-

TCF Financial in Wayzata, Minn., reported sharply higher profits driven by gains on the sale of auto loans even as auto-related chargeoffs rose.

April 21 -

Ally Financial has blasted a proxy advisory firm for its recommendation that shareholders vote against the re-election of four of the Detroit company's directors.

April 19 - North Carolina

B of A is normally thought of as a U.S. economic bellwether, but it has substantial operations overseas, and its international performance last quarter provided a painful reminder of that fact.

April 14 -

The world knows JPMorgan's quarterly profits fell and that it flunked the living wills test. But underneath all that were solid first-quarter results in its core lending businesses that bode well for other banks at the start of earnings season.

April 13 -

The deal to buy TradeKing would allow the online-only bank to offer wealth-building products to its roughly 1.1 million depositors. The additional low-cost deposits could also help fund loan growth as it looks to expand beyond auto lending and into mortgages and credit cards.

April 6 -

GOP lawmakers and witnesses at a Senate Banking Committee hearing pointedly criticized the Consumer Financial Protection Bureau on Tuesday, setting the stage for a likely contentious hearing with the agency's director later in the week.

April 5 -

Ally Financial announced Tuesday that it had agreed to buy the online brokerage firm TradeKing Group for approximately $275 million. TradeKing, based in Fort Lauderdale, Fla., has roughly $4.5 billion in client assets.

April 5 -

The Dallas-based subprime consumer lender backed off controversial changes to its method for calculating its quarterly provisions for loan losses, forcing it to revise earnings downward for the last two years. It also announced that it had found more accounting issues.

March 31 -

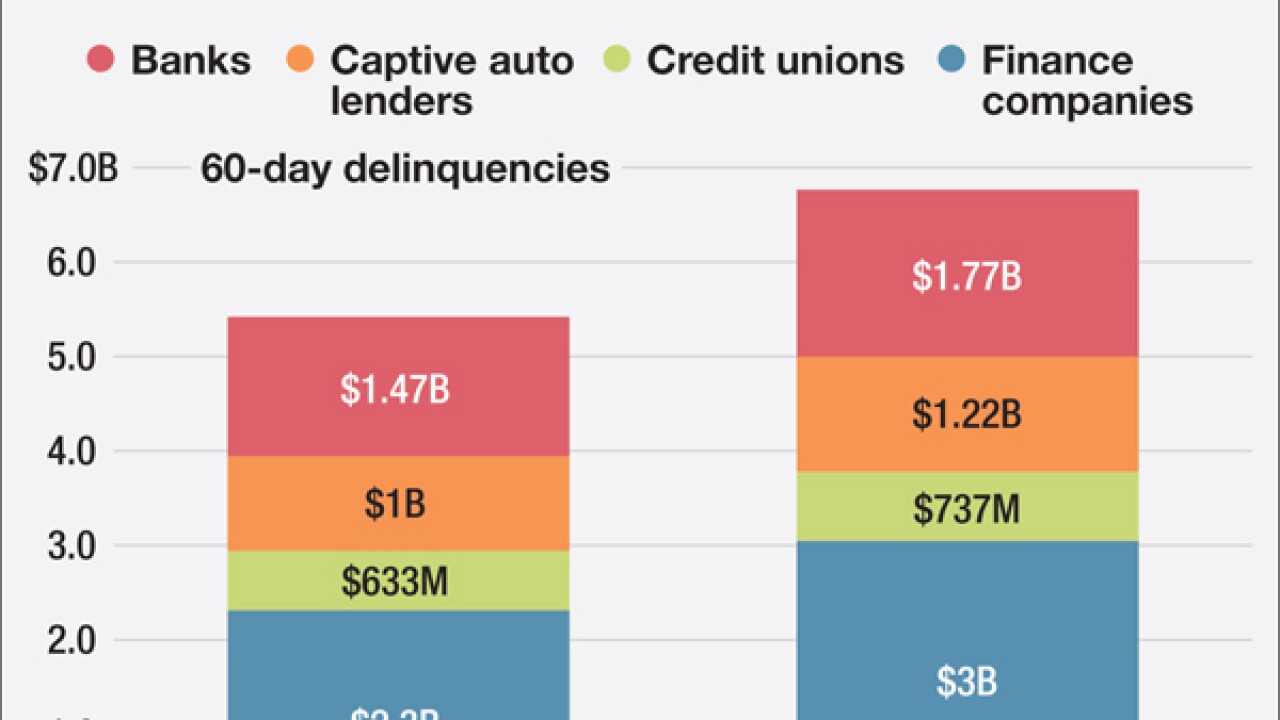

Competition is spurring subprime auto lenders to stretch their underwriting guidelines for new customers, raising fears of another bust. In February, 5.16% of securitized subprime auto loans were at least 60 days past due, according to Fitch Ratings. That slightly exceeded the level of late payments at the height of the Great Recession. Here's a guide to who's doing what in the market, courtesy of our colleagues at Asset Securitization Report.

