-

The subprime auto lender failed to disclose that it received fees for referring borrowers to CarMax, the used-car dealer, according to California's financial regulator.

April 6 -

The St. Louis-based company partnered with 38 new credit unions last fiscal year.

April 6 -

The Auburn Hills, Mich.-based credit union serves 200,000 members with more than $2.3 billion in assets.

April 6 -

Growing numbers of small subprime auto lenders are shutting down after loan losses and slim margins spur banks and private equity owners to cut off funding.

April 6 -

Late-payment rates at banks declined in nine out of the 11 consumer loan categories tracked by the American Bankers Association, including credit cards, auto loans and personal loans.

April 4 -

While the banking industry is divided on the use of conversational technology, the San Francisco company believes chatbots can make it easier for customers to discuss their finances.

April 3 -

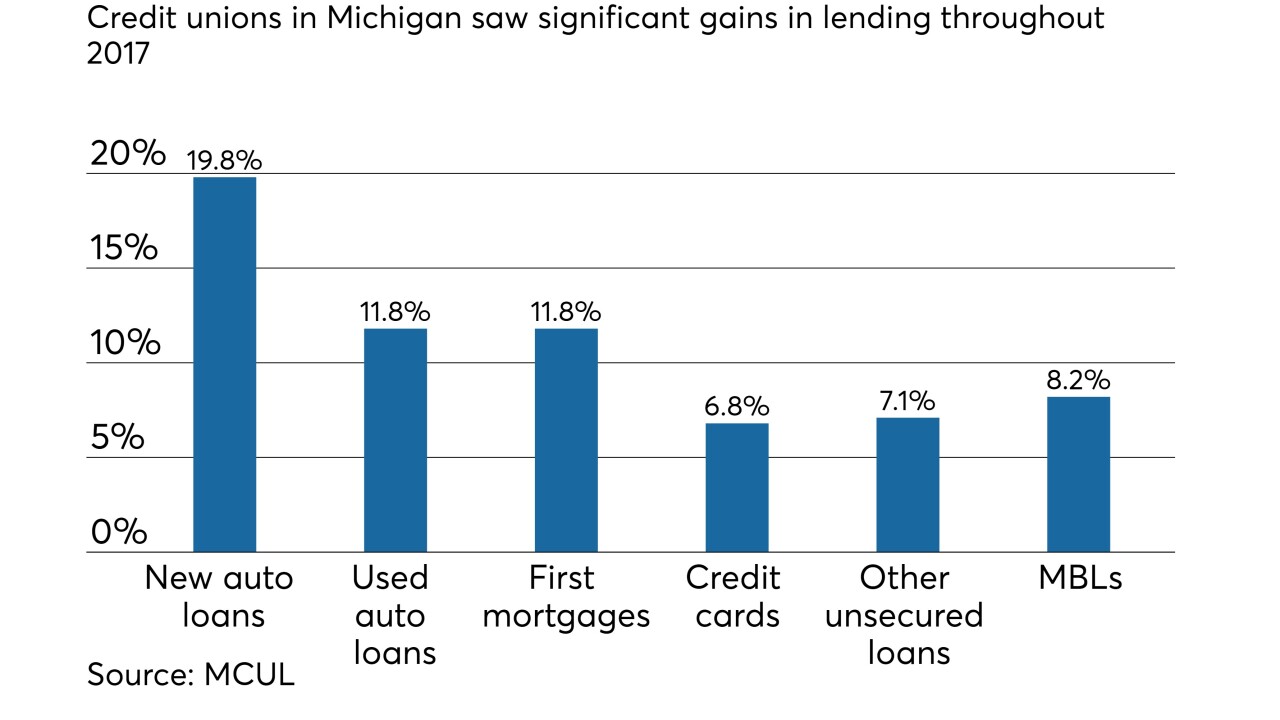

Credit unions in Michigan saw significant gains in Q4 2017, as CUs there ended the year with significant boosts to membership and lending.

March 28 -

The latest Credit Union Trends Report from CUNA Mutual Group predicts robust membership growth in the year ahead and sustained lending growth due to positive economic factors.

March 26 -

The Federal Reserve raised interest rates by a quarter-point at its Wednesday meeting and more increases are expected this year. Here's what credit unions need to know to be prepared.

March 21 -

As it expands to the West Coast, the bank will first target car dealers at which it is already an indirect consumer lender.

March 14 -

The country’s ratio of household debt to disposable income reached a record 171% in 2017.

March 13 -

The fear of data breaches has become a regular part of life, but many regs that help protect auto lenders were written before that threat originated. Here's how to protect yourself.

March 7 EFG Companies

EFG Companies -

The bank will allow its customers to apply for car financing online and receive a decision within minutes.

February 22 -

The Arizona-based online auto dealer has partnerships with 35 credit unions – and is looking to expand.

February 22 -

The subprime auto lender paid $2.9 million to Connecticut consumers and a $100,000 fine for miscalculating balances owed on repossessed cars and for charging improper fees. It says the settlement is part of an effort to clean up "legacy issues."

February 20 -

Popular will acquire $1.5 billion in auto loans amid questions about the potential for loan losses following Hurricane Maria. The deal also coincides with Wells Fargo's need to stay inside a growth cap imposed by regulators.

February 14 -

Sen. Elizabeth Warren, D-Mass., asked Wells Fargo's chief executive to address recent reports that the bank's efforts to compensate customers for unnecessary fees is falling short.

February 14 -

In some states, total mortgages outstanding are at all-time highs, but in others hard hit by the financial crisis they remain well below their 2008 peaks, the New York Fed said Tuesday in its quarterly report on household debt.

February 13 -

U.S. consumers are borrowing more than ever to buy homes and cars, pay for college and even finance every day purchases. Is it a display of confidence in the U.S. economy or are many households living far beyond their means?

February 11 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7