recent months. Wells Fargo CEO Charlie Scharf was less pessimistic, but he still spoke of the “reality that the economy has to slow.”

By Polo RochaJune 1 -

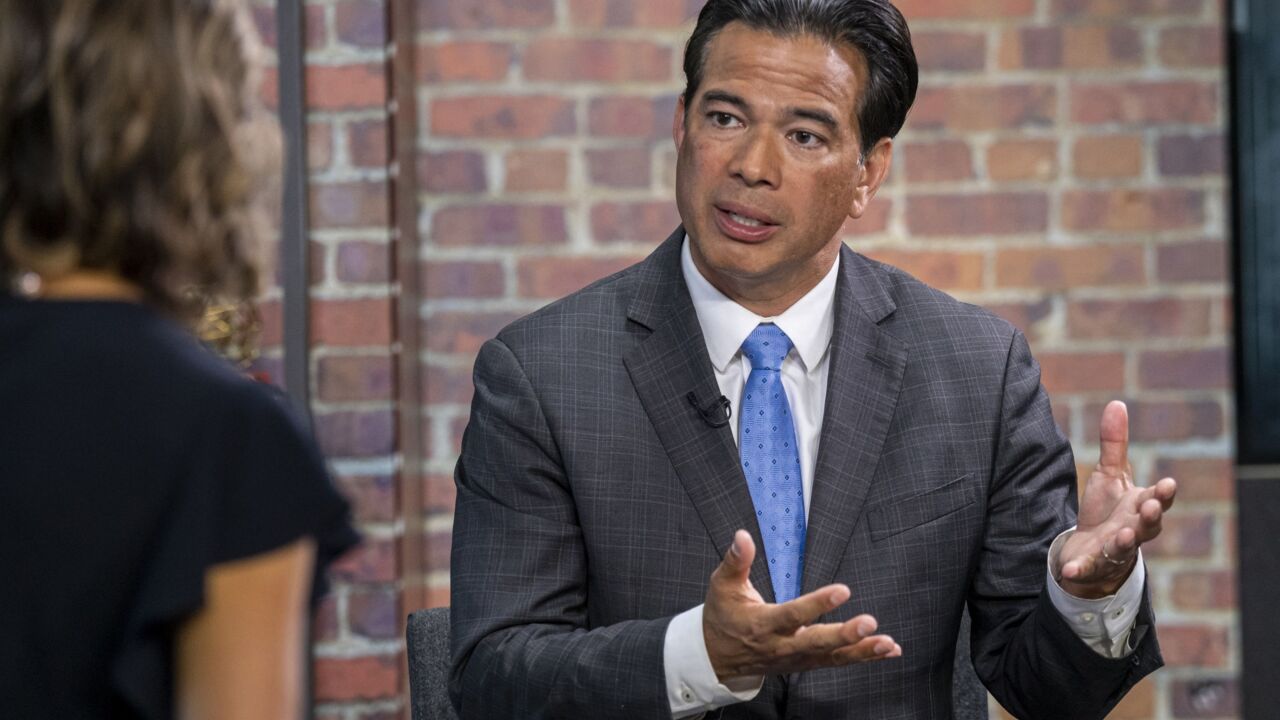

District attorneys in the Golden State are tangling with Credit One Bank over its debt-collection practices. The bank says the prosecutors have overstepped, but Democratic Attorney General Rob Bonta argues that the legal action should continue.

By Polo RochaMay 31 -

A recent California Supreme Court decision means that lenders can be on the hook for consumers’ attorney fees in situations where car dealers defraud them. The case involved TD Auto Finance and a dealer that allegedly sold a vehicle without certain advertised features.

By Polo RochaMay 30 -

The nation’s six largest credit card companies are facing questions from the Consumer Financial Protection Bureau over their alleged failure to report customer payment data on a regular basis. The agency says that the industry’s practices can hurt consumers’ ability to qualify for cheaper loans.

By Polo RochaMay 26 -

Goldman Sachs’ Marcus, Synchrony Financial, American Express and Capital One Financial are among the banks that have recently raised their five-year CD yields. The price competition arrives as the Federal Reserve acts quickly to rein in inflation, spurring expectations that rates will continue to rise.

By Polo RochaMay 25 -

Strong spending trends, combined with a reduction in card repayment rates, contributed to 17% loan growth last month. The data suggests that rising fears of a recession aren’t yet changing consumers’ behavior.

By Polo RochaMay 19 -

While red states like Florida have embraced the cryptocurrency industry, officials in New York and Illinois are taking action on Democratic Party priorities such as diversity and climate change. Here's a look at some hotbeds of innovative policymaking.

By Jon PriorMay 18 -

The new service, which will offer one-on-one advice, is open to people with at least $100,000 in investable assets. It’s part of the company’s ongoing efforts to build a full suite of retail banking products.

By Polo RochaMay 18 -

A hearing on the pending BMO-Bank of the West merger will be held in July, and another on TD's proposed acquisition of First Horizon is set for August. The announcements indicate that regulators have decided to hold such hearings more often.

By Polo RochaMay 17 -

A 2019 state law limits annual interest rates on many loans to 36%, but some high-cost lenders have found a way to continue operating in California by partnering with banks. Now Democratic legislators want the Federal Deposit Insurance Corp. to take action.

By Polo RochaMay 16 -

The former JPMorgan Chase executive will will replace Jim Hays, who is retiring.

By Polo RochaMay 13 -

The Federal Reserve’s forceful moves to fight inflation are resetting expectations about how quickly banks will need to start raising their deposit rates.

By Polo RochaMay 13 -

The San Francisco-based online lender originated more than $2 billion in personal loans during the first quarter, a big jump from a year earlier. The surge made up for softness in the company's home loan and student loan businesses.

By Polo RochaMay 11 -

Roughly 24,000 people had new foreclosures listed on their credit reports in the first quarter, up from about 9,000 three months earlier, a Federal Reserve Bank of New York report says. States are trying to cushion the blow on homeowners now that many pandemic-related federal protections have ended.

By Polo RochaMay 10 -

A cannabis-related company said it has secured a $60 million credit facility backed partly by East West Bank. The California-based regional bank is moving into a realm once dominated by small banks, credit unions and more expensive nonbank lenders.

By Polo RochaMay 5 -

The chances of an economic slowdown are rising as the Federal Reserve is poised to take further steps to tame inflation, say the heads of JPMorgan Chase, Bank of America and Morgan Stanley.

By Polo RochaMay 4