-

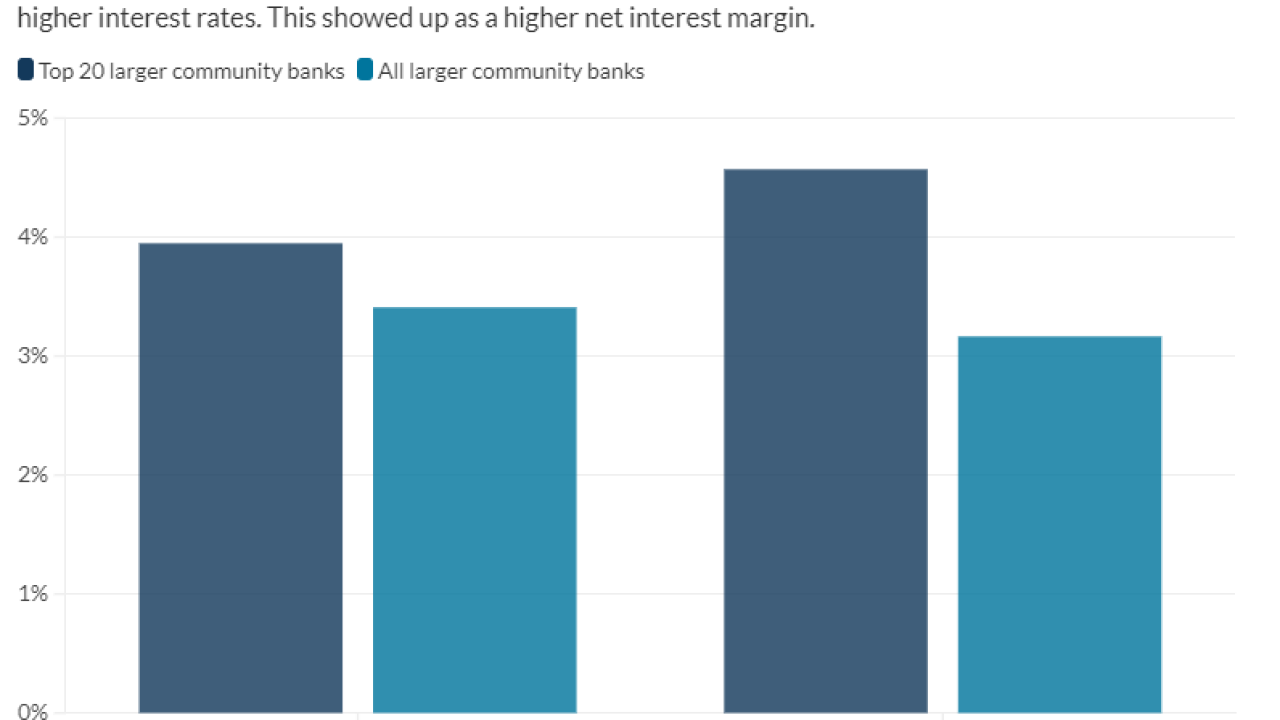

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

June 23 -

PeoplesBank and Cornerstone Bank entered into an agreement to combine their holding companies in a deal slated to close early in 2025. The banks would continue to operate separately.

June 20 -

The collateral that supports commercial and industrial loans is generally weaker than in commercial real estate, where banks can take over a devalued office building. Analysts say the loans merit a closer look as commercial bankruptcies rise.

June 19 -

The Canadian institution will offer cross-border banking services, financing, wealth management and more with its new TD Innovation Partners platform.

June 18 -

Some banks with large commercial real estate concentrations are seeing their stock values take a roller-coaster ride as investors discount their assurances about the wobbly asset class.

June 17 -

-

-

Rather than fueling uncertainty, the Consumer Financial Protection Bureau should be devising strategies that facilitate clearer policies that bring more certainty to lending markets.

June 6

-

In this month's roundup of top banking news: a Supreme Court ruling on CFPB funding, TD Bank's money laundering woes, an FDIC workplace probe reveals a culture of misconduct and more.

June 3 -

The bank took a big hit on an office property in Washington, D.C., during the first quarter. This month, it filed a shelf registration statement for an offering of up to $150 million that could be used to bolster capital or refinance debt.

May 23 -

While the $800 billion in PPP loans has largely self-liquidated through the forgiveness process, SBA continues to service the longer-duration EIDL portfolio and will likely be doing so for years to come after opting to hold on to the loans.

May 22 -

West Coast Community Bancorp agreed to acquire 1st Capital Bancorp in an all-stock deal slated to close in the fourth quarter.

May 21 -

The $116 million deal to acquire HMN Financial in Rochester would mark the 26th acquisition of this century for Alerus. The transaction is slated to close in the fourth quarter.

May 15 -

The small business lender's bankrupt shell has agreed to pay up to $120 million in connection with allegations that its verification processes for Paycheck Protection Program loan applications were faulty. The government argued that Kabbage reaped larger fees by enabling fraudulently inflated loans.

May 14 -

Executives also say funding pressures have begun to ease, though high interest rates and deposit costs remain a leading worry, according to new surveys.

May 14 -

Quaint Oak Bancorp sold its majority stake in an equipment lender less than two years after the partnership helped drive record profits at the Southampton-based company.

May 13 -

A group of 24 institutional investors say a recent pledge by the British bank to restrict financing for companies that focus exclusively on fossil-fuel exploration and extraction doesn't go far enough.

May 9 -

Bank stocks are up this year as interest rates have leveled off and there are hopes that pressure on lenders' profits could moderate.

May 8 -

OakNorth Bank in London is eager to utilize the data it's collected from providing risk management software to American banks over the past five years. Its growth plans include eventually acquiring a charter here and making commercial real estate loans.

May 7 -

Banks maintain lists of consulting firms that they trust to help troubled commercial borrowers to fix their businesses. These specialists say they're getting more calls, especially in areas such as multifamily and CRE, from business owners who need help.

May 2