The National Credit Union Administration is evaluating the results of a pilot program testing remote examinations for credit unions

For years, CUs across the asset spectrum have been pushing the regulator to better utilize technology in order to shorten on-site exams. In 2016, then-NCUA Chairman Rick Metsger established the Exam Flexibility Initiative working group, which led to the creation of NCUA’s Flexible Examination program. Also known as FLEX, the initiative allows NCUA to dip its feet into conducting remote examinations with federal credit unions, a pivot from its current process that's strictly on-site.

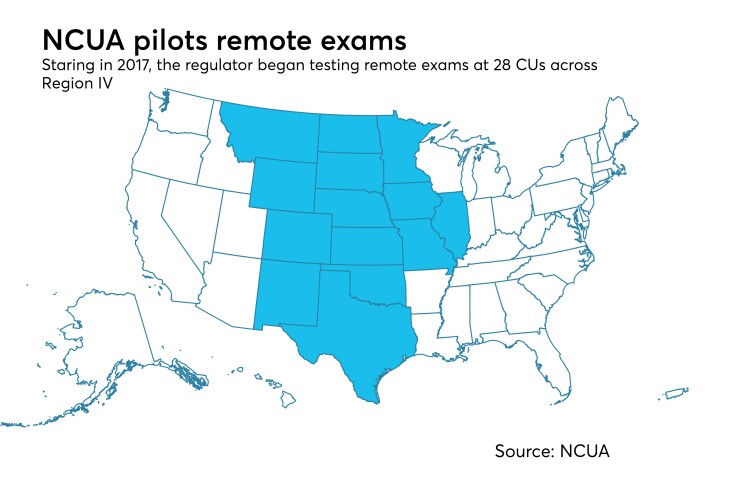

Starting in 2017, 28 credit unions spread across NCUA’s Region IV began testing a pilot program. The region itself encompasses 14 states, spreading from Montana to Illinois and south to Texas. Participating credit unions ranged from $4 million to $9.8 billion in assets, and CUs were deemed eligible for the pilot based on their technological savvy, along with operational and financial history.

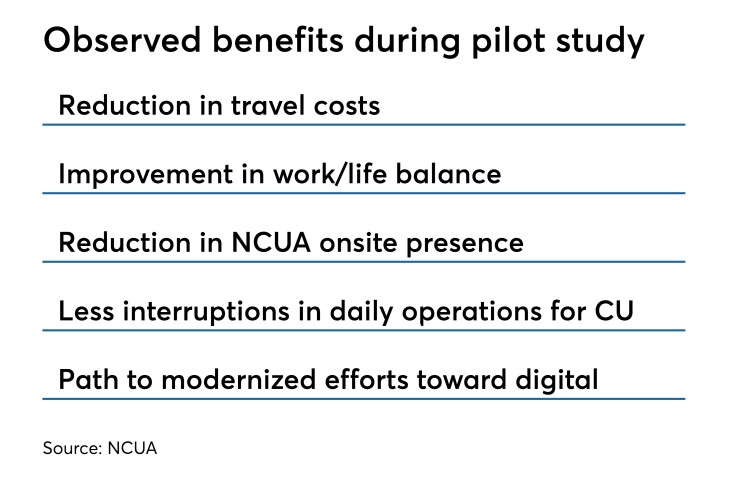

NCUA has said remote exams will have a variety of benefits, including cutting the agency's travel costs, improvements in the work-life balance of NCUA employees, and reducing NCUA’s time on-site at individual credit unions, which in turn decreases interruptions to a credit union's operational capacity.

CU perspectives

For starters, what once involved multiple individuals traveling across the country to conduct examinations has now been whittled down to one lead examiner – a move expected to save NCUA as much as $50,000 in travel costs.

Dale Johnson, president and CEO of Trustar Federal Credit Union, a $230 million-asset institution, told Credit Union Journal he was apprehensive of taking part in the pilot, but noted that he quickly noticed that the process was shorter and more efficient.

“We’re very bullish on it,” he declared, calling remote exams “one of the most positive moves” NCUA has made recently.

