Robert Barba is the technology editor of American Banker. Robert previously served as deputy editor of American Banker's dealmaking and strategy section. He joined American Banker in late 2007 as a community banking reporter, just in time for the financial crisis. Robert played a lead role in covering community banks' struggle for survival in the years following the downturn. Robert has appeared on Fox Business to discuss bank failures and the Treasury Department's Troubled Asset Relief Program. Prior to joining American Banker, Robert was a general business reporter at Scripps Treasure Coast Newspapers in Stuart, Fla. He began his career as a business desk intern at The Denver Post and Boulder Daily Camera. Robert is based in New York.

-

Virun Rampersad, the guy in charge of global innovation for the 230-year-old BNY Mellon, is more banker than technologist, and it shows in his strategy. His job is to create a culture that'll keep this banking behemoth relevant for centuries to come.

By Robert BarbaNovember 2 -

JPMorgan Chase entered the digital wallet wars in announcing Chase Pay, a product that will launch next year. Although mobile payments have been more bark than bite so far, the company says that its product plans to use loyalty programs to lure reluctant consumers.

By Robert BarbaOctober 28 -

JPMorgan Chase entered the digital wallet wars in announcing Chase Pay, a product that will launch next year. Although mobile payments have been more bark than bite so far, the company says that its product plans to use loyalty programs to lure reluctant consumers.

By Robert BarbaOctober 27 -

SunTrust has removed a clause from its severance agreement that laid-off employees claimed would have put them on call for two years to answer questions without compensation. Loss of institutional knowledge may be the cost of offshoring.

By Robert BarbaOctober 23 -

The widespread adoption of online and mobile banking has largely happened at a time when rates have been near zero. At some point, rates will rise and the value of the experience will be pitted against the value of a yield for depositors. Rate-hoppers will be able to move at an unprecedented speed.

By Robert BarbaOctober 23 -

The widespread adoption of online and mobile banking has largely happened at a time when rates have been near zero. At some point, rates will rise and the value of the experience will be pitted against the value of a yield for depositors. Rate-hoppers will be able to move at an unprecedented speed.

By Robert BarbaOctober 22 -

Regional banks did a much better job of expanding revenue than their megabank counterparts in the third quarter, but they had to spend more to do so and risk angering investors in a tight-margin environment.

By Robert BarbaOctober 15 -

The chiefs of Fiserv, FIS and TCS Financial Solutions explain how they continue meeting customers' current needs while preparing for the inevitable day when those needs radically change.

By Robert BarbaOctober 14 -

In a Q&A, Hari Gopalkrishnan, who oversees mobile banking for Bank of America's consumer and wealth management operations, discusses the mobile trends of the past year, including the difference between what its technology is capable of doing and what consumers are willing to adopt.

By Robert BarbaOctober 8 -

Swift CEO Gottfried Leibbrandt talks about how the global messaging network is looking to stay relevant to its bank members; the potential and limitations of blockchain technology; and his views on the startups looking to disrupt banking.

By Robert BarbaOctober 5 -

Can true innovation happen when so much of the industry is still working on systems built in the 20th century?

