-

The company, which announced the conclusion of a three-year-old credit card partnership with TD Bank, is shifting to digital financing of individual consumer purchases.

July 18 -

Alleged discrimination over immigration status is the latest legal headache for Wells Fargo.

July 17 -

The autonomous vehicle lending market isn’t expected to peak for decades, but some CUs are already jumping in, and they could be at the forefront of rapid shifts in the automotive industry.

July 12 -

CUs in both states surpassed total asset milestones, but many business lines are growing at a slower pace than they were one year ago.

July 11 -

CUs in the Keystone State saw loan balances rise by 8.5%, while membership rose more than 3.3% to top 4.2 million.

July 10 -

Membership continues to rise across the Wolverine State, though at a slower pace, but lending overall is on the decline.

July 1 -

The agreement is expected to solidify a lending partnership whose status had been in doubt for more than a year. But it raised as many questions as it answered.

July 1 -

Credit unions reported gains in areas such as loan balances and membership but it was at a slower pace than a year earlier.

June 21 -

The first full day of America's Credit Union Conference in Orlando hit on a variety of topics, including narrowing the gender gap and ongoing attacks from banks.

June 19 -

The bank was accused of forcing borrowers to pay for insurance they did not need, pushing almost 250,000 of them into delinquency, according to a 2017 lawsuit.

June 7 -

Santander Bank and Santander Consumer USA have put many problems behind them in recent years under CEO Scott Powell, but he still has a Federal Reserve enforcement action to resolve and is negotiating with Fiat Chrysler to preserve a crucial auto lending relationship.

June 3 -

A look back at Credit Union Journal's May 2019 special report on auto lending.

May 31 -

The scandal-plagued bank announced Wednesday that it is adding a board member with deep experience in accounting. It is also considering a switch to flat pricing in indirect auto lending, a change long favored by consumer advocates.

May 29 -

Borrowers with poor credit make up less than 15% of the industry's total auto loan portfolio. That has shielded CUs from some delinquency issues, but some say it raises questions about whether the movement is reaching the consumers it was chartered to serve.

May 28 -

Kathy Kraninger, the bureau's director, is in a standoff with Democrats about her claim that the agency cannot supervise institutions under the Military Lending Act.

