-

More lenders and governments should partner with community development financial institutions to ensure aid reaches minority-owned businesses that are the backbone of many neighborhoods slammed by the coronavirus.

November 30 Next Street

Next Street -

The industry is asking for more time to comment on a regulatory proposal that aims to prohibit banks from denying services to oil and gas companies and other firms in politically sensitive industries.

November 25 -

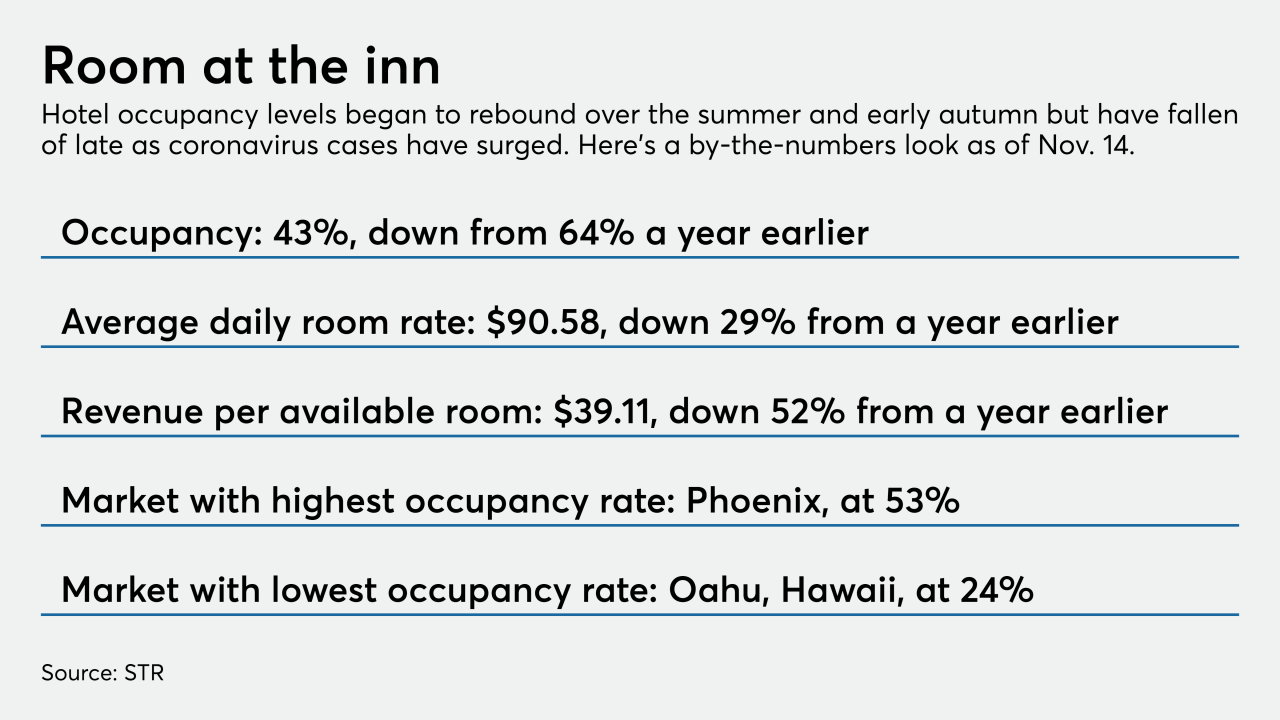

Hospitality sector credits are coming out of forbearance just as coronavirus cases surge. Restructurings and charge-offs could mount unless vaccine distribution happens quickly enough to jump-start travel by mid-2021.

November 23 -

On Jun. 30, 2020. Dollars in thousands.

November 23 -

On Jun. 30, 2020. Dollars in thousands.

November 23 -

The move comes a day after the Federal Reserve had balked at the Treasury Department's demand that it return funds meant for pandemic relief that have so far gone unused.

November 20 -

The Partnership for Carbon Accounting Financials recently released a methodology for measuring the environmental impact of loans and investments, a key hurdle to the banking industry's long-term goal of net-zero emissions tied to its portfolios.

November 20 -

Lenders want Congress to bring back incentives used during the last recession, such as bigger subsidies and reduced fees, to jump-start participation in the Small Business Administration's flagship 7(a) program.

November 20 -

Community development financial institutions, which tend to be less digitally savvy than traditional banks and credit unions, are developing online-lending platforms and automating backroom processes with investments and technical assistance from big banks, high-tech firms and other sources.

November 19 -

More lenders and governments should partner with community development financial institutions to ensure aid reaches minority-owned businesses that are the backbone of many neighborhoods slammed by the coronavirus.

November 18 Next Street

Next Street