By Robert BarbaSeptember 21 -

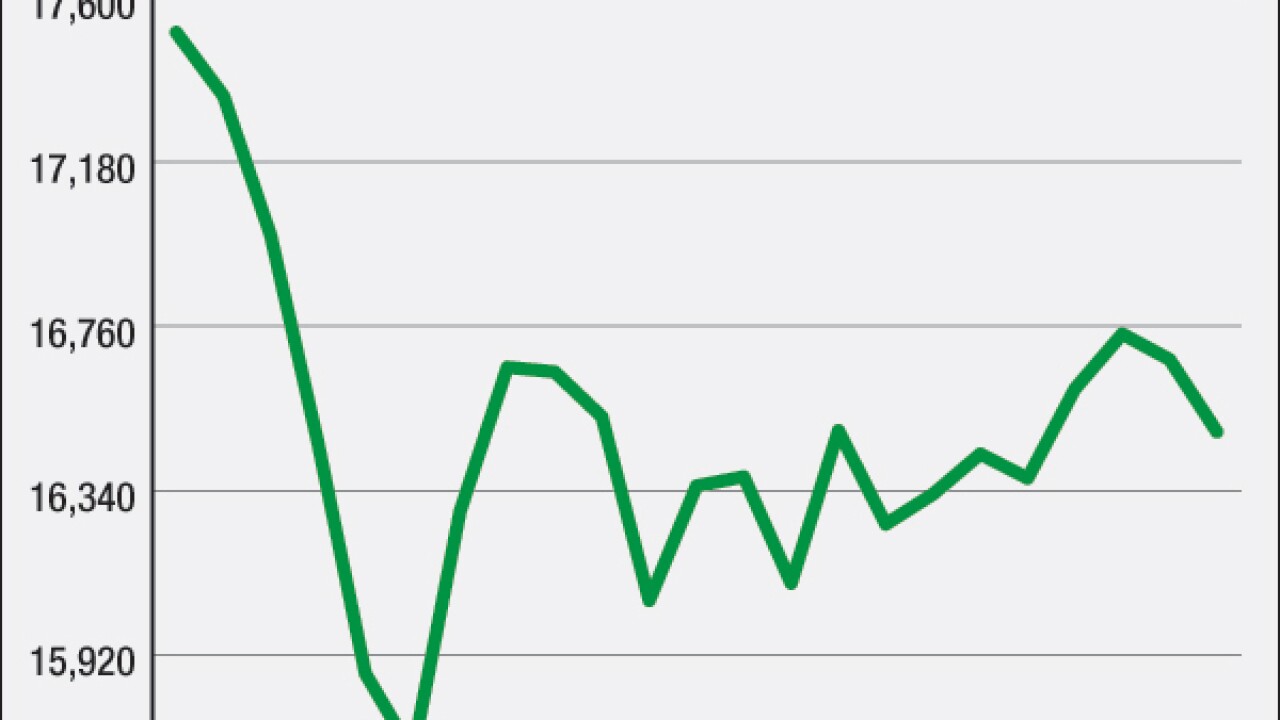

During the recent market volatility, apps that aim to lure non-typical investors into the market faced a problem with which all digital-only financial products contend: no office to visit for reassurance. Companies turned to emails, tweets and pop-up messages to try to replicate the soothing voice.

By Robert BarbaSeptember 18 -

In the relatively small universe of mobile banking apps created for business clients, the standouts offer views of worldwide account balances and customized news feeds.

By Robert BarbaSeptember 11 -

Application programming interfaces (APIs) have driven a technology revolution for small businesses that use the open development tools to add payments to e-commerce sites.

By Robert BarbaAugust 28 -

Tim Colvin used to make consumer loans at Community Trust Bank. Now, as the bank's "dream manager," he spends his workday counseling the bank's employees on everything from figuring out how to adopt a baby to landing their ideal job.

By Robert BarbaAugust 25 -

An employee committee that goes by the name CHEER has one mission: make the $1.5 billion-asset Boiling Springs Savings Bank a fun place to work.

By Robert BarbaAugust 25 -

Standard Treasury, the startup that Silicon Valley Bank absorbed this month, is helping create software gateways for the institution's high-tech business clients to customize the way they interact with it.

By Robert BarbaAugust 25 -

Rather than simply considering whether a prospective borrower's business contributes to climate change, banks are slowly turning their attention to making sure borrowers in a variety of industries account for how climate change could affect them.

By Robert BarbaAugust 18 -

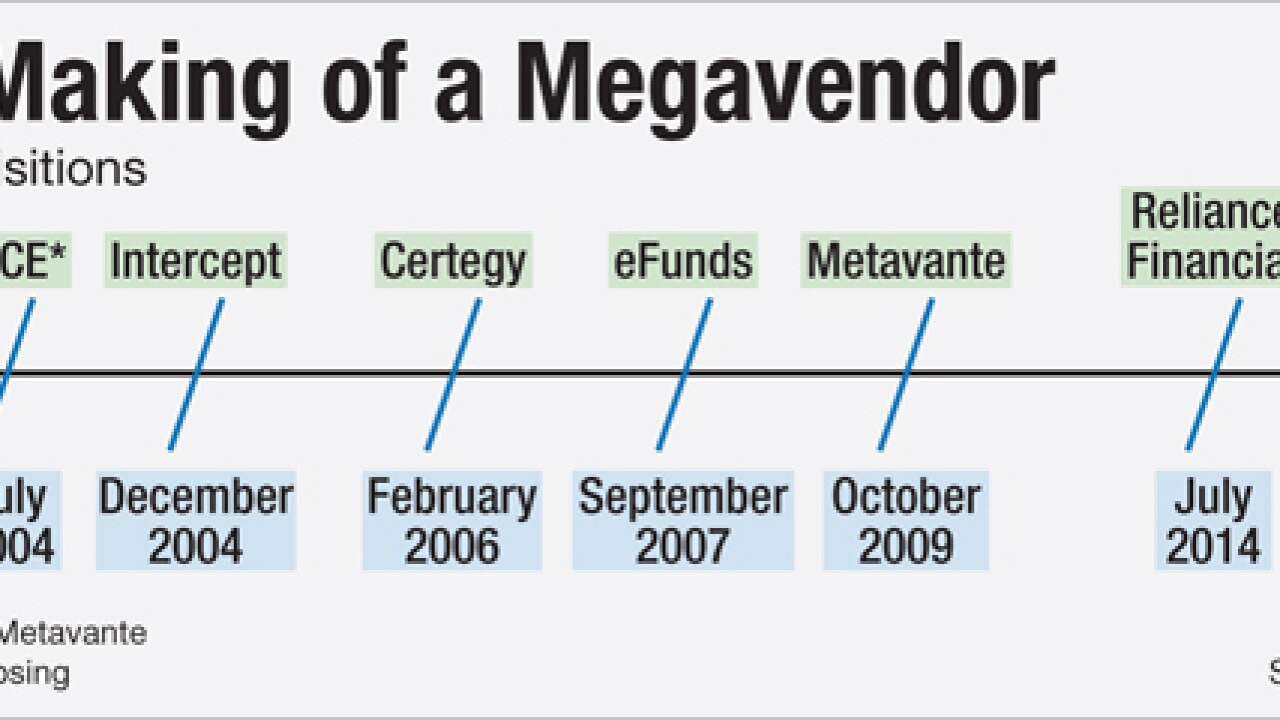

As banks look to shorten their list of vendors, the industry's largest technology supplier is looking to lengthen its list of products and services.

August 13 -

The $9.1 billion acquisition of SunGard Data Systems would deepen FIS' bench in banking and asset management services and add products for capital markets, dovetailing with banks' desire to narrow the list of companies that serve them.

By Robert BarbaAugust 12