May 27 -

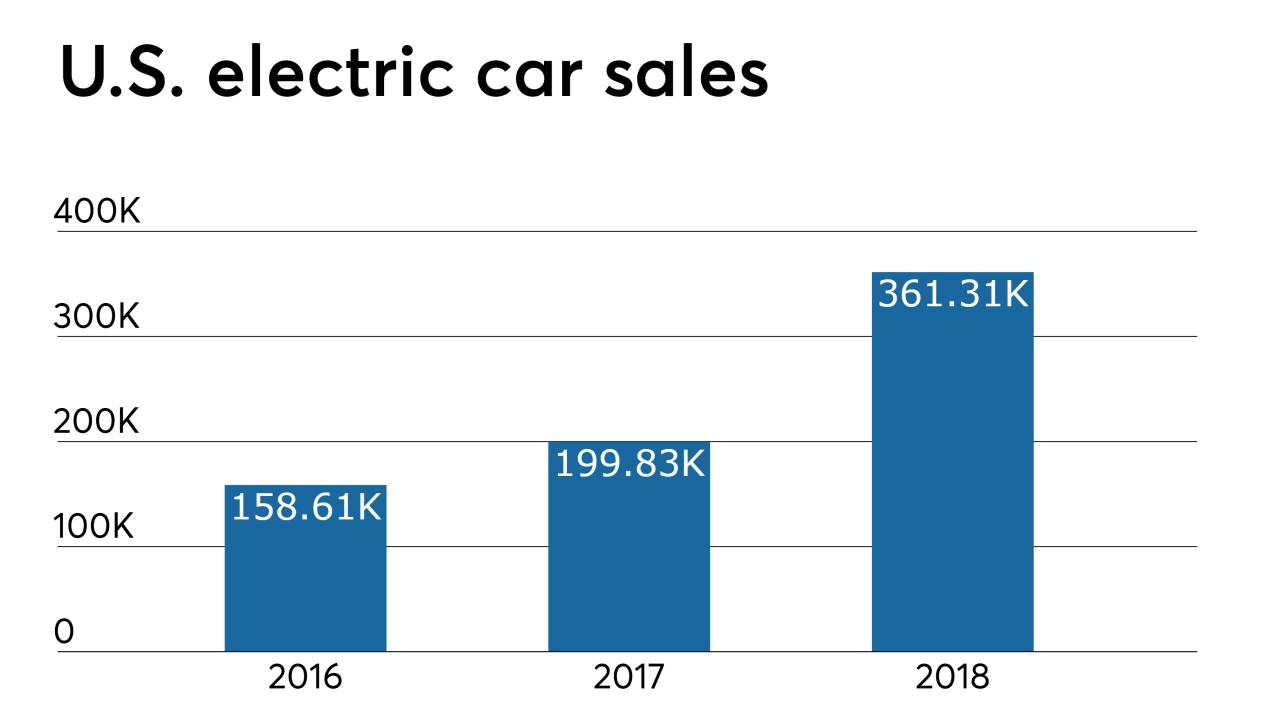

All-electric, zero-emission vehicles make up less than 2% of the market, but a handful of credit unions see an opportunity despite some unusual variables.

May 22 -

Credit union executives reported seeing an uptick in car loans as the weather improved but some predicted lending would be down this year.

May 21 -

Mainland-based credit unions with operations in the territory witnessed a surge in auto lending after Hurricane Maria ravaged the island but demand for these loans seems to be ticking down.

May 21 -

From data analytics to focusing on a service culture and more, here's a look at how technology is radically remaking lending.

May 20 -

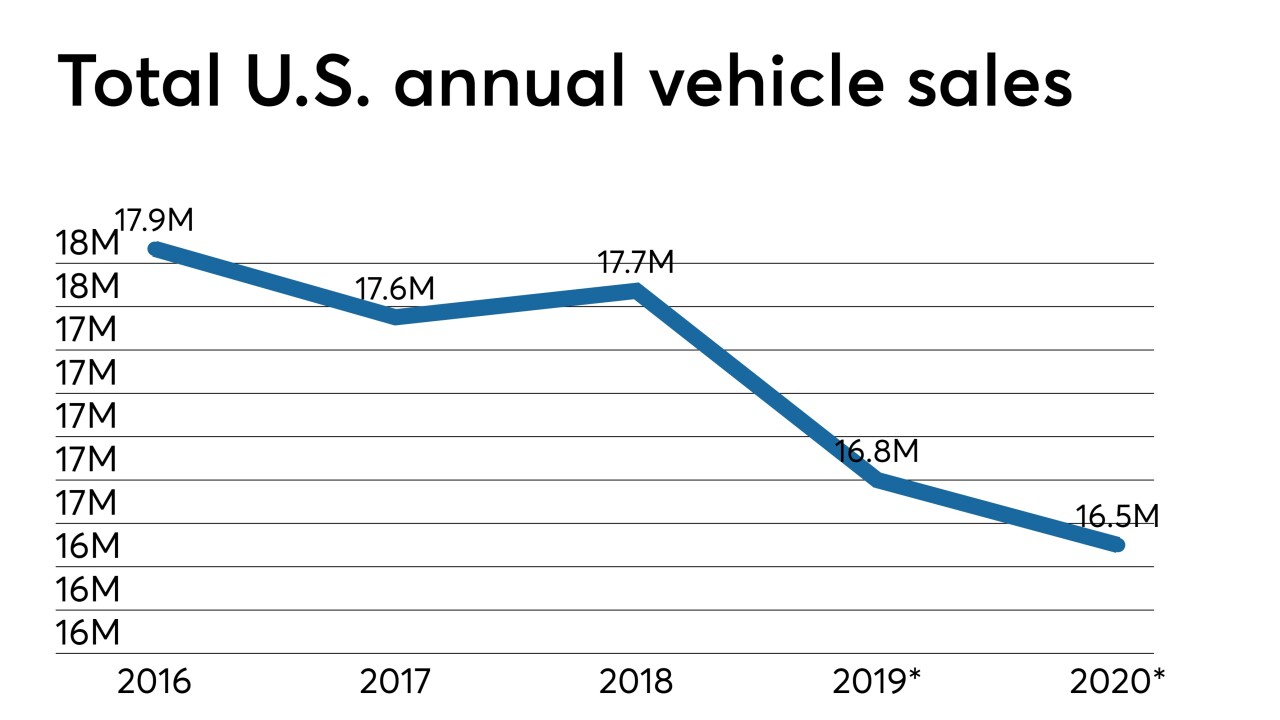

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20