Robert Barba is the technology editor of American Banker. Robert previously served as deputy editor of American Banker's dealmaking and strategy section. He joined American Banker in late 2007 as a community banking reporter, just in time for the financial crisis. Robert played a lead role in covering community banks' struggle for survival in the years following the downturn. Robert has appeared on Fox Business to discuss bank failures and the Treasury Department's Troubled Asset Relief Program. Prior to joining American Banker, Robert was a general business reporter at Scripps Treasure Coast Newspapers in Stuart, Fla. He began his career as a business desk intern at The Denver Post and Boulder Daily Camera. Robert is based in New York.

-

Can true innovation happen when so much of the industry is still working on systems built in the 20th century?

By Robert BarbaSeptember 21 -

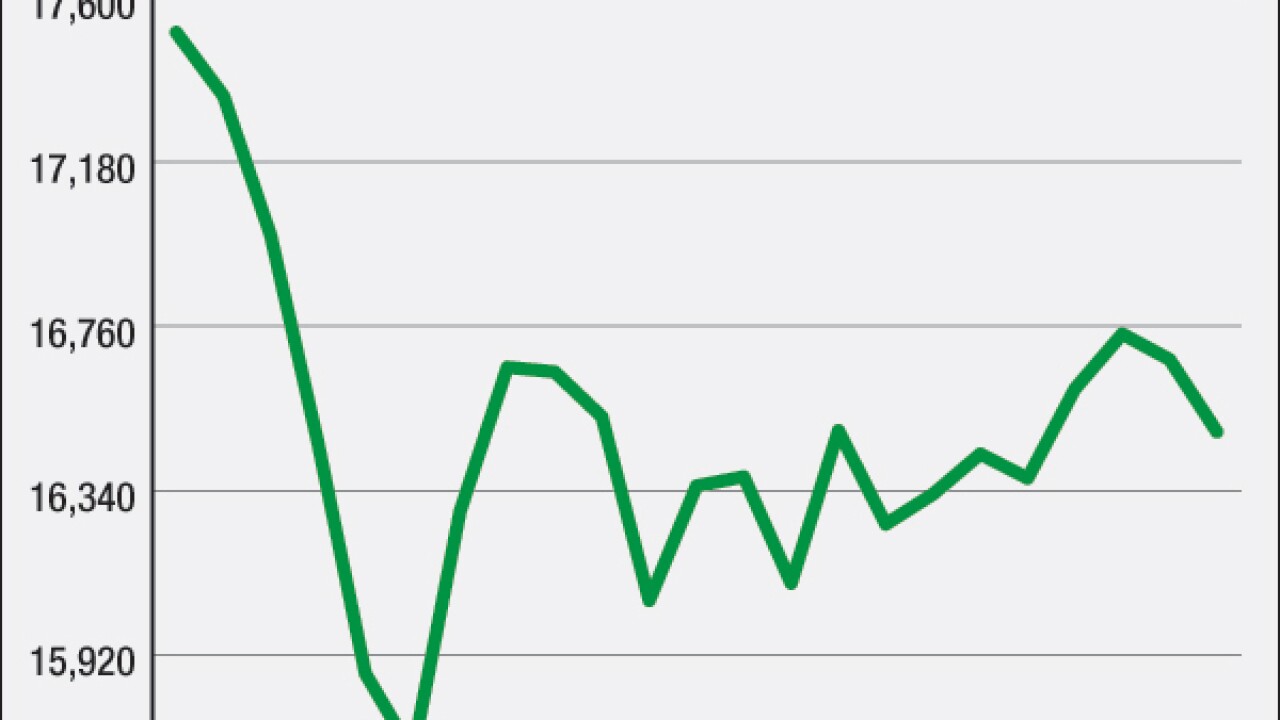

During the recent market volatility, apps that aim to lure non-typical investors into the market faced a problem with which all digital-only financial products contend: no office to visit for reassurance. Companies turned to emails, tweets and pop-up messages to try to replicate the soothing voice.

By Robert BarbaSeptember 18 -

In the relatively small universe of mobile banking apps created for business clients, the standouts offer views of worldwide account balances and customized news feeds.

By Robert BarbaSeptember 11 -

Application programming interfaces (APIs) have driven a technology revolution for small businesses that use the open development tools to add payments to e-commerce sites.

By Robert BarbaAugust 28 -

Tim Colvin used to make consumer loans at Community Trust Bank. Now, as the bank's "dream manager," he spends his workday counseling the bank's employees on everything from figuring out how to adopt a baby to landing their ideal job.

By Robert BarbaAugust 25 -

An employee committee that goes by the name CHEER has one mission: make the $1.5 billion-asset Boiling Springs Savings Bank a fun place to work.

By Robert BarbaAugust 25 -

Standard Treasury, the startup that Silicon Valley Bank absorbed this month, is helping create software gateways for the institution's high-tech business clients to customize the way they interact with it.

By Robert BarbaAugust 25 -

Rather than simply considering whether a prospective borrower's business contributes to climate change, banks are slowly turning their attention to making sure borrowers in a variety of industries account for how climate change could affect them.

