Miriam Cross is a Washington-based reporter covering bank technology and fintech at American Banker. Previously, she was an associate editor at Kiplinger's Personal Finance magazine.

-

Few banks are listening to what their customers are saying on Reddit, but the site can help them spot customer complaints and develop content that dispels misinformation.

By Miriam CrossNovember 4 -

Queensborough National Bank & Trust did not expect that its branches would be in the path of Hurricane Helene. Getting its buildings up and running again was a physical and technological ordeal.

By Miriam CrossOctober 30 -

Community banks will have to pay more, get creative and train from within to build robust banking-as-a-service divisions that can withstand higher regulatory standards.

By Miriam CrossOctober 29 -

The consumer neobank, made by and for Native Americans, understood its target audience deeply and had a plan in place to earn revenue beyond interchange fees. Its struggles to get off the ground reflect other challenges — and lessons — for neobanks where a good idea is only the starting point.

By Miriam CrossOctober 21 -

American Banker's annual recognition of the most powerful women in banking includes two CIOs and the newly created position of chief data and analytics officer at a megabank.

By Miriam CrossOctober 15 -

The company, which helped consumers strategize their credit card payments and pivoted to a B2B model earlier this year, has sold its intellectual property two months after it folded.

By Miriam CrossOctober 9 -

First State Bank of Purdy is on the forefront of new technology from Jack Henry & Associates thanks to the decades-long relationship between the bank and Jack Henry himself.

By Miriam CrossOctober 9 -

The all-digital Grasshopper will vault from $835 million of assets to $1.4 billion and gain a potential audience of 13 million Auto Club Group customers in 14 states.

By Miriam CrossOctober 8 -

The European legislation prohibits or curtails what it deems to be risky usage of artificial intelligence. Banks will be caught in its net if they provide or deploy such AI systems in the EU.

By Miriam CrossOctober 2 -

Digital Federal Credit Union and First Tech Federal Credit Union, among the largest in the country, originated from technology companies.

By Miriam CrossSeptember 30 -

Citigroup, First National Bank and Marqeta headlined some of the biggest changes in executive leadership in the banking, fintech and payments industries.

By Miriam CrossSeptember 30 -

Three of the companies that were part of the FTC's sweep, Operation AI Comply, charged consumers to open online storefronts that generated little money compared to what was promised.

By Miriam CrossSeptember 26 -

Thurlow has been the CEO at Reading for 18 years, and will finish her stint as chair of the American Bankers Association in October.

By Miriam CrossSeptember 26 -

Barker joined BNY in 2022 as global head of treasury services. In the first quarter of 2024, she started overseeing depositary receipts, a line of business that helps clients get listed on a stock exchange outside of their home country.

By Miriam CrossSeptember 24 -

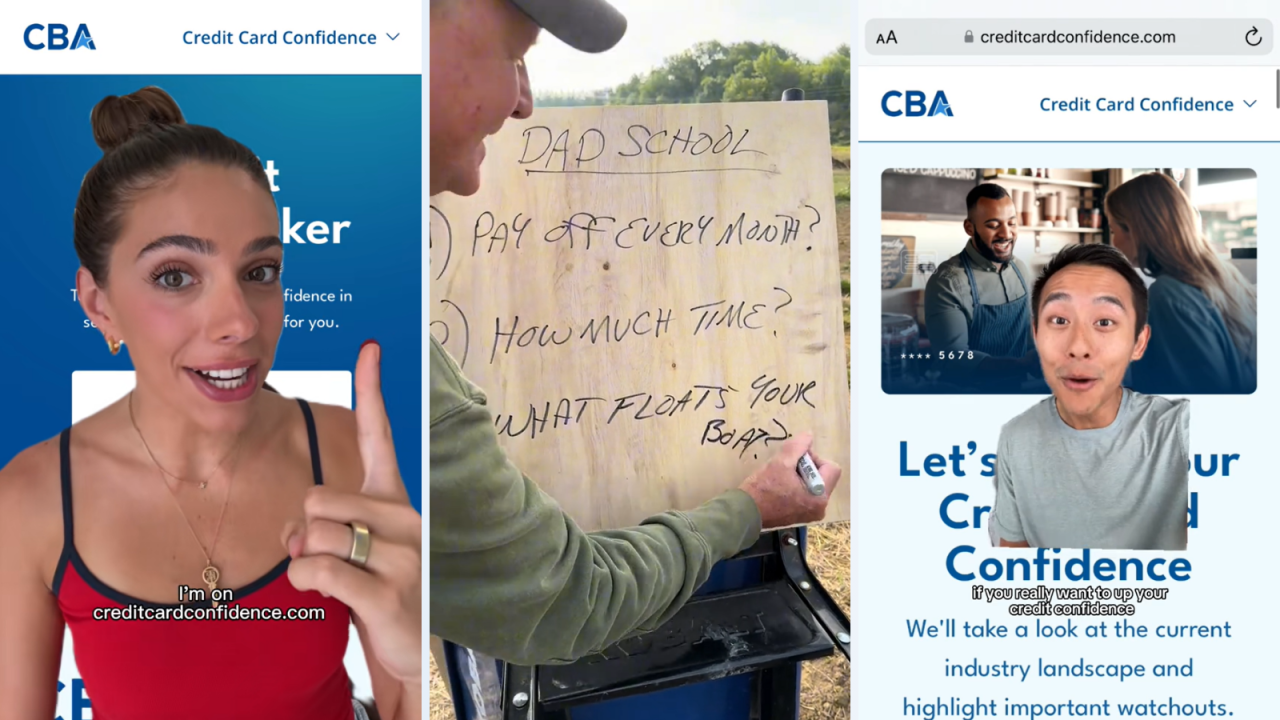

The Consumer Bankers Association launched its first campaign using social media influencers to promote credit card education, experimenting with a mix of personalities and refraining from specific card recommendations.

By Miriam CrossSeptember 18 -

The company, which counts JPMorgan Chase and TD Bank Group among its customers, has also appointed a new executive chairman.

By Miriam CrossSeptember 17 -

The New York community bank cited the contribution of BaaS to its core financial results, evolving regulatory expectations, and the cost of talent and technology needed to scale as factors in this decision.

By Miriam CrossSeptember 17 -

Community bankers have found that demonstrating efficiency, providing proper training and describing use cases can help get employees on board with AI products.

By Miriam CrossSeptember 13 -

The Treasury Department's chief AI officer said artificial intelligence can relieve the burden of mind-numbing activities such as anomaly detection and can spur employees to think more creatively.

By Miriam CrossSeptember 12 -

Banks are finding that they rarely save money off the top when they migrate applications to the cloud. The more substantial benefits are about productivity and speedier development.

By Miriam CrossSeptember 9