Consumer banking

Consumer banking

-

Investment banking fees shot up at the nation's largest bank, thanks to rebounds in M&A and the equity capital markets segment. And despite higher credit costs in the company's card business, a top bank executive expressed confidence in the health of U.S. consumers.

July 12 -

The San Francisco bank's interest expenses continue to rise as depositors switch to higher-yielding options. At the same time, soft loan demand from business customers is putting a lid on how much interest Wells is collecting from borrowers.

July 12 -

Higher funding costs, lower loan demand and the potential for increased credit costs continue to drag on the sector heading into second-quarter earnings season.

July 11 -

The top five community banks have combined first mortgage loans of more than $2.8 billion as of March 31, 2024.

July 11 -

Susser Bank has proved successful attracting business from small and midsize companies the past two years. It's hoping a successful capital raise and continued branch expansion can extend the trend.

July 10 -

The Cincinnati bank has agreed to pay a total of $20 million to settle a lawsuit by the Consumer Financial Protection Bureau over fake bank accounts and to resolve separate violations involving force-placed auto insurance.

July 9 -

The Sacramento-area institution moved quickly and decisively to fill the gap created by the loss of First Republic and Silicon Valley Bank. A first-quarter rise in Bay Area deposits is a sign of bigger gains to come, San Francisco Bay Area President DJ Kurtze says.

July 8 -

Marcus Castilla was recently named director of the Oklahoma bank's digital banking unit for service members; he shares what Roger offers today and some plans for the future.

July 5 -

The OCC's new Vital Signs initiative gives bankers an important tool to help them assess the financial health and stability of their customers, and to help them build a strong foundation for the future.

July 4 -

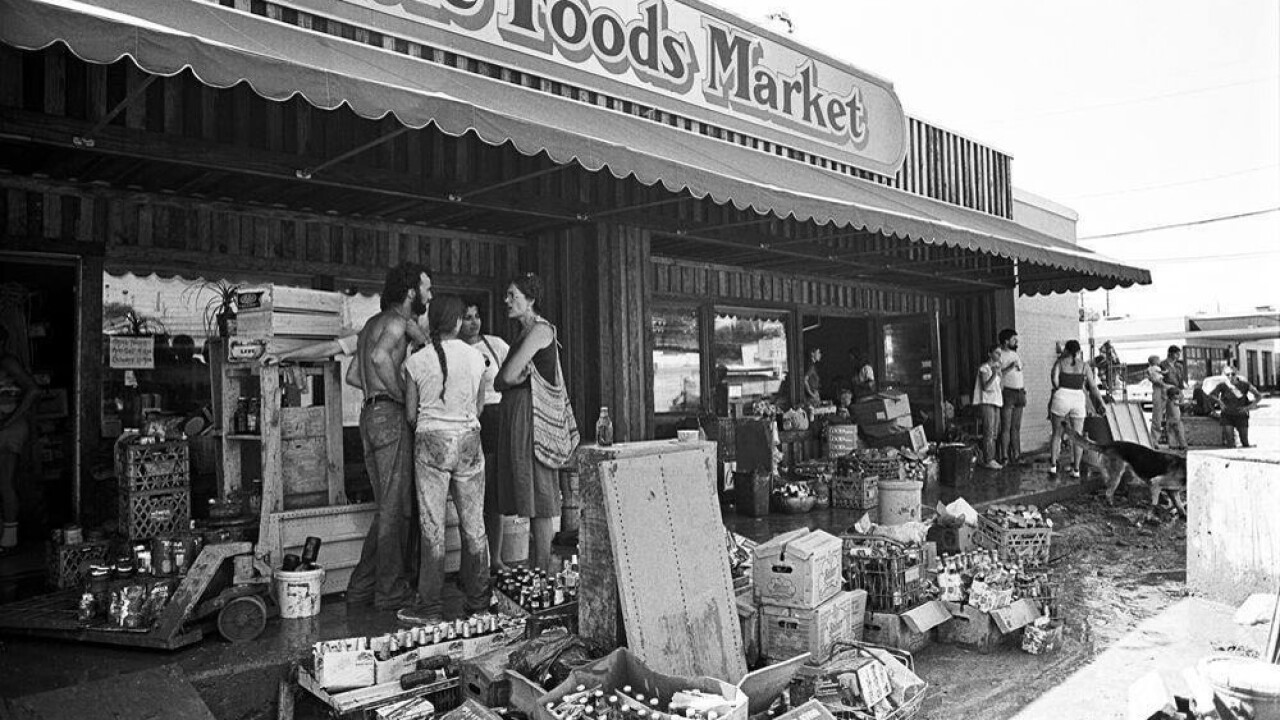

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3