Consumer banking

Consumer banking

-

Banks would be allowed to own stakes in venture capital funds; the combined BB&T-SunTrust isn’t realizing cost savings as fast as it projected.

January 31 -

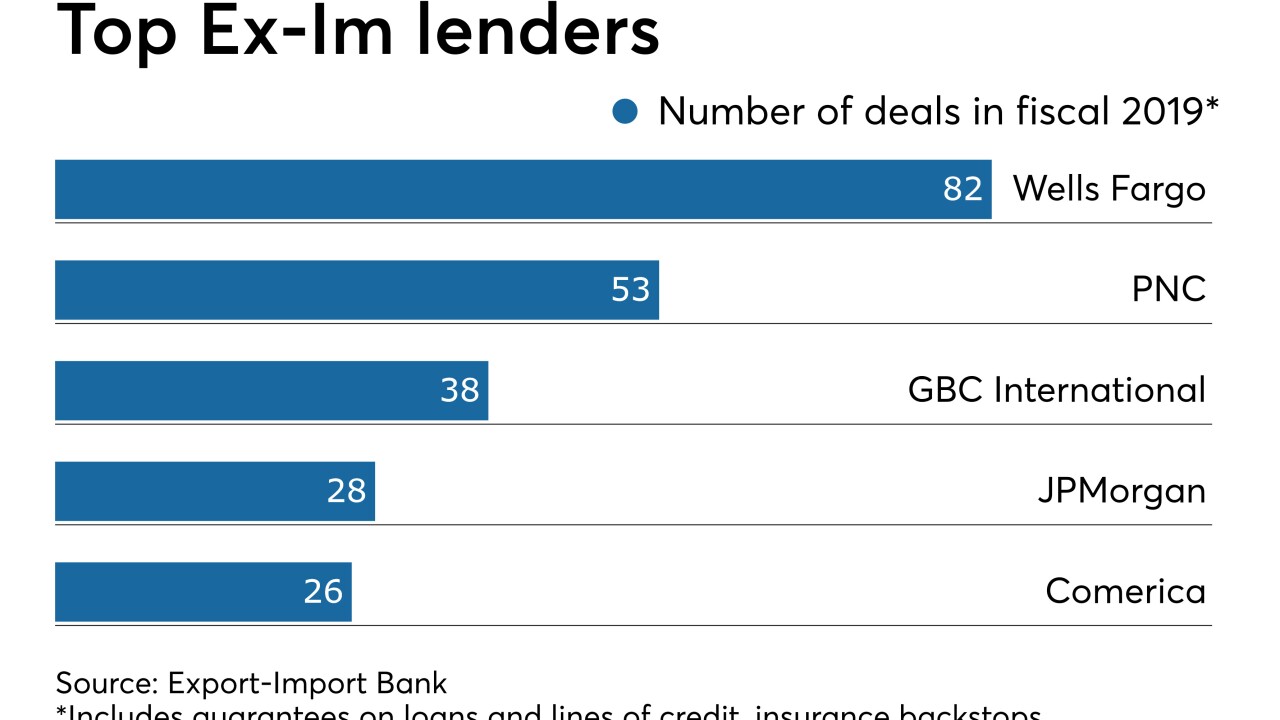

Lenders that depend on the Export-Import Bank to back loans to exporters are already seeing business borrowing pick up after Congress reauthorized the agency in December.

January 30 -

Kenneth Lehman, a former banking attorney who acquires large stakes in small banks, will buy BankFlorida, which lost $555,000 through the first nine months of 2019.

January 30 -

The head of the small-bank trade group called for hearings to discuss tougher limits on credit union acquisitions of banks.

January 30 -

The company has revised its near-term forecasts for reducing expenses, citing delayed branch closings and a decision to spend more time testing systems ahead of conversion and integration.

January 30 -

The benefits include improved financial inclusion, the chairman of the NCUA argues.

January 30 -

The promise of post-closing payments encourages top executives to pursue deals that aren’t necessarily in their self-interest, but investors may eventually raise concerns that the packages are expensive and too focused on the short term.

January 29 -

The Los Angeles company set aside more money to cover a problem loan after an updated appraisal of the credit's collateral.

January 29 -

The Wall Street bank aims to double consumer deposits and triple outstanding consumer loans in five years. A checking account is slated for 2021, and more cobranded credit cards could be coming.

January 29 -

Cassandra McKinney's promotion to executive vice president of the retail bank is the latest executive move by Curt Farmer, who became the Dallas company's CEO in April.

January 29