With studies showing

Some states are beginning to change those policies to make it easier for members to still access savings without discouraging them from putting away money when they can during the pandemic.

“This was designed to help members become better savers and save for a rainy day, and we’ve got a storm going on now,” said Tara Krejcarek, SVP of strategic partnerships at the Wisconsin Credit Union League, which runs the state’s Savers Sweepstakes program.

The league is allowing credit unions the flexibility to waive fees and restrictions on members’ PLS accounts as needed. The state currently has 37 credit unions participating in the program with 6,400 accounts. Consumers in the Badger State have saved more than $3.1 million since the

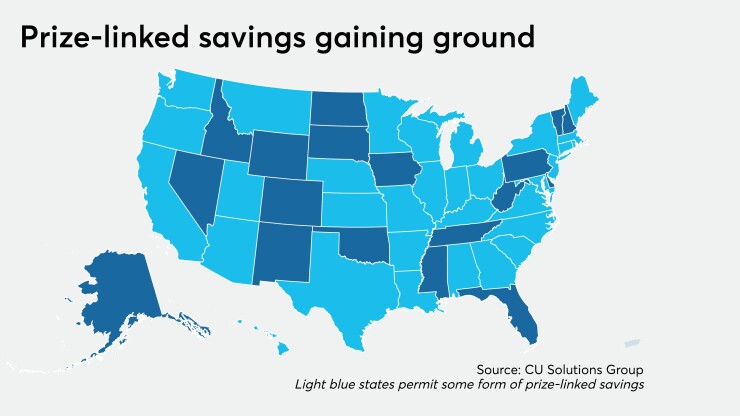

While prize-linked savings is available in most states, many states run their own programs. The largest of them — Save to Win, from the credit union service organization CU Solutions Group — serves more than 140 credit unions across 19 states and is also allowing that flexibility.

Wisconsin’s program — like that of some other states, including Louisiana — was created in conjunction with the Minnesota Credit Union Network and its Wincentive offering. Ben Hering, MNCUN’s program director, said the league has encouraged all CUs it works with to think creatively about how to use prize-linked savings during the COVID-19 outbreak.

“After all, this savings account platform was meant to ensure credit union members build in positive savings behaviors to help alleviate financial uncertainty,” Hering said via email. “Aside from making sure credit unions on our platform know they can, and should, be flexible with members’ withdrawals, we’re able to facilitate extra prizes, adjust prize drawing eligibility and further build in ways to use these accounts to showcase the credit union difference.”

Wisconsin’s Krejcarek said CUs there have also increased the number of entries available for members to win prizes. More than $70,000 in prizes is up for grabs between April and July, “so hopefully that will help a little bit too,” she said. “Hopefully the folks that win this money are going to be able to help with some of the additional costs of the things they’re dealing with now.”

Krejcarek said it’s unclear what impact the current crisis might have on prize-linked savings balances in the state, though she said they’re likely to go down. The good news, she said, is that because CUs’ total balances for these offerings are comparatively minimal, even a significant decline shouldn’t have any sizable impact on liquidity.

“When credit unions are looking to increase deposits this might be part of their deposit-acquisition strategy, but it’s not their key,” she said. “They’re doing certificates and things like that to get those additional funds, so this will have very little impact on their liquidity.”