-

The subprime consumer lender currently rejects many of its personal loan applicants. It hopes to qualify more borrowers by offering cash to those who are willing to put their cars up as collateral.

March 28 -

California Republic Bancorp, which has been aggressively originating and securitizing auto loans for years, is keen on revving up the engine to expand from a 10-state area to a national platform.

March 22 -

Ally Financial in Detroit reached a truce with Lion Point Capital, as it agreed to appoint an independent director in consultation with the activist investor.

March 21 -

Chicago-based Avant said Monday that it has started offering to refinance car owners loans. The firm also plans to begin financing purchases of new and used vehicles later in 2016.

March 21 -

The increasingly troubled sector often draws comparisons to the subprime mortgage market of the 2000s. But the more apt analogue is the auto-lending sector of the 1990s.

March 16 -

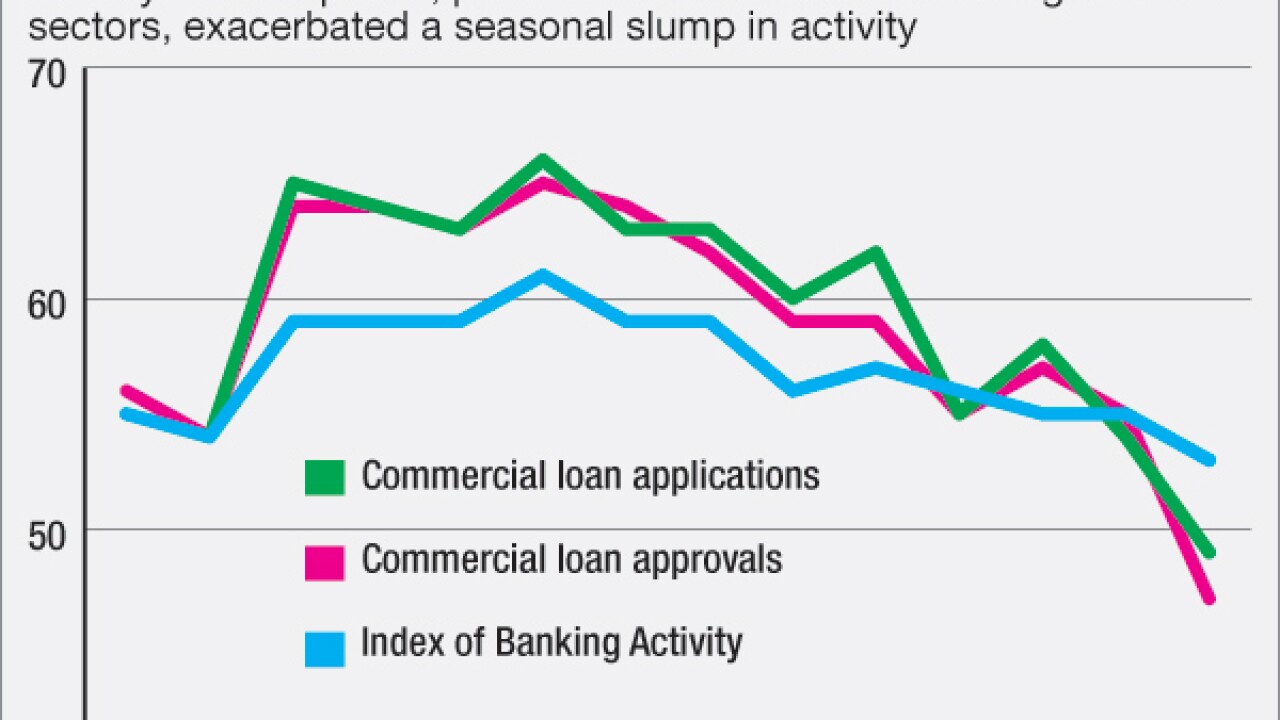

American Banker Research's Index of Banking Activity, which had the lowest reading in its nearly four-year history in January, revealed that issues in oil-producing states are contributing to decreases in commercial loan applications and approvals.

March 16 -

Santander Consumer USA Holdings said that it is changing certain accounting practices after the Securities and Exchange Commission raised questions about the firms methodology.