By Robert BarbaAugust 18 -

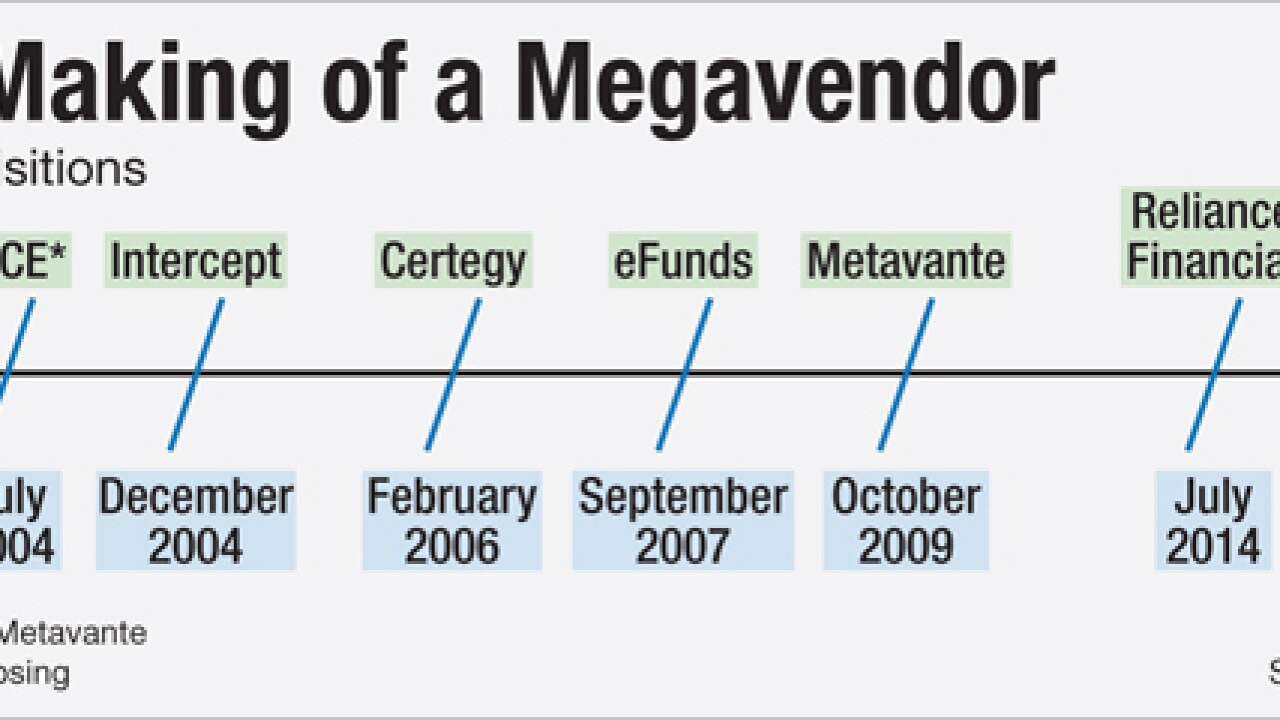

As banks look to shorten their list of vendors, the industry's largest technology supplier is looking to lengthen its list of products and services.

August 13 -

The $9.1 billion acquisition of SunGard Data Systems would deepen FIS' bench in banking and asset management services and add products for capital markets, dovetailing with banks' desire to narrow the list of companies that serve them.

By Robert BarbaAugust 12 -

The acquisition of Yodlee, considered PFM's pioneering firm, would cement Envestnet's capability to serve an emerging demand for data aggregation and leveraging data insights and behavioral science in wealth management.

By Robert BarbaAugust 10 -

Community Trust in Ruston, La., took the rare step of replacing its hodgepodge legacy core system. The move should cut processing costs in half. In the meantime, the bank's taking a lot of calls from confused customers.

By Robert BarbaAugust 10 -

The number of banks has fallen just 18% nationwide in the five years since Dodd-Frank became law, far less than the 40% figure cited by Rubio in Thursday night's debate.

August 7 -

Ellie Mae will add new integrations of Fannie Mae's automated loan review technology to its loan origination system to help lenders ensure loans remain eligible for sale throughout the underwriting process and eliminate surprises at the end.

By Robert BarbaJuly 23 -

Buyout heavyweight Accel-KKR just bought a stake in Banker's Toolbox, a software company that helps community banks flag fraud. The PE firm says it was on the hunt for investments in the compliance space given the regulatory climate.

By Robert BarbaJuly 22 -

JPMorgan Chase is set to launch its new homepage on Sunday, marking its first major overhaul of Chase.com since 2012. The new homepage aims to simplify language and makes the company's news and stories feature more prominent with the hopes of driving customer engagement.

By Robert BarbaJuly 17 -

Meta Financial Group in Sioux Falls, S.D., has agreed to buy Fort Knox Financial Services, a software firm that helps independent tax firms process refund transfers.

By Robert BarbaJuly 17 -

The leak of documents from the surveillance software and "ethical hacking" firm Hacking Team revealed that some foreign banks were clients. Had any U.S. banks been on the list, the last two weeks would have been interesting.

By Robert BarbaJuly 16 -

Banks better get ready for a quick, steep increase in deposit costs after the Fed raises rates. Technology, new regulations and other factors have changed the slower-paced retail-banking game of old, JPMorgan Chase executives say.

By Robert BarbaJuly 14 -

BB&T's top executives are set to get up to $2.6 million in bonuses if the Susquehanna deal goes well. While viewed as a good way to make sure the deal works out well, some analysts note that M&A already contributes to executive compensation when it boosts earnings per share and return metrics.

By Robert BarbaJuly 10