-

Executives say they are passing on more loans as bank and nonbank competitors cut rates and forgo traditional safeguards.

October 23 -

The company says the upgrade will support future digital investments. It also said Tuesday that third-quarter profits climbed 8% but reported a sharp increase in criticized business loans.

October 22 -

Amid concern that an economic downturn is approaching, Greg Carmichael said that banks need to focus on credit quality and not worry about expanding their balance sheets.

October 22 -

The Columbus, Ga., company had been counting on increased volume to offset a squeeze in net interest margins.

October 22 -

Declining interest rates took a toll on its profit margin, but the Salt Lake City company still beat earnings expectations in the third quarter.

October 21 -

At TCF National Bank in Detroit and First National Bank of Omaha, early results from artificial intelligence pilot programs are strong.

October 21 -

On Jun. 30, 2019. Dollars in thousands.

October 21 -

Customers of the New Jersey bank will be able to complete applications in minutes and receive funding in as little as one business day.

October 20 -

Credit unions have been heavily focused on millennials but serving older consumers is just as important. Vehicle leasing is one way to reach both demographics.

October 18 Credit Union Leasing of America

Credit Union Leasing of America -

Commercial lending provided a boost for some regional banks in the third quarter, but further rate cuts and a slowing economy could challenge future growth.

October 17 -

The Pittsburgh company’s “branch lite” approach to retail and middle-market banking in new markets will break even sooner than expected and has had a noticeable impact on loans and deposits.

October 16 -

The Dallas company also warned of a decline in net interest income this quarter due to the anticipated impact of Federal Reserve interest rate cuts on loan yields.

October 16 -

Its quarterly results show lower rates and emerging credit risks can be overcome. Whether most banks have all the same levers to pull is another matter.

October 15 -

Slowdowns in new factory orders and production, largely tied to the trade war with China, could translate to more defaults among industrial clients.

October 15 -

The bank is providing a point-of-sale loan to women seeking IVF treatments and getting funds to clinics, in some cases, within 24 hours.

October 15 -

Despite a strong economy, volume in the agency's flagship loan program has declined for two straight years. Here's why.

October 10 -

The company has rolled out an online platform for firms considering marketplace loans as an asset class.

October 10 -

The head of the firm's real estate investment arm pushed back at the idea that buildings with coworking companies as lead tenants are risky bets for lenders.

October 10 -

Renaud Laplanche, one of the first fintech disruptors, is launching an unusual type of credit product at Upgrade, his new company, that is a cross between a credit card and an unsecured loan.

October 10 -

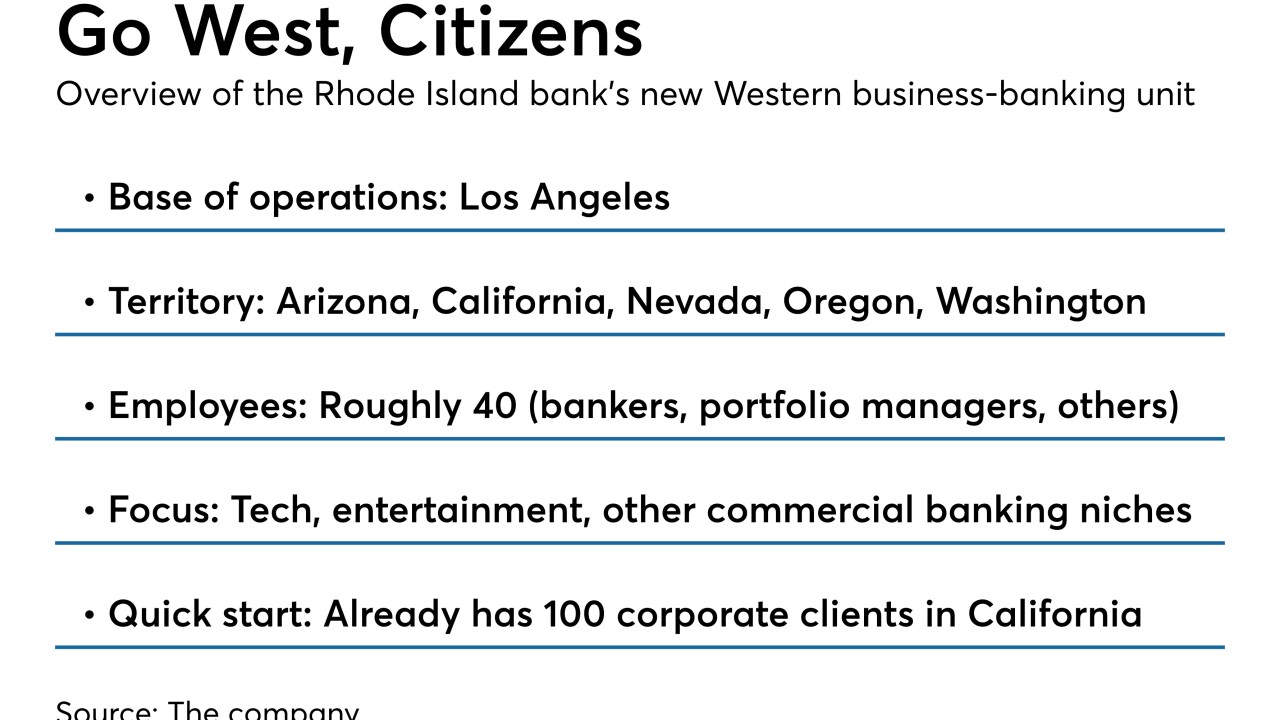

The Providence, R.I., bank recently installed a new regional head in California to oversee a commercial banking expansion into five western states. The bank says it’s trying to craft a successful growth strategy while reassuring investors it isn’t overreaching.

October 9