March 16 -

Personal income gains, coupled with historically low interest rates, should help cushion borrowers and reduce the likelihood of a rise in defaults despite the recent increase in auto lending, according to a new report from London-based Capital Economics Ltd.

March 10 -

Their top executives sure don't. Income streams are constrained in every business line, the economic picture remains murky, and big banks are talking about cutting more expenses again.

March 8 -

HarborOne Bank, a mutually owned co-operative bank in Brockton, Mass., plans to sell shares to the public.

March 7 -

During the fourth quarter of 2015, U.S. auto loans carried longer terms, while average monthly payments rose, and a larger percentage of loans went to less creditworthy borrowers, according to a new report from Experian Automotive.

March 3 -

Santander Consumer USA Holdings delayed the filing of its annual report Monday amid discussions with the Securities and Exchange Commission regarding unresolved accounting issues.

February 29 -

The Houston-based institution plans to build profit into the repayment agreement for a loan, with profit replacing interest, under the model of other Muslim-based lenders.

February 26 -

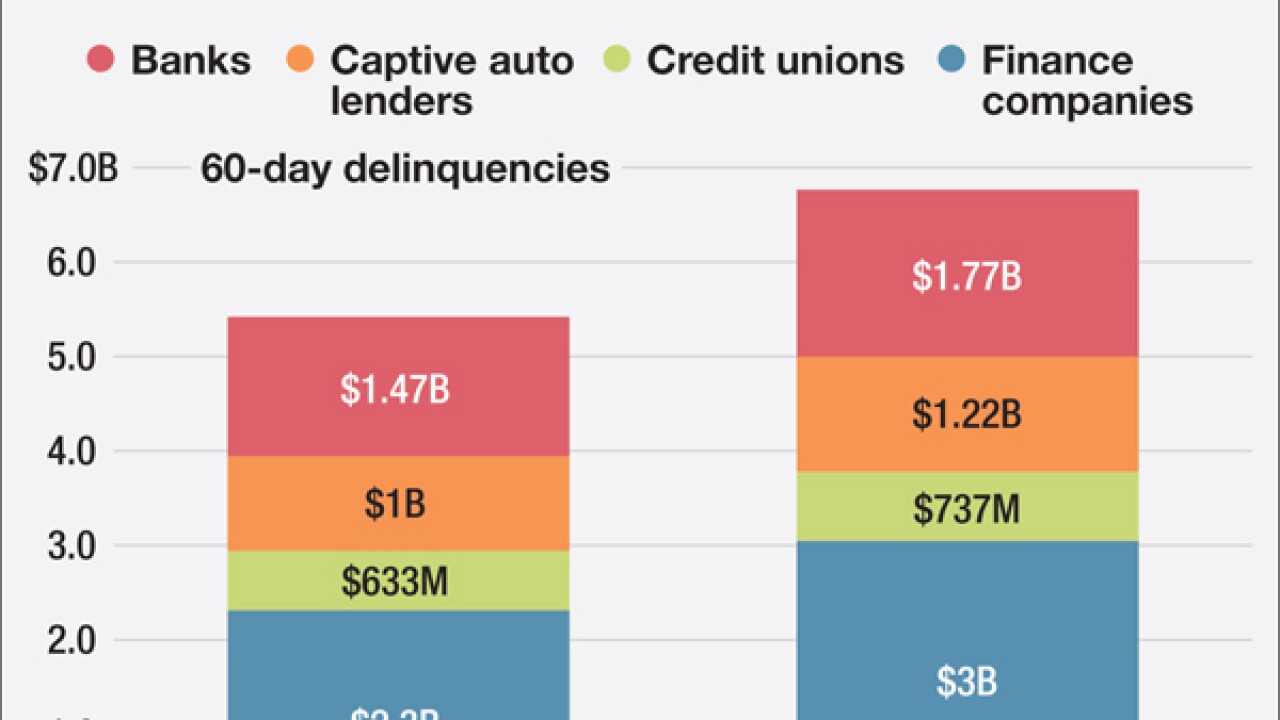

More borrowers with spotty credit are failing to make monthly car payments on time, a troubling sign for investors who have snapped up billions of dollars of securities backed by risky auto debt.

