-

Most executives are comfortable crossing over $1 billion of assets, where more frequent exams are the biggest supervisory change. But few are eager to take on the compliance burdens that accompany the jump above $10 billion.

May 5 -

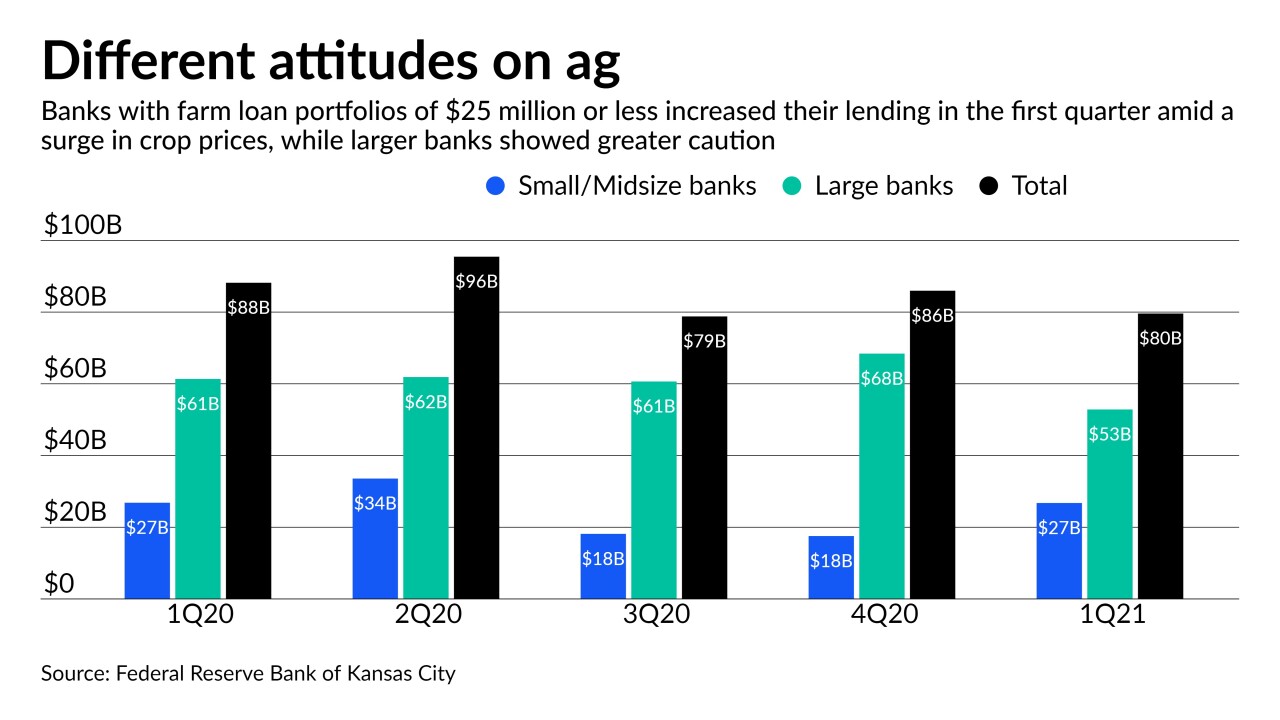

Smaller lenders have proved more aggressive than their larger rivals in making new loans during the farm country rebound. Market watchers warn that the price boom may not last.

May 5 -

The Paycheck Protection Program has about $8 billion remaining, with those funds earmarked for community development financial institutions, minority depository institutions and other mission-driven lenders.

May 5 -

Lenders including Howard Bancorp and First Carolina Bank are shunning acquisitions as a route into new markets, to avoid overpaying for targets and inheriting potential loan problems.

May 5 -

The specialty lender provides leases for preowned Ferraris, Porsches, McLarens, Lamborghinis and other luxury cars.

May 4 -

With the Paycheck Protection Program likely winding down at the end of the month, many lenders are seeing heightened demand for the Small Business Administration’s 7(a) and 504 loans.

May 3 -

The Tennessee bank's deal for Fountain Leasing is set to close this month.

May 3 -

The fintech credit card provider is pitching to banks the same software it uses to determine borrowers' creditworthiness. But whether banks are ready for technology that emphasizes cash-flow analysis over traditional credit scoring is open to debate.

April 28 -

The Arkansas bank is turning to asset-based lending and loans to venture capital and other investment groups to help fill a void created by a shortage of new, big-ticket commercial real estate deals.

April 28 -

The investment, tied to PNC's deal to acquire BBVA USA, was always going to be large but seemed to grow as CEO Bill Demchak got intimately involved in the discussions and the needs of communities and businesses hit hard by the coronavirus pandemic became more apparent.

April 28 -

Banks could be a better option than payday lenders to meet consumers’ short-term credit needs. But all the OCC’s regulation does is enable partnerships that circumvent state usury laws.

April 28 The Pew Charitable Trusts

The Pew Charitable Trusts -

Citigroup said a full review conducted after the lender mistakenly sent $900 million to a group of investment firms concluded the bank didn’t need to claw back any pay from executives.

April 27 -

The Missouri company announced the deal just five months after buying Seacoast Commerce in San Diego.

April 26 -

Deposits keep flooding in, mortgage lending shows signs of cooling, and bankers can’t agree on when commercial lending will rebound. Here’s what we learned from first-quarter results.

April 25 -

CEO John Turner said green projects present a strong business opportunity for the Birmingham, Ala., company.

April 23 -

Morgan Stanley was also among 43 banks worldwide to sign on as initial members of the Net-Zero Banking Alliance. Convened by the United Nations, the group has pledged to help clients in carbon-intensive industries — including transportation, mining and agriculture — reduce their reliance on fossil fuels.

April 21 -

The Tennessee company says it has been pitching specialty finance products inherited from Iberiabank to its own clients.

April 21 -

Oil and gas companies — flush with cash from rising oil prices — are catching up on debt payments and will seek new credit later in the year as the economy recovers, the Oklahoma company says.

April 21 -

The legislation, led by Sen. Ben Cardin, D-Md., would qualify many farmers, ranchers and self-employed Americans for more Paycheck Protection Program funds.

April 21 -

The Cleveland company had a strong quarter for investment banking as midsize companies raised capital to fund growth initiatives. Executives expressed confidence that such activity will translate into more loans over the second half of 2021.

April 20