-

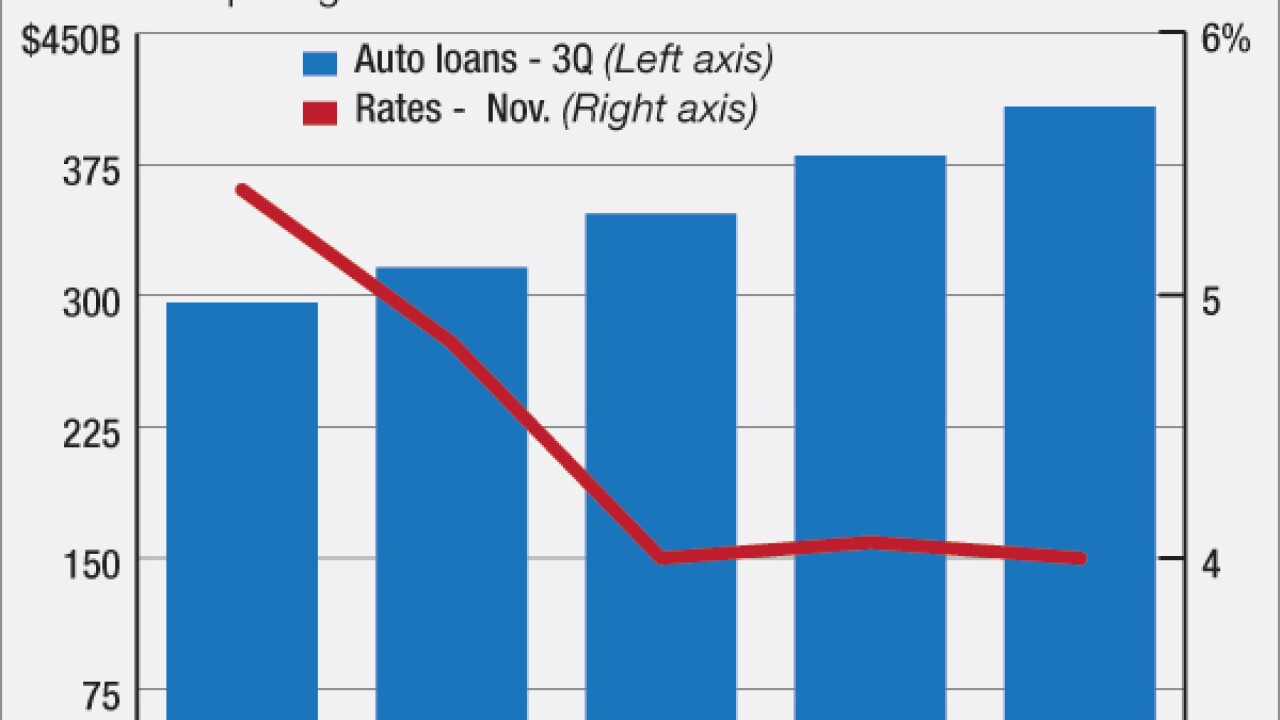

During the fourth quarter of 2015, U.S. auto loans carried longer terms, while average monthly payments rose, and a larger percentage of loans went to less creditworthy borrowers, according to a new report from Experian Automotive.

March 3 -

Santander Consumer USA Holdings delayed the filing of its annual report Monday amid discussions with the Securities and Exchange Commission regarding unresolved accounting issues.

February 29 -

The Houston-based institution plans to build profit into the repayment agreement for a loan, with profit replacing interest, under the model of other Muslim-based lenders.

February 26 -

More borrowers with spotty credit are failing to make monthly car payments on time, a troubling sign for investors who have snapped up billions of dollars of securities backed by risky auto debt.

