-

The Pennsylvania company will pay $31 million for a bank with $269 million in assets.

September 19 -

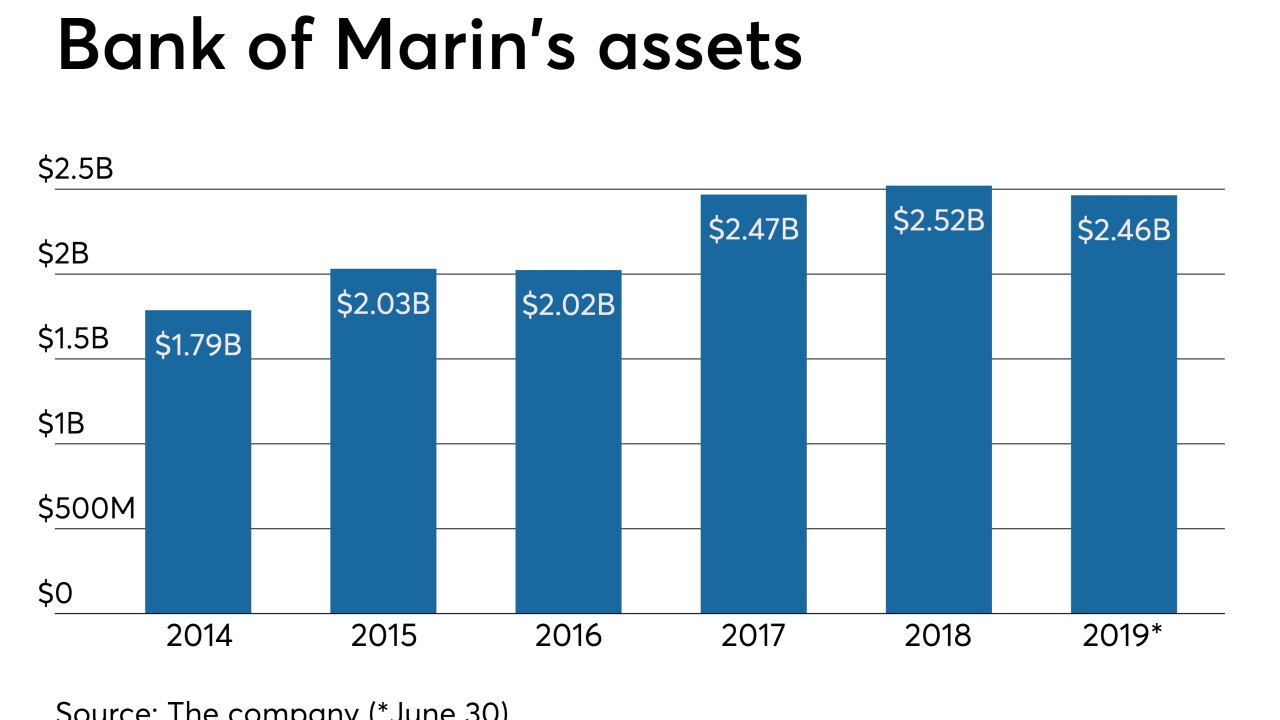

The California company said it has no timeline for Russell Colombo's expected retirement.

September 19 -

Nearly a tenth of the industry’s deals this year were connected to the state, which boasts a good number of sought-after small banks.

September 18 -

The company will pay $42 million in cash for the parent of Main Street Bank in southeastern Michigan.

September 18 -

The company will pay $29 million for Cornerstone Financial Services.

September 18 -

The Tennessee company will gain access to the Bowling Green, Ky., market as part of the $52 million deal.

September 18 -

A new registry aims to make it easier for credit unions to set up voice banking capabilities, but it remains to be see if consumer demand is there for this service.

September 18 -

First Commerce Credit Union's agreement to buy Citizens Bank brings to 14 the number of deals this year in which a credit union is buying a bank.

September 17 -

The company agreed to buy Tennessee Community Bank Holdings, which has operations just west of Nashville.

September 16 -

A seller's assets and deposits lose some luster if the best and brightest who helped bring in the business leave after a deal closes.

September 16 -

Geographic scale and low-cost funding are the foundation of a good deal, seasoned bank acquirers said in a panel discussion.

