-

During much of the first quarter, bankers and issuers pounded the loan market with repricing deals, which got done, one after another, despite the requisite grumbling from investors.

March 30 -

Morgan Stanley and Goldman Sachs have arranged two term loans totaling $395 million that will back Hubbard Radio's acquisition of 17 radio stations from Bonneville International, according to sources.

March 23 -

Moves by banks and mutal funds as well as other market factors are allowing a long list of issuers such as Denny's, Solutia, Petco and DineEquity to reprice their debt at cheaper rates.

February 18 -

SunTrust Banks Inc., Wells Fargo & Co. and Rabobank Group are arranging a $3.7 billion credit facility to help back Rock-Tenn Co.'s acquisition of Smurfit-Stone Container Corp., according to sources.

January 25 -

JPMorgan Chase & Co. has established pricing on a $1 billion term loan backing the Carlyle Group's acquisition of CommScope, according to sources.

January 5 -

As of Thursday, banks had shopped roughly 20 term loans totaling more than $11 billion. The largest deal announced was a $2.5 billion term loan that will be used to back the roughly $5.3 billion buyout of Del Monte Foods.

December 3 -

As of Thursday, banks had shopped roughly 20 term loans totaling more than $11 billion. The largest deal announced was a $2.5 billion term loan that will be used to back the roughly $5.3 billion buyout of Del Monte Foods.

December 3 -

A bank consortium launched a $610 million first-lien term loan and a $140 million second-lien term loan for BNY ConvergEx Group Wednesday.

December 1 -

Loan-market participants are predicting the big one. Not an earthquake, but a $10 billion leveraged buyout. Indeed, according to some, such a megadeal is already in the works.

November 22 -

Wells Fargo & Co. has arranged a $600 million term loan B for AutoTrader, according to sources.

November 17 -

Bank of America Merrill Lynch has arranged a $300 million collateralized loan obligation, surprising market participants who, after the worsening of the debt crisis overseas, weren't expecting to see new CLOs for some time.

August 2 -

The number of smaller commercial banks buying leveraged loans rose sharply in the first half of the year and probably will keep rising, and the trend will affect how new deals are structured, market watchers say.

August 2 -

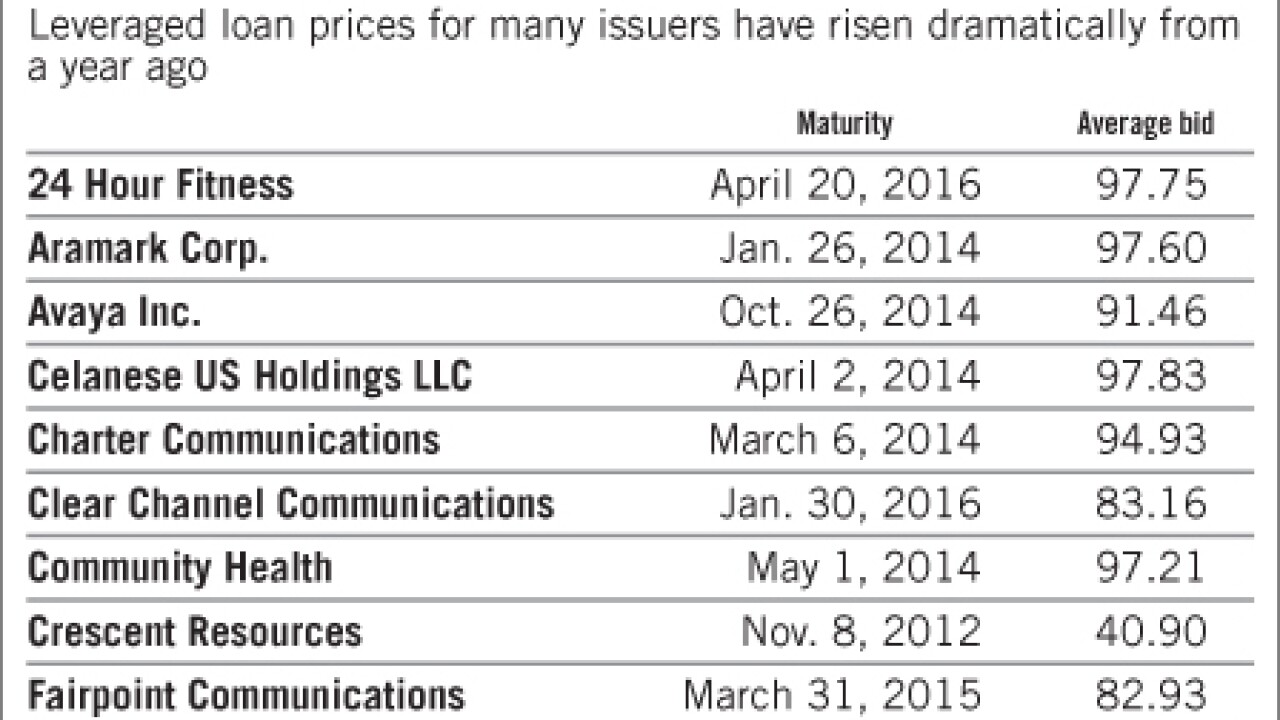

When they talk about the recovery in the bank loan market, many market participants make much of the gains in prices, the drop in yield premiums and the decline in corporate defaults.

May 21 -

Repricings have been a fact of life in the bank loan market for a while, but while there's little doubt that they can be good news for the issuer, they are beginning to irk investors, who are tiring of seeing coupons slashed by more than a third, Libor floors sliced in half and pricing grids being added to deals.

May 10