Polo Rocha is a Mexico-based freelance reporter who worked at American Banker from 2021 to early 2025, covering consumer finance and national banking trends. He previously covered the Federal Reserve at S&P Global Market Intelligence and state politics at WisPolitics.com. He graduated from the University of Wisconsin-Madison and has a master's in finance degree from Johns Hopkins University.

-

A partisan split at a congressional hearing offered a preview of coming regulatory debates over the nascent sector. One key question is whether the consumer bureau will impose ability-to-repay requirements on installment lenders.

By Polo RochaNovember 2 -

During third-quarter earnings calls, Bill Demchak of PNC raised concerns about stablecoins, while Jane Fraser of Citigroup pledged that there will be accountability for fixing her company's regulatory troubles and Jamie Dimon of JPMorgan Chase sounded downbeat about the Biden-era regulatory environment.

October 25 -

The Financial Stability Oversight Council's guidelines for regulators avoided measures that banks feared such as fossil fuel loan limits and rigid new stress tests. But the panel is recommending rules that would require financial institutions to disclose their exposure to global warming.

October 24 -

Lesher, previously the company’s head of middle-market banking operations on the East Coast, takes over as Wells is making technology investments in the unit.

By Polo RochaOctober 22 -

The auto lender’s acquisition of Fair Square Financial would diversify its consumer product lineup. The pandemic derailed its last effort to buy a card company.

By Polo RochaOctober 21 -

The Tennessee company, which reported 1% linked-quarter loan growth, has sought to “protect the integrity of the balance sheet” and has a strong pipeline of commitments.

By Polo RochaOctober 20 -

Goldman Sachs, Truist and Regions have all made deals to acquire home improvement lenders. Here's why their executives are so bullish on the sector.

By Polo RochaOctober 20 -

At Fifth Third, Synovus and Zions, third-quarter loan growth and improved outlooks indicate that businesses are finally more open to borrowing. Industrywide data further suggests “a much hoped-for rebound” has begun, according to analysts at Piper Sandler.

By Polo RochaOctober 19 -

The bank, which acquired General Electric’s health care lending business in 2015, is looking to expand its presence amid a merger boom in the sector.

By Polo RochaOctober 15 -

Charlie Scharf faced tough questions Thursday in the wake of a recent $250 million fine. Analysts did not get the clarity they sought on how much longer the bank will be constrained by a three-year-old consent order with the Fed.

By Polo RochaOctober 14 -

A new state law effectively bans the deposit of state public assistance funds into certain accounts that charge the fees. Supporters say it prevents companies from exploiting a loophole in existing prepaid card rules, while firms that will likely be affected say it limits options for underserved consumers.

By Polo RochaOctober 8 -

Acquiring Watonga, which runs Cornerstone Bank, would raise the buyer's asset size to roughly $1.4 billion.

By Polo RochaOctober 7 -

In her role as head of consumer and small-business banking, Mack is leading an initiative to establish accounts for the millions of Americans who are unbanked.

By Polo RochaOctober 6 -

The bank's head of home lending has been tasked with managing the mortgage division through a housing boom but also with fixing years of regulatory troubles.

By Polo RochaOctober 6 -

The Federal Reserve is prepared to move “very vigorously” to crack down on banks that insist on making loans using the soon-to-be-defunct benchmark rate, Vice Chairman for Supervision Randal Quarles said.

By Polo RochaOctober 5 -

The prepaid card issuer disclosed that it failed to get the Federal Reserve’s approval for its $165 million acquisition of a Republic Bank unit. The deal’s termination prompted a lawsuit by the seller.

By Polo RochaOctober 5 -

The new pilot program is only operating at four of more than 30,000 post offices nationwide. But it's drawing loud criticism from the banking industry and Republican lawmakers, along with strong praise from congressional Democrats.

By Polo RochaOctober 4 -

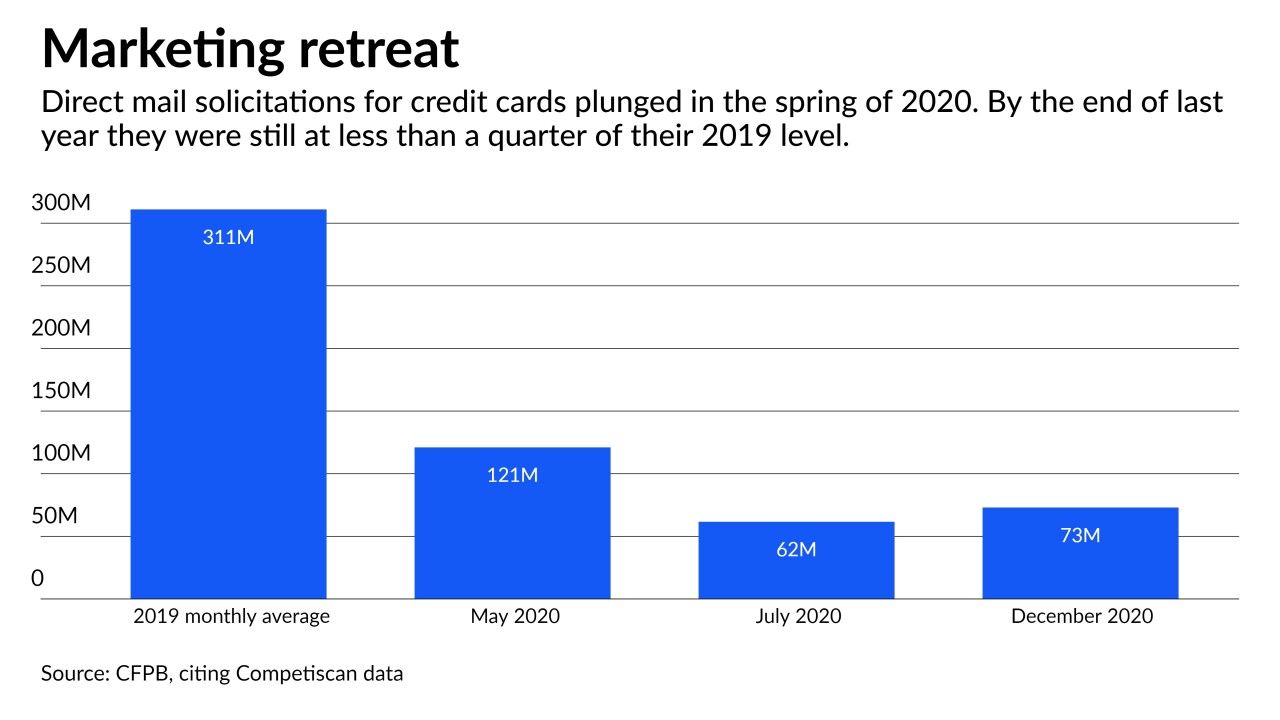

Banks generally did not curtail loans to existing cardholders last year despite mass unemployment, according to new research by the Consumer Financial Protection Bureau. The results contrasted with what happened during the Great Recession.

By Polo RochaOctober 1 -

Many banks are still making loans tied to the scandal-plagued benchmark despite years of preparation for its demise. The end of 2021 could prove hectic as bankers scramble to implement changes and explain them to commercial borrowers.

By Polo RochaSeptember 28 -

U.S. Bancorp, M&T Bank, Citizens Financial are among the regionals that are buying smaller competitors in an effort to achieve greater scale.

September 28