Loans to manufacturing companies could be the next stumbling block for banks.

While that sector has been relatively benign for lenders in recent years, there are indicators that credit issues are looming.

The Institute for Supply Management reported earlier this month that its manufacturing index contracted in September, with new orders and production continuing to slow. And spending on commercial construction fell by 0.4% in August from a month earlier, according to the most recent Census Bureau data.

Cases of financial hardship — including severe revenue declines, reduced liquidity and increased leverage — among manufacturers rose in the third quarter, the research team at Stephens Inc. said in a note highlighting broader issues across the U.S. economy.

The report comes as more banks report isolated credit issues in areas such as agriculture and health care.

“We’re seeing some flashing signs of caution,” said Matt Olney, a Stephens analyst, though it could take “a few quarters” before manufacturing woes cause meaningful headaches for lenders.

Most U.S. regions had a material spike in hardship events, with the exception of the West Coast, the Stephens team found.

The drawn-out trade war with China is a major factor, industry experts said.

“You absolutely have areas of this economy that are starting to see some difficult times — and it is tied to this trade war,” said Kevin Jacques, chairman of the finance department at Baldwin Wallace University in Ohio.

The stress is especially pronounced in manufacturing-heavy states with vulnerability in areas such as automobiles, plastics and machinery that historically derive substantial revenue from exports, added Jacques, a former economist at the Treasury Department.

Briggs & Stratton, which makes engines and power equipment, and Vista Outdoor, which produces hunting ammunition and outdoor recreation accessories, were among the prominent manufacturers to have their credit ratings downgraded in the third quarter.

The Institute for Supply Management reported earlier this month that its manufacturing index contracted in September, noting that new orders and production are continuing to slow.

Commercial construction is also struggling. Spending on such projects fell by 0.4$ in August from a month earlier, according to the most recent Census Bureau data.

Sentiment “remains cautious,” said Timothy Fiore, chairman of the ISM manufacturing business survey committee.

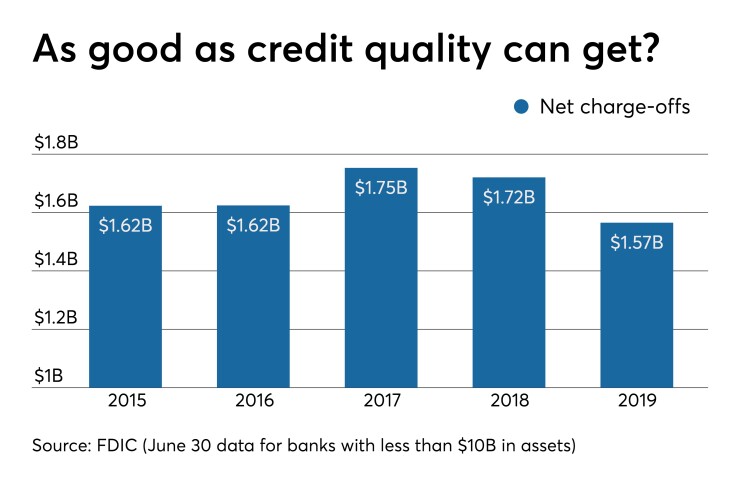

Community banks, which are usually less diversified than bigger lenders, are particularly susceptible, Jacques said, warning that today’s pressures could translate into higher charge-offs and loan-loss reserves in coming months.

“For at least some of the small banks, you can see it coming,” Jacques said.

The trade war is also taking a toll on the agricultural sector, which in turn is pinching companies that make farm equipment.

Creighton University’s Rural Mainstreet Index, based on a monthly survey of bankers across 10 Midwest states, fell below 50 in August, indicating contraction. Three-fourths of bankers surveyed said the trade war was hurting their markets.

“Trade wars have been and will continue to be a drain on our ag economy,” Jeffrey Gerhart, CEO of the $35 million-asset Bank of Newman Grove in Nebraska, said in response to the Creighton survey.

“The dismal economic outlook for farm income continues to decimate agriculture equipment sales in the region,” said Ernie Goss, the Creighton economist who oversees the banker survey.

The energy sector, which has had its ups and downs in recent years, is continuing to cause issues across the Southwest. Olney said key things to watch are oil prices and production, along with debt that is set to mature in coming years.

Texas banks with exposure to potential ongoing issues in energy include the $9.9 billion-asset LegacyTexas Financial Group in Plano, the $17.5 billion-asset Cadence Bancorp. in Houston and the $30 billion-asset Texas Capital Bancshares in Dallas.

Executives at those banks and others have said that their credit issues are contained.

“We continue to be positive about overall credit quality” despite a pair of challenged energy credits, Julie Anderson, Texas Capital’s chief financial officer, said during the company’s second-quarter earnings call.

For now, credit issues appear to be isolated, Olney said.

“The big unknown is if, and when, these one-off issues start to accelerate,” he added. “That’s what we are watching for closely.”