The study analyzed credit card data from TransUnion to calculate costs and required time to pay off a median card balance per state and Washington, D.C. Here are the states that ranked in the top 10.

10. New Mexico

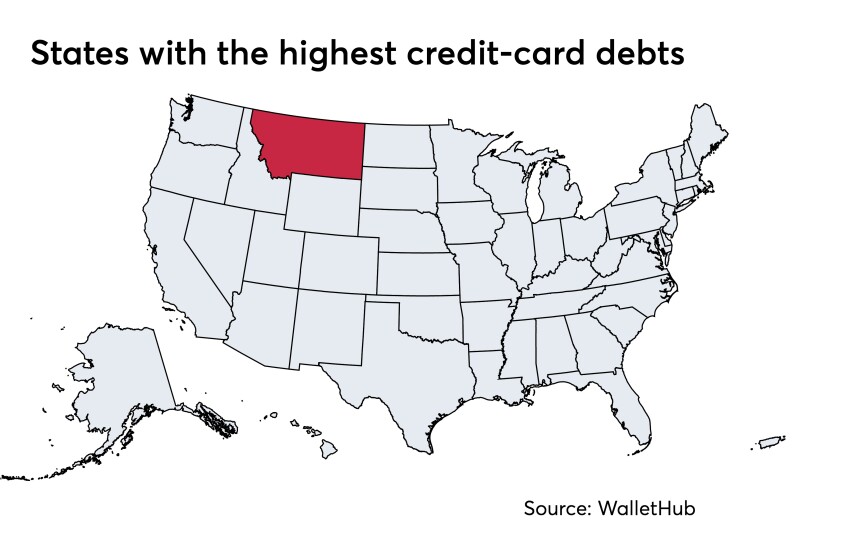

9. Montana

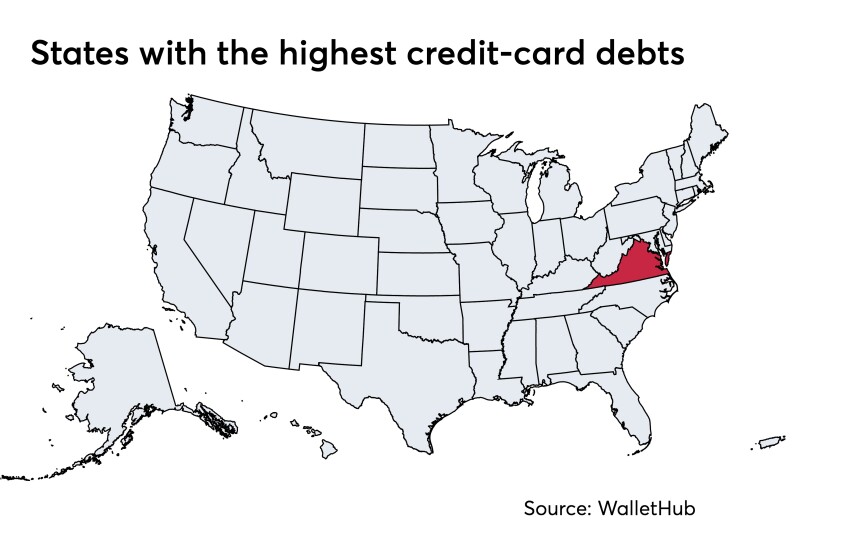

8. Virginia

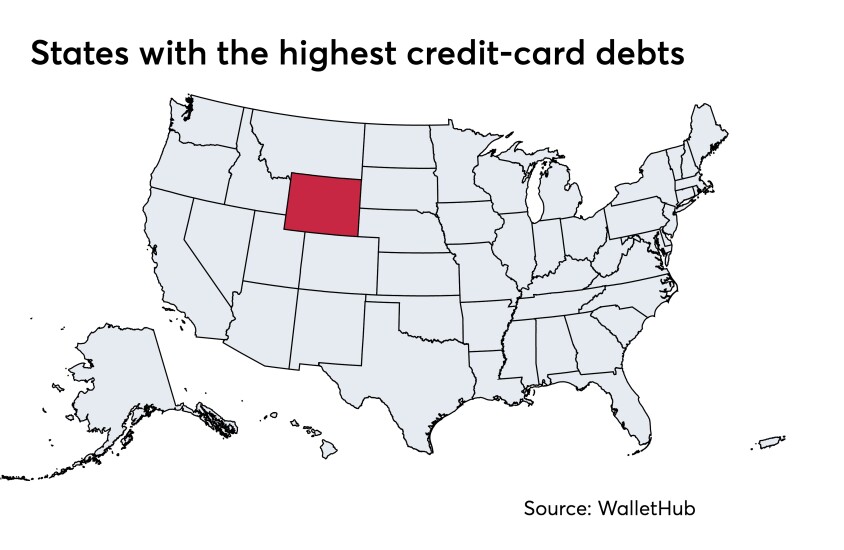

7. Wyoming

6. Oregon

5. Colorado

4. Washington

3. Vermont

2. District of Columbia