September 15 -

The online lender’s name will go on a glitzy new stadium scheduled to open next year in Inglewood, Calif. The big question is whether the 20-year deal will contribute to profitability, which SoFi has yet to achieve on a consistent basis.

September 15 -

The Seattle company rebranded as WaFd Bank to address confusion that it might have ties to the federal government.

September 13 -

An increase in credit union acquisitions of banks has been a blow to the morale of many commercial bankers, and some of their trade organizations are trying to slow down the trend. There may be little they can do.

September 12 -

First Community Bankshares will buy Highlands Bankshares for $91 million.

September 11 -

The Texas-based institution will work alongside CU Financial Group to provide insurance solutions for members

September 11 -

Dimon doesn’t expect it to happen, but the bank is getting ready just in case; the state will require banks to disclose their relationship with gun sellers.

September 11 -

A proposed combination of First Defiance and United Financial is designed to create an Ohio company that can better weather shocks from lower rates and economic uncertainty.

September 9 -

The deal between First Defiance and United Community would create a $6 billion-asset bank.

September 9 -

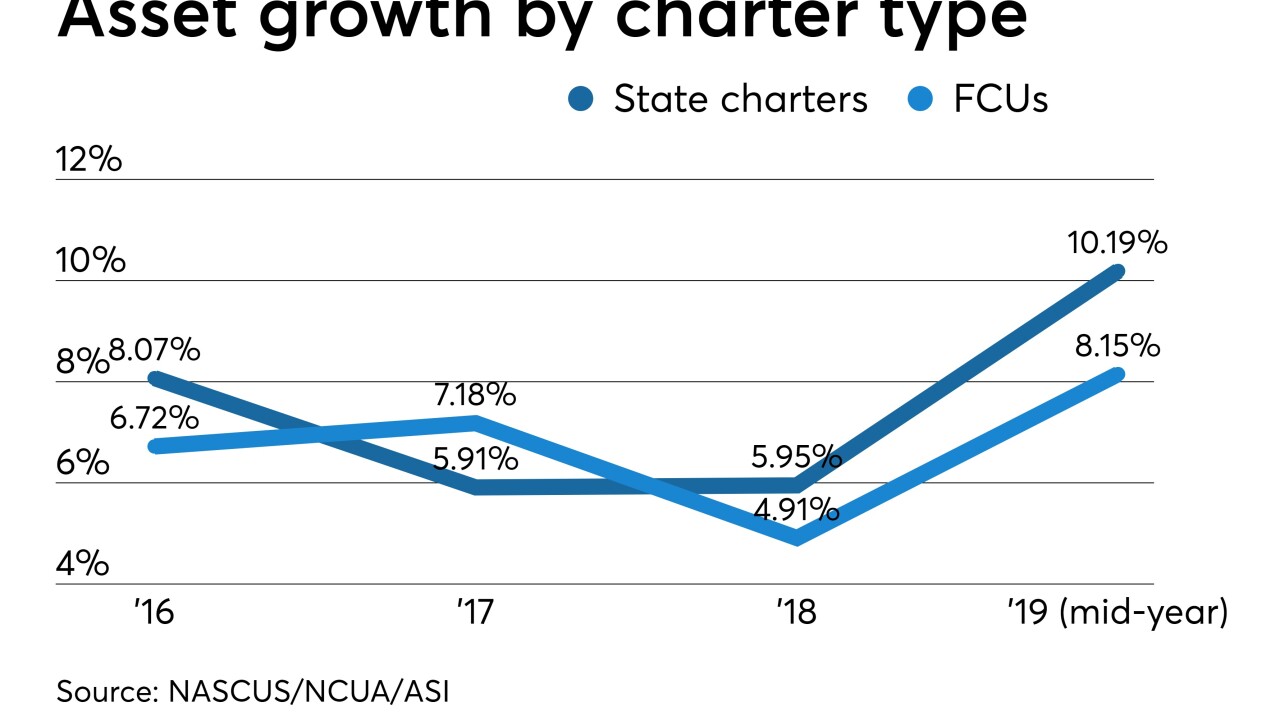

Despite state charters' best gains in four years, their ranks continue to shrink at a pace nearly equal to that of federal charters.

September 6