February 24 -

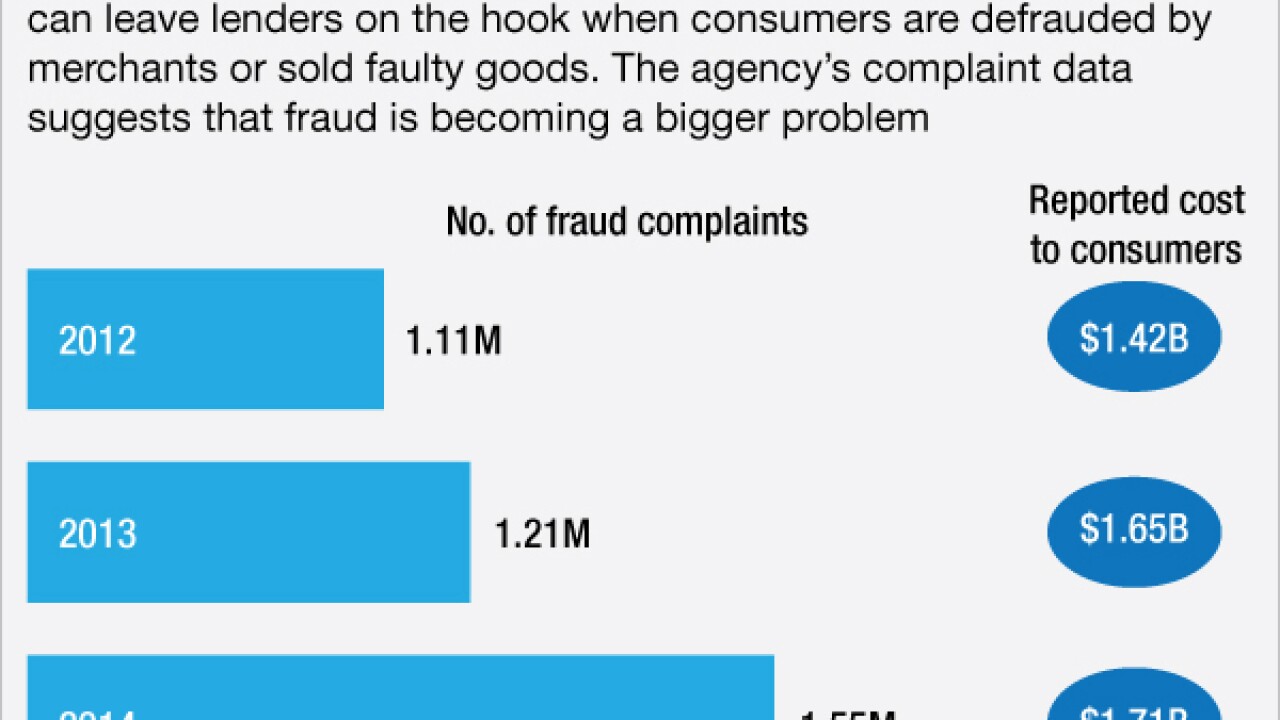

Shoppers who finance the purchase of cars, furniture and home improvements are protected under a decades-old federal regulation. Now consumer groups are urging the FTC to update its rule and consider offering the same protections to victims of home-mortgage or auto-leasing scams.

February 19 -

Key differences in the CFPB's agreements with Toyota and Honda are making it harder for the CFPB to make systemwide changes to the auto lending market. Here's why.

February 19 -

The Detroit company is plowing ahead with its growth strategy at a time when some shareholders are agitating over its sagging share price.

February 11 -

In an interview, Comptroller Thomas Curry expressed concern about eroding loan standards and the potential for crippling cyberattacks. But he also argued that the industry is much stronger than it was a decade ago.

February 11 -

Outstanding automotive loan balances rose 11.5% from a year earlier in the fourth quarter, Experian Automotive said Tuesday.

February 9 - Ohio

Stephen Steinour, chief executive of Huntington Bancshares in Columbus, Ohio, has pursued a risky strategy of taking losses in exchange for adding new customers, the Cleveland Plain Dealer reported.

February 9 -

The Consumer Financial Protection Bureau should have direct oversight of auto dealers instead of being forced to go through indirect auto lenders to make changes to the market, Sen. Elizabeth Warren, D-Mass., suggested Wednesday.

February 3 -

The CFPB notched another victory in its effort to limit dealer discretion after Toyota Motor Credit Corp. agreed to cut in half how much partnering dealerships can mark up the interest rate on a loan as compensation.

February 2 -

CEO Jeffrey Brown spent much of the firm's quarterly earnings call Tuesday responding to the demands of shareholders who are unhappy with Ally's weak stock price.

February 2 -

The public focus on whether Ally should pursue a sale has obscured other issues being raised by the firm's unhappy shareholders.

January 31 -

The Minnesota company's management team expressed confidence in its ability to monitor risk, even as companies such as BB&T and Fifth Third issue warnings over pricing and returns.

January 28 -

TCF Financial in Wayzata, Minn., reported higher profits on lower provision costs and a pickup in lending in the fourth quarter.

January 28 -

Chargeoffs jumped 13% at the Dallas lender, and its warning that they could increase further because of deterioration in subprime auto lending set off alarm bells about the broader consumer finance market.

January 27 -

Santander Consumer USA Holdings on Wednesday reported a sharp drop in profits, due to losses tied to its exit from personal lending.

January 27 -

The way the Consumer Financial Protection Bureau is regulating the auto finance industry's relationships with dealers is simply wrong both legally and ethically according to Blair Evans of Baker Donelson. It's also directly counterproductive to its goal of protecting consumers, she says.

January 25

-

At least five regional banks on Thursday discarded concerns about the global economy, stocks, interest rates and credit quality, forecasting loan growth for the rest of this year.

January 21