That sentiment was echoed by Frank Weidner, president and CEO of $4.8 billion-asset Wings Financial Credit Union, who said his credit union had previously had upwards of 15 people on-site during exams.

“I wouldn’t call them disruptive, but they’d cover and review the entire organization and if you have a large group of people for three weeks, it takes a good amount of resource internally,” he said.

Operations at the two Minnesota-based credit unions are at least 70 percent digital, according to their CEOs, which made the process of conducting secure file transfers easier. And both said they believe the process will continue to improve as they continue to reduce paper and increase their respective electronic footprints.

Agency’s challenges

While the pilot is aimed at improving the exam process for credit unions, it held plenty of challenges for NCUA. Among the issues the regulator faced were challenges related to finding reliable and secure file transfer portals, enhanced data collection methods, and effective communication between examiners and credit unions. The secure file transfer portal is a new addition to NCUA’s technology toolset, which Larry Fazio, director of NCUA's Office of Examination and Insurance, said was actually a separate measure from the pilot.

Fazio admitted some NCUA staffers were skeptical of the program at first, believing that being on-site was “the best way to do the exam, to add value and to get the job done."

While doubters were “not an insignificant percentage,” he added, they were “still a minority.”

The technological gap is yet another obstacle the NCUA will face given that the operations of smaller institutions will require more technological aid compared to that of their larger competitors.

“We’re still in this phase where we’re bringing online capabilities and credit unions are still migrating from paper to fully electronic, so there’ll be this blending of their readiness and our capabilities over the next five to ten years that will facilitate most of the exam being off-site,” said Fazio.

TruStar’s Johnson said he believes the remote process will work for smaller and mid-sized institutions, but raised concerns about the potential for missed coaching opportunities. While TruStar has grown to a $230 million-asset institution, Johnson recalled how his credit union once benefited from prior coaching sessions with examiners. He said he believes there are ways to continue that process while still conducting exams remotely.

“I guess from my standpoint, I’d like to see the ability to do more with [Apple’s] FaceTime,” he said. “I think that would have a better value when we can see them and when they can see you. With today’s technology, that should be able to be done.”

Reservations remain

Still, even if remote exams save the regulator money, credit unions have concerns about what the technology each institution needs for the exams will cost.

“The hope is that the agency doesn’t mandate that credit unions pay for technology that may be required to provide the electronic documentation for exam purposes when they finalize the exam modernization efforts,” said CUNA’s Chief Compliance Officer Jared Ihrig. “Additionally, we would expect that the agency’s budgeted expenditures for examinations will decrease as they transition to more and more remote exams versus the current ‘boots on the ground’ model where examiners are located on-site at credit unions.”

Despite some reservations, credit union trade groups remain generally positive about the prospect of remote exams.

“Both NASCUS and state regulators have provided input on remote examinations and other exam modernization initiatives,” said Lucy Ito, CEO of the National Association of State Credit Union Supervisors. “We support NCUA’s efforts to leverage technology to improve the examination and supervision process. The use of remote examination technology can reduce supervisory burden on credit unions, reduce the wear and tear of examiners’ road time, improve analytical abilities and preserve limited agency budgets.”

Others, however, caution that any program for on-site exams must be just as beneficial for credit unions as it is for the regulator.

“NAFCU supports effective exams that are efficient but meaningful,” said Carrie Hunt, EVP of government affairs and general counsel at the National Association of Federally-Insured Credit Unions. “NCUA’s modernization plan has many elements that should be thoroughly vetted and studied by all stakeholders prior to full implementation. Overall credit unions are well capitalized and healthy therefore, any changes to the exam process should promote continued health without unnecessary burdens.”

Going coast to coast?

Rolling out the pilot nationwide will take some time, however, as the NCUA gears up to adapt their program to the rest of the nation’s needs. Not only will the agency have to train its staff, but the agency will potentially also have to look into labor relations – two factors that will determine the expediency toward mass integration of the program.

“We’re still in this phase where we’re bringing online capabilities and credit unions are still migrating from paper to fully electronic, so there’ll be this blending of their readiness and our capabilities over the next five to ten years that will facilitate most of the exam being off-site,” said Fazio.