Amid the coronavirus emergency, the central bank may have to decide at what point the imperatives of an economic crisis outweigh the requirements of its most severe enforcement action in recent memory.

The agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

For the second time in a week, the National Credit Union Administration has delayed the deadline for public comment on a proposed regulation.

Bank of America said it has agreed to allow 50,000 mortgage customers to defer payments for three months because they've lost income as a result of the pandemic.

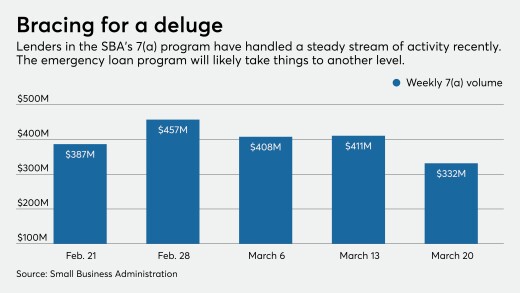

The pandemic may force the Small Business Administration to rely more on fintechs and digital channels to hasten loan approvals, a shift that could stick.

The coronavirus pandemic has forced Irish fintech Prepaid Financial Services Limited (PFS) to drop its sale price by $117 million to close its deal with EML payments Limited.

One-third of small business owners reported that they don’t expect to survive for more than three months in the current coronavirus-impacted restrictions on shopping, dining and travel.

Federal Housing Finance Agency Director Mark Calabria said a virus-induced financial crisis might give rise to more delinquencies and foreclosures than the 2007 subprime mortgage meltdown.

-

Amid the coronavirus emergency, the central bank may have to decide at what point the imperatives of an economic crisis outweigh the requirements of its most severe enforcement action in recent memory.

April 1 -

The agency said lenders should avoid reporting delinquent payments to credit bureaus for consumers who have sought payment relief due to the pandemic.

April 1 -

For the second time in a week, the National Credit Union Administration has delayed the deadline for public comment on a proposed regulation.

April 1 -

Bank of America said it has agreed to allow 50,000 mortgage customers to defer payments for three months because they've lost income as a result of the pandemic.

April 1 -

The pandemic may force the Small Business Administration to rely more on fintechs and digital channels to hasten loan approvals, a shift that could stick.

April 1 -

The coronavirus pandemic has forced Irish fintech Prepaid Financial Services Limited (PFS) to drop its sale price by $117 million to close its deal with EML payments Limited.

April 1 -

One-third of small business owners reported that they don’t expect to survive for more than three months in the current coronavirus-impacted restrictions on shopping, dining and travel.

April 1