-

Nine banks and lenders were impacted by the yearslong, $923 million fraud enterprise, according to an indictment of top Tricolor executives. The banks were not publicly named, but JPMorganChase, Fifth Third, Barclays, Louisiana-based Origin Bancorp and Texas-based Triumph Financial have said they would take write-downs.

December 17 -

A survey compiled by the American Financial Services Association showed deteriorating business conditions during the third quarter of this year. The outlook for subprime borrowers was particularly grim.

December 8 -

The Consumer Financial Protection Bureau is considering a proposal to reduce its oversight of auto finance lenders, saying the benefits of supervision may not justify the "increased compliance burdens."

November 6 -

Triumph Financial took steps to guard and move scores of cars backing its $23 million loan to Tricolor Holdings after the subprime auto lender filed for bankruptcy last week.

September 19 -

Origin Bancorp, Renasant Bank and Triumph Financial are the latest financial institutions to report exposure to the bankrupt auto lender Tricolor, joining a list that includes Fifth Third, Barclays and JPMorganChase.

September 11 -

Tricolor Holdings had been showing some cracks leading up to its bankruptcy filing Wednesday. Fifth Third, which had funded the company, said that the problem is a "one-off."

September 10 -

Fintech lenders often get criticized for high rates or fees on their consumer lending. But there's an argument to be made that the alternatives are worse.

December 24 -

The subprime lender OppFi sued California's consumer protection agency last year, arguing its loans are not subject to the state's interest rate cap of 36%. State officials are asking a judge for an injunction on new loans until the broader fight is resolved.

February 2 -

A lawsuit filed by Attorney General Maura Healey last year said Credit Acceptance Corp. in Michigan made predatory loans to Bay State borrowers and used deceptive practices to collect debt.

September 1 -

The Chicago subprime lender had previously warned that regulators were investigating its military lending practices. Its stock price rose by about 9% after the disclosure that the probe has wrapped up.

August 30 -

Subprime borrowers whose credit scores have risen since they bought their cars are increasingly looking for a better deal. Credit unions and small banks are seizing the opportunity, often with the help of fintechs.

August 25 -

The Spanish bank’s U.S. holding company said it will pay a premium to purchase the publicly traded shares in Santander Consumer Holdings. The proposal is subject to the approval of the auto lender’s board of directors.

July 2 -

KMD Partners, which makes high-interest rate loans through its CreditNinja brand, has agreed to acquire the $11.7 million-asset Liberty Bank. The purchase is likely to draw scrutiny, but the companies argue that it will help borrowers with lower credit scores qualify for less expensive loans.

June 15 -

After more than 100 years of mostly in-person operations, the subprime installment lender is seeking to adapt to changing consumer preferences — launching an online loan platform just before the pandemic and recently striking a deal to acquire a financial wellness app.

May 10 -

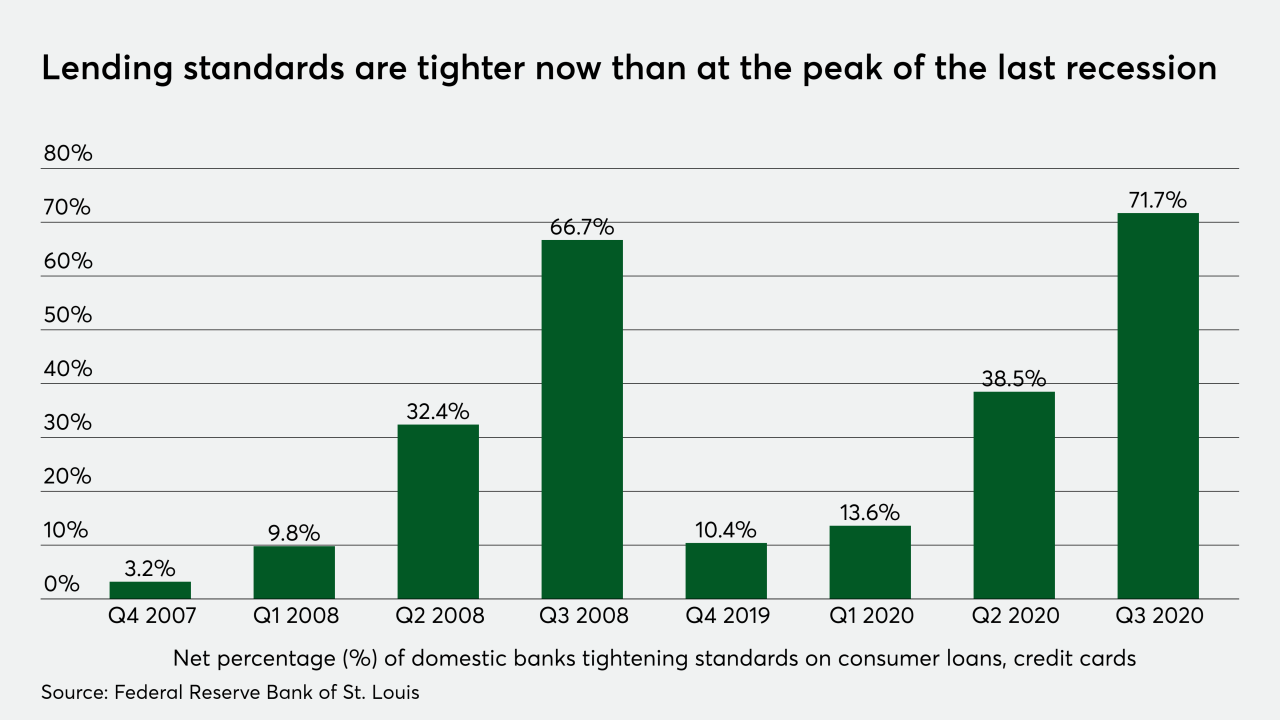

Looming defaults and the potential for heavier regulatory scrutiny have prompted banks to pull back from the sector. Is that a good thing?

April 28 -

The San Francisco company has faced financing challenges as its customers, largely lower-income Latinos, have struggled to keep up with monthly payments.

January 11 -

The company, which provides credit cards to millennials, is expanding its target audience beyond thin-file consumers and those without credit histories. It will now also target those with blemished, nonprime credit histories.

October 7 -

Millennial credit card provider Petal is expanding its target audience beyond thin-file consumers and those without credit histories. It will now also target those with blemished, non-prime credit histories.

October 7 -

A borrower advocacy group is asking federal banking regulators to investigate PayPal and Synchrony Financial, which partner on a product that is used to offer high-cost education financing.

August 24 -

Covered Care is promising to offer affordable loans to borrowers with credit scores below 700.

August 13