With a growing number of economic indicators showing signs that a recession is coming, experts are cautioning credit unions to prepare now.

Perhaps the biggest signal that tough times could be ahead is the reemergence of an inverted yield curve, which typically signals a recession within the next 12 to 18 months.

“I think credit unions would be wise to consider a strategy for a recession,” said Curt Long, chief economist at the National Association of Federally-Insured Credit Unions. “Whether or not the yield curve was as powerful as it was in the past, it shouldn’t be ignored.”

Still, economists cautioned that it’s important to distinguish that inverted yield curves do not cause recessions, they merely reflect economic conditions associated with economic downturns. More importantly, this inverted yield curve is unlike others in the past.

The most recent yield curve inversion came not because the Federal Reserve was concerned about inflation, but because international investors are worried about the future and flew to safety, explained Mike Schenk, chief economist at the Credit Union National Association.

Right now, he added, the U.S.-China trade war is working against a healthy global economy. And while the Federal Reserve is trying to be accommodating, Schenk said the panel is starting at a point where short-term rates are already low, and further rate reductions could contribute to an overvaluation of equities and furthering an already bubble-like situation in the equities market.

So what does that mean for credit unions?

For one, loan volume and membership will slow down. A CUNA economics forecast predicts membership growth slowing by 3 basis points next year, from 3.2% growth in 2019 to just 3% in 2020. Loan growth, meanwhile, is expected to drop by half a percentage point to 7 percent during that same period (from 7.5% to 7%) with a corresponding lift in savings growth (6% to 6.5% by the end of 2020).

“If your goal is to maintain loan volume and to maintain membership that we’ve recorded in the recent past, then more than likely you’re going to have to adjust underwriting criteria and make a more marginal loan,” Schenk advised.

He also pointed out that a slowdown in loan growth is likely to place downward pressure on interest margins at credit unions, along with ROA. Being mindful of that is pivotal when communicating with a credit union’s board, and directors will need to adjust their expectations since the institutions they oversee are unlikely to maintain the strong results leadership may have become used to in recent years, Schenk said.

One additional impact from a possible recession is an increase in the industry’s already robust M&A climate. But Bill Phelan, president and co-founder of PayNet, a company owned by Equifax, suggested that could ultimately be a good thing for growth-oriented institutions.

“If you have the capital, you might be able to make that acquisition and grow your institution while everyone else is contracting,” Phelan said.

Credit constraints during a recession may also force CUs to look elsewhere for new members during a time when membership is slowing, but NAFCU’s Long said that may also serve as an opportunity for some shops to “broaden their membership base.”

And the timing could be fortuitous. Given the National Credit Union Administration’s recent court victories regarding field of membership, many CUs could find themselves poised to take advantage of the new FOM rule right at a time when they need to diversify their membership. And with NCUA not yet ready to move ahead full bore on FOM implementation, that opportunity could break wide open at the right time for credit unions.

Still, said Long, a recession will also mean reassessing the sort of members credit unions want. That means the potential for an influx of new members with limited or weak credit histories, which could also lead to an increase in loan delinquencies and charge offs.

Credit unions have historically served members of modest means and those with less-than-perfect credit, though recent data shows – at least when it comes to auto lending, a key loan product for the entire industry – credit unions have

For CUs that do elect to serve members without sterling credit, Schenk emphasized the importance of learning the circumstances behind that member’s lending history.

“Just because a credit score is deteriorating does not mean that a [credit union] won’t make a loan to that member,” he reminded.

Still, the yield curve inversion is not enough reason to grow hysterical yet. Schenk agreed that though the yield curve historically has been a strong indicator for past recessions, this time it doesn’t appear that the current inversion is sending an accurate signal. Instead, he pointed to additional measures that economists weigh when assessing the economy.

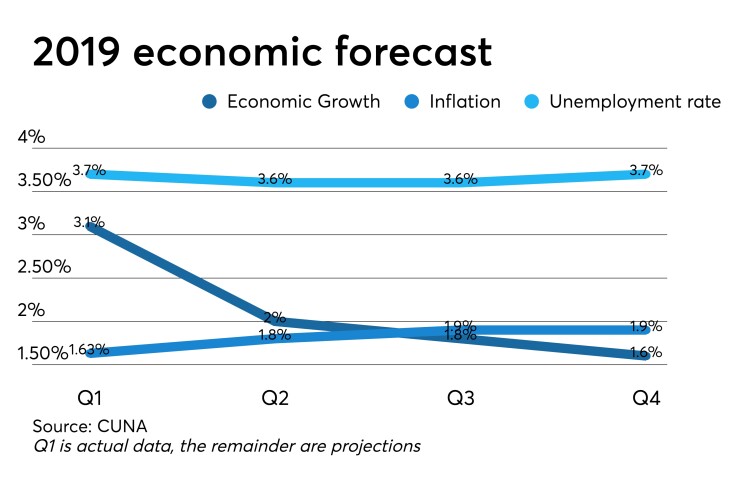

Those factors include unemployment and insurance claims rising significantly, which have not been the case. U.S. employers added 130,000 jobs in August as shown by the latest jobs report, signaling a slowdown with job growth momentum. Unemployment remained at 3.7%. Never the less, PayNet’s Small Business Lending Index shows a 14.5% dip in small business lending for June, the sharpest monthly decline on record since December. The same report also showed short-term delinquency rates continue to rise.

Given that this is the longest economic expansion in U.S. history, some say that economic contraction is expected. Credit unions will need to assess their comfort levels in a volatile economic climate coupled with an assessment of their asset portfolio and asset quality to brave the year ahead.

“We’re not making a call on it, but we’re saying be prepared,” PayNet’s Phelan said. “We do know that prior inversions have caused prior recessions within the next 18 months.”