CFPB News & Analysis

CFPB News & Analysis

-

The CFPB is giving stakeholders until Dec. 1 to file comments on a potential overhaul to its rules related to the Equal Credit Opportunity Act, which prohibits discrimination in credit and lending decisions.

August 19 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 19 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

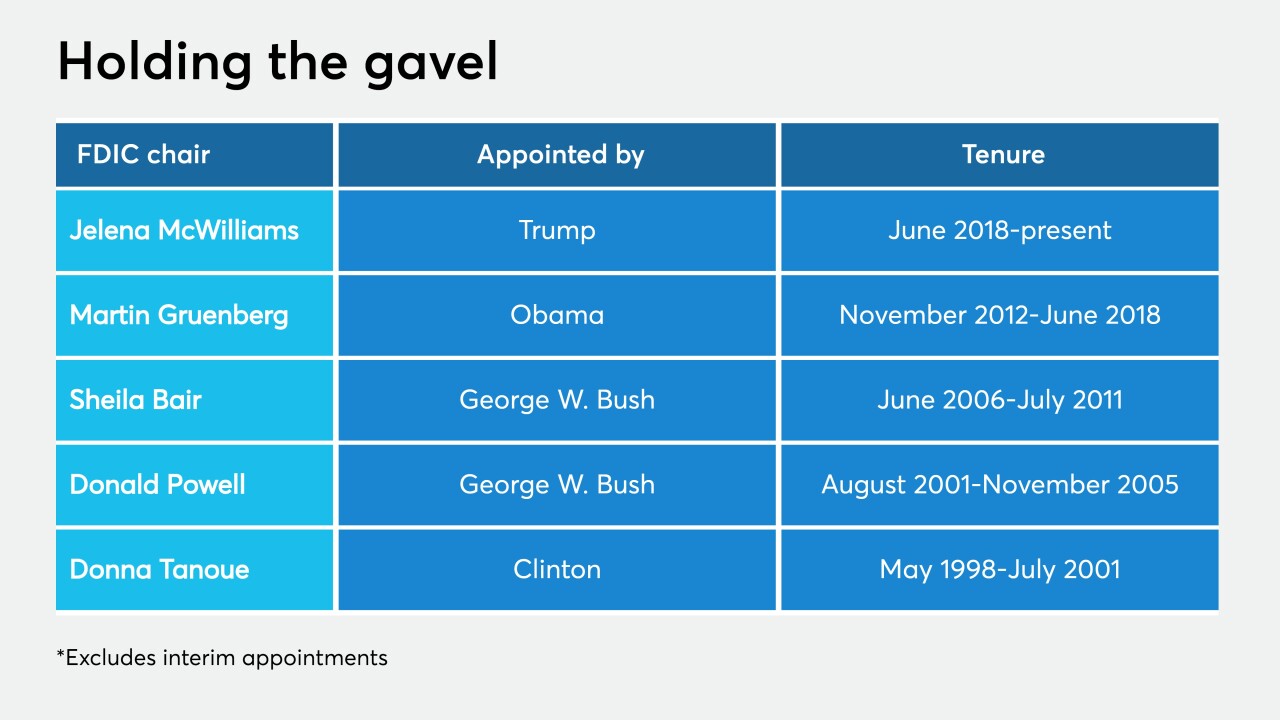

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 18 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 14 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 12 -

A second-term Trump administration would likely continue its deregulatory efforts, focus on Fannie Mae and Freddie Mac's exit from conservatorship, and seek to facilitate fintech participation in the banking system.

August 11 -

The agency sought feedback on potential changes to the Equal Credit Opportunity Act. But a coalition of industry and advocacy groups want a longer comment period to afford “a greater opportunity for thoughtful public participation.”

August 10 -

Kathy Kraninger told the House Financial Services Committee that she supports proposed action to revamp the bureau's leadership framework following a major Supreme Court decision.

July 30