February 24 -

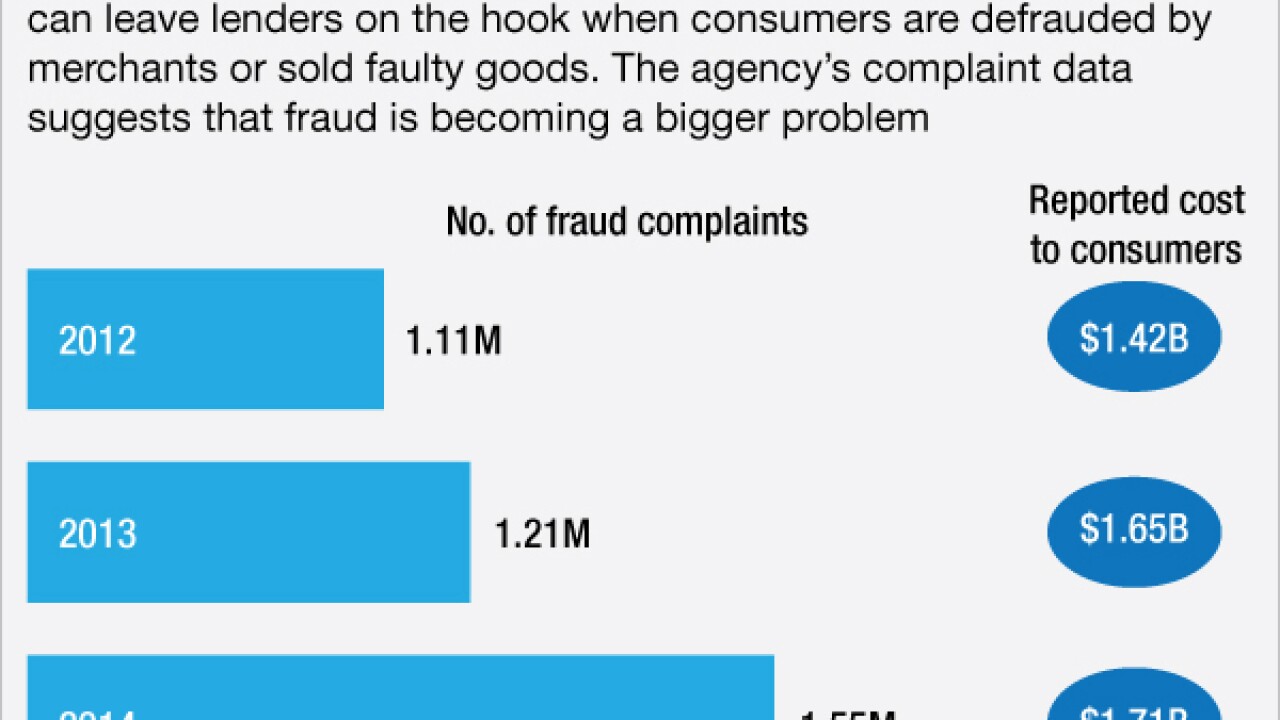

Shoppers who finance the purchase of cars, furniture and home improvements are protected under a decades-old federal regulation. Now consumer groups are urging the FTC to update its rule and consider offering the same protections to victims of home-mortgage or auto-leasing scams.

February 19 -

Key differences in the CFPB's agreements with Toyota and Honda are making it harder for the CFPB to make systemwide changes to the auto lending market. Here's why.

February 19 -

The Detroit company is plowing ahead with its growth strategy at a time when some shareholders are agitating over its sagging share price.

February 11 -

In an interview, Comptroller Thomas Curry expressed concern about eroding loan standards and the potential for crippling cyberattacks. But he also argued that the industry is much stronger than it was a decade ago.

February 11 -

Outstanding automotive loan balances rose 11.5% from a year earlier in the fourth quarter, Experian Automotive said Tuesday.

February 9 - Ohio

Stephen Steinour, chief executive of Huntington Bancshares in Columbus, Ohio, has pursued a risky strategy of taking losses in exchange for adding new customers, the Cleveland Plain Dealer reported.

February 9