Like countless other credit unions at this time of year, Las Vegas-based Clark County Credit Union paid a dividend to its members, but instead of quietly depositing the money in members' accounts, the $700 million CU decided to turn it into a party.

The “Dividend Day” event included donuts, balloons, a photo booth with a $3 million bill (representing the total amount of money returned to members) and free movie tickets to members who shared their photos on social media using #CCCUDividendDay.

The dividend payment was calculated based on average annual daily balances for deposit amounts and for loans of any type, including auto loans, new home construction loans or commercial loans, the credit union explained. CCCU members were informed of their dividend amount via e-mail or in real time inside one of the credit union’s six branch locations in the Las Vegas area.

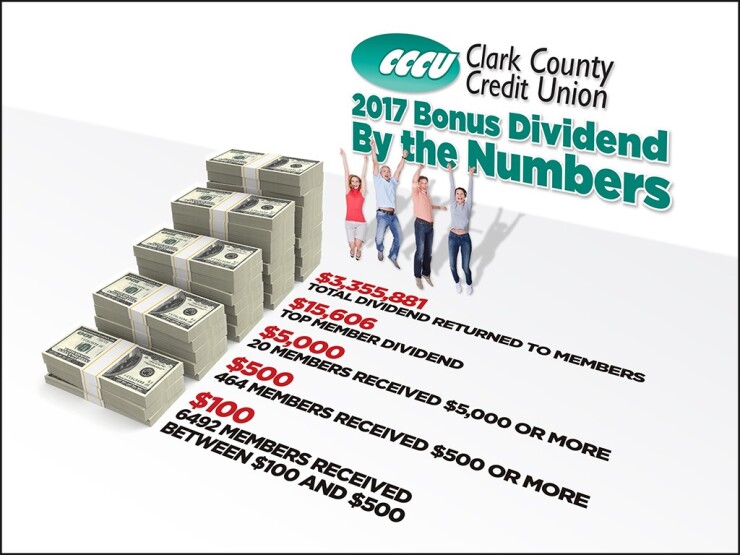

This year’s dividend payment was $3,355,881.43, which brings the total to $59.7 million the credit union has returned to its members since 2001. All 44,000 CCCU members will receive at least $20 deposited into their accounts this month, with the average dividend payment this year $74.76. The credit union said hundreds of members received $500 or more.

Saver, payer or spender?

After first learning of their dividend amount, members were asked how they will use their dividend with, “Are you a saver, a payer or a spender?” According to the credit union, many members keep their dividend as extra savings, pay down a bill or use it as fun money.

CCCU member Crystal Cooper, an investigator for the Clark County District Attorney’s office, told the credit union the annual dividend is the main topic she talks about when telling others about CCCU. She reportedly likes to use her dividend for fun money, using the extra cash for shopping and traveling.

“Our members’ loyalty and commitment to CCCU help make this dividend happen year after year,” Matt Kershaw, Clark County Credit Union’s CEO, said in a statement. “As member-owners, their deposits and loans are investments that pay dividends, literally.”

Founded in 1951, CCCU is a not-for- profit financial institution serving more than 44,000 members who are municipal employees (Clark County, City of Henderson, City of Las Vegas and City of North Las Vegas), medical professionals, members of Nevada Public Radio (KNPR) and numerous select employer groups.