March 31 -

Credit unions have a dominant auto lending presence in the West, boasting as much as a 50% market share in some areas. Credit Union Journal explores what is driving that dominance.

March 29 -

The subprime consumer lender currently rejects many of its personal loan applicants. It hopes to qualify more borrowers by offering cash to those who are willing to put their cars up as collateral.

March 28 -

California Republic Bancorp, which has been aggressively originating and securitizing auto loans for years, is keen on revving up the engine to expand from a 10-state area to a national platform.

March 22 -

Ally Financial in Detroit reached a truce with Lion Point Capital, as it agreed to appoint an independent director in consultation with the activist investor.

March 21 -

Chicago-based Avant said Monday that it has started offering to refinance car owners loans. The firm also plans to begin financing purchases of new and used vehicles later in 2016.

March 21 -

The increasingly troubled sector often draws comparisons to the subprime mortgage market of the 2000s. But the more apt analogue is the auto-lending sector of the 1990s.

March 16 -

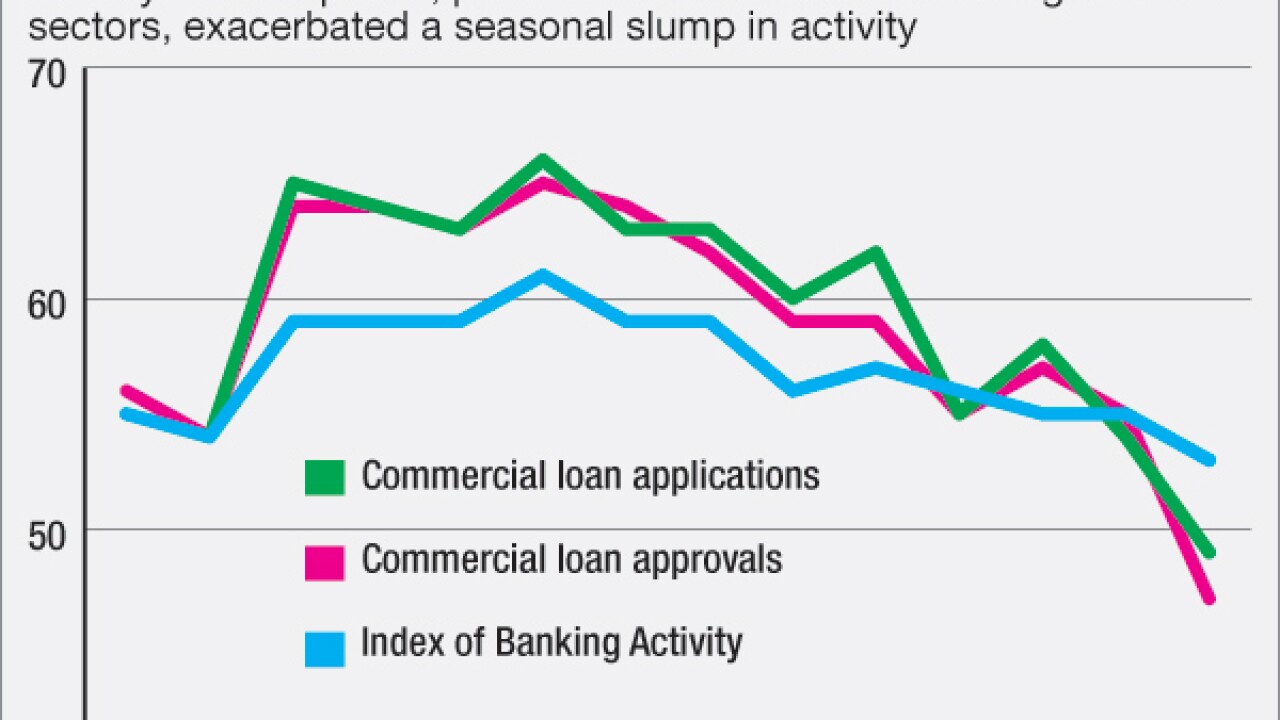

American Banker Research's Index of Banking Activity, which had the lowest reading in its nearly four-year history in January, revealed that issues in oil-producing states are contributing to decreases in commercial loan applications and approvals.

March 16 -

Santander Consumer USA Holdings said that it is changing certain accounting practices after the Securities and Exchange Commission raised questions about the firms methodology.

March 16 -

Personal income gains, coupled with historically low interest rates, should help cushion borrowers and reduce the likelihood of a rise in defaults despite the recent increase in auto lending, according to a new report from London-based Capital Economics Ltd.

March 10 -

Their top executives sure don't. Income streams are constrained in every business line, the economic picture remains murky, and big banks are talking about cutting more expenses again.

March 8 -

HarborOne Bank, a mutually owned co-operative bank in Brockton, Mass., plans to sell shares to the public.

March 7