The death of George Floyd and the protests that followed have added a sense of urgency to credit unions’ efforts to diversify their boards of directors.

But while the industry has made some progress, experts said more work remains to be done.

“Sadly, even though awareness of diversity, equity and inclusion has generally increased in the last decade — and has been significantly reinforced by the events of 2020 — the actual composition of credit union boards has not meaningfully changed,” said Michael Daigneault, CEO and founder of Quantum Governance.

Even before 2020, credit unions were taking strides to diversify so that their staffs better reflect the members they serve. Since Floyd’s death, many institutions have made financial commitments to DEI efforts and installed executives with the mandate to advance that cause. Change at the board level has been a long time coming, but there are signs it is happening.

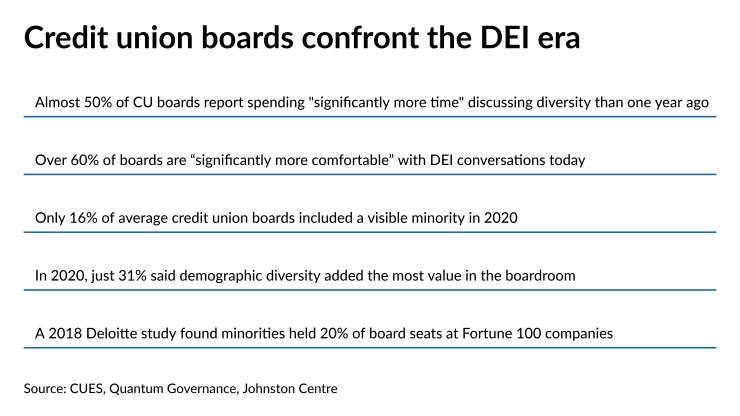

Nearly 50% of credit unions say they are spending "significantly more time” discussing board diversity than they did a year ago, according to a forthcoming report on COVID-19 and diversity. Sixty-two percent of respondents said they are more comfortable with those conversations now than they were one year ago.

The report is part of the State of Credit Union Governance series from the Credit Union Executives Society (CUES), Quantum Governance and the Johnston Centre for Corporate Governance Innovation at the Rotman School of Management in Toronto. More than 300 credit union board members, CEOs and senior management teams were surveyed for the study, which found diversity is the highest priority when it comes to recruiting new board members.

Progress has been made in certain areas but is still lagging in others, said Daigneault. For instance, more women than ever serve on credit union boards. The number of women in volunteer leadership has increased by at least 8% in the last decade, he said, and women hold 30% or more of all credit union board seats.

Many credit unions declined to discuss their own efforts at board diversification due to the sensitive nature of the subject, but firms that help recruit new directors indicate more attention is being paid to diversity than ever before.

The national conversation that began after Floyd’s death emphasized how limited individual perspectives are and the importance of not just diversifying but including voices that represent the entire community, said Jill Nowacki, CEO and founder of Humanidei, a diversity-consulting firm.

“It made people go from thinking board diversity would be nice to have to understanding that credit unions really cannot deliver completely on their mission if they do not address it,” she said.

But not all the news is good.

Studies continue to indicate the racial and ethnic makeup of credit union boards has not significantly improved over the last decade. And less than a quarter of credit union boards report having a formal diversity policy that governs the recruitment of directors.

“We would be naive if we didn't acknowledge that there are certain individuals at some credit unions who would offer some form of resistance to DEI efforts,” Daigneault said. “Social justice and racial issues are so emotionally loaded — and we as a society have been so challenged to discuss them — that many folks are afraid to say or do the wrong thing and potentially make things worse.”

Some credit union leaders in the past have suggested geography and demographics could make it harder to diversify their staff and boards.

“If one looks around you can find a physician, a CPA, an engineer, a contractor, a shop owner of color or different gender in any corner in America,” Sundip Patel, CEO of Extensia Financial, a credit union service organization with a diverse board of directors. “All it takes is the will to approach them to be involved and see if they are interested in helping with the credit union and its communities.”

Part of the push for diversification in recent years has also come from a younger generation of employees who want to see broader representation in the industry, said Nick Hayes, a credit union recruiter with search firm Smith & Wilkinson.

One hurdle is that few boards even believe actively recruiting for new directors is necessary, Hayes said. Many institutions haven’t historically sought out candidates with diverse racial and ethnic backgrounds, and instead relied on networking, word of mouth and internal postings to find directors.

“The reality is that there are many boards who don't see [diversity] as a necessary part of their conversation,” he said.

Extensia Financial recently announced several diverse new board members, but Patel said diversity has been at the CUSO’s core since its inception in 2002. The recent additions aren’t reflective of any changes but “merely an extension of how we think and have acted since our first day,” he said.

Patel said the national conversation on race and social justice had no bearing on Extensia looking to add diversity to its board, and the organization was already seeking out talented executives who brought different perspectives from experience, education and the institutions where they worked.

Credit unions must know the demographics of the market they serve and have strategy leaders in place who understand the different financial needs that might be present in that market in order to shape product offerings for the membership, said Nowacki.

“If you have a community with 20% of people living below the poverty line and a board made up of affluent retirees,” she said, the board may more naturally consider offerings for consumers who are well-off financially, and need help when it comes to considering “products that help people make ends meet like small dollar loans.”

There can also be a downside for credit unions that don't diversify or move too slowly. SchoolsFirst Federal Credit Union in Santa Ana, Calif.,

Hayes suggested the industry is in the early stages of a shift toward more active recruitment of diverse governance.

“I can envision a day where boards mostly made up of dominant [select employee groups] members will end,” he said. “Credit unions are in an incredibly unique position, with some having hundreds of SEG groups, giving them access to an amazing diversification of talent that they can reach out to.”

However, Nowacki noted that even when boards diversify, challenges often still remain.

“I have worked with boards who have added diversity but then complained when the new board members did not last longer than one term,” she said. “What the board described to me as a lack of loyalty from someone who didn’t get the way this board operated, I interpreted as a situation where someone with a unique perspective was brought in and then encouraged to assimilate. That situation creates a sense of individuals not feeling valued, leading to disengagement.”

It's going to be a long road, but the process has started. Most board members’ terms have expiration dates and some are term-limited, but Hayes said board turnover does not happen quickly enough to make diversification an overnight process.

Daigneault says any such transformation takes a sustained effort over a number of years. “There are no quick or easy fixes,” he said. “But the time to start — or reinforce — the DEI process is now.”