-

Bankers Healthcare Group, which is minority owned by the Tennessee company, is moving beyond its primary strategy of selling health care originations to community banks and will start marketing pools of loans to investors.

July 15 -

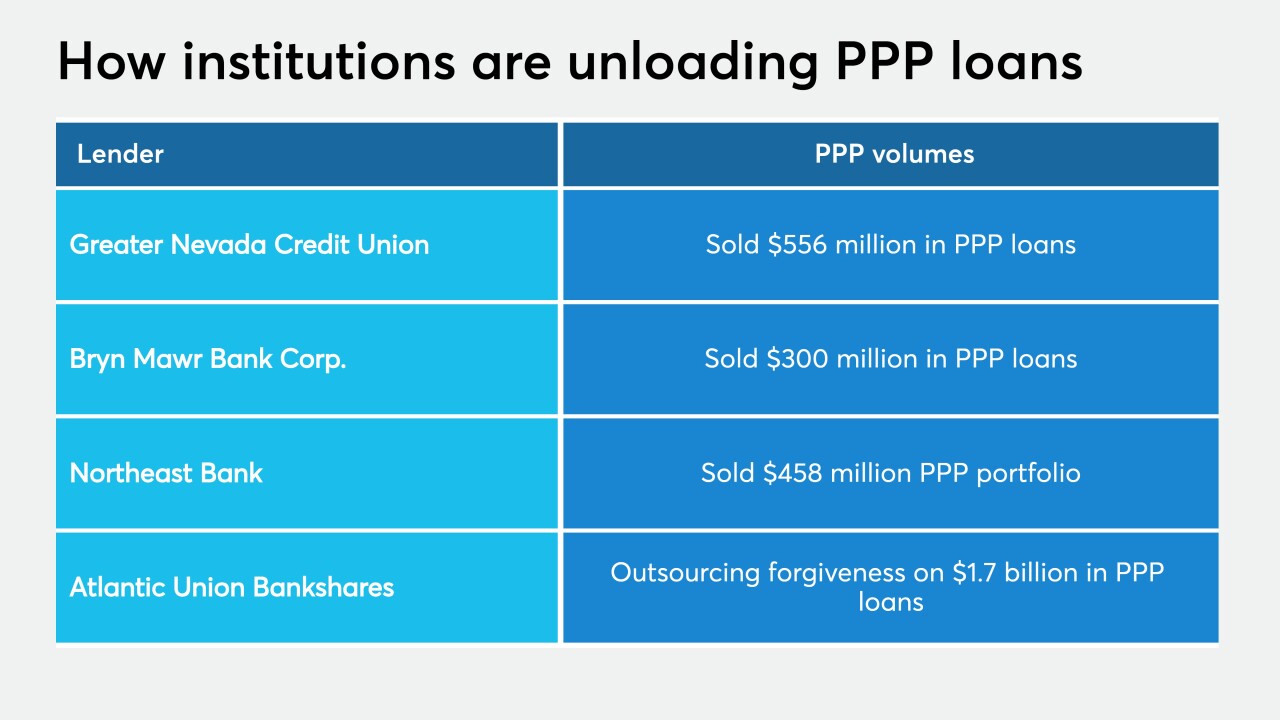

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

July 15 -

The energy sector, retail and hospitality are among the industries that are faring poorly during the pandemic. The bank expects loan losses to remain elevated well into 2021.

July 14 -

Pedro Bryant will oversee a $3 million effort to fund small businesses in disadvantaged communities.

July 14 -

Consumers now have more control over their own financial decisions and loan options.

July 14 Community Financial Services Association of America

Community Financial Services Association of America -

A Bloomberg News analysis shows that the data for Paycheck Protection Program loans totaling more than $521 billion released on July 6 are riddled with anomalies.

July 13 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 13 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 10 -

After tech firms assisted community bankers in processing applications in the Paycheck Protection Program, small-business lenders are continuing to engage with cloud providers and other outside companies to automate the loan forgiveness process.

July 10 -

Two state assembly members introduced legislation that would let the California Infrastructure and Economic Development Bank accept deposits from public entities and provide financing to small businesses and local governments.

July 9