Want unlimited access to top ideas and insights?

The National Credit Union Administration board is set to vote Thursday on its 2020-21

As reported, NCUA's budget continues to rise even as other federal banking regulators such as the Federal Deposit Insurance Corp. rein in their own spending. On top of that, the credit union industry continues to consolidate,

The regulator received 26 responses to its call for comment on the latest budget, a nearly three-fold increase over last year. The three major national trade groups weighed in on the issue during

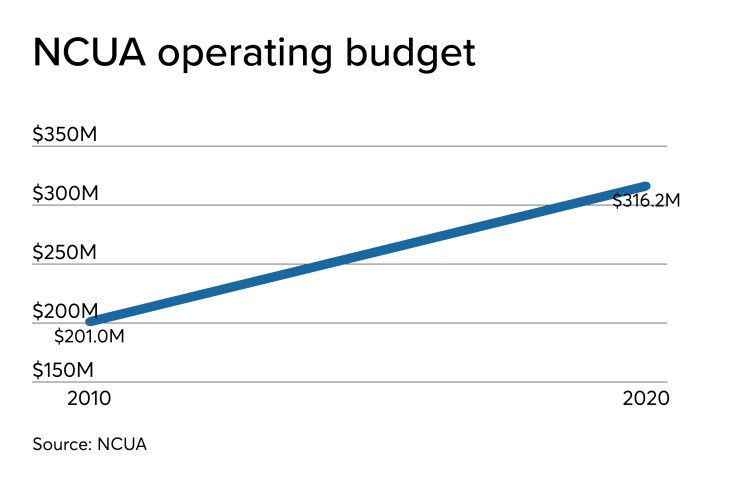

One industry leader suggested NCUA is covering up the real cost of its budget increases by only highlighting year-over-year changes rather than showing budget trends over a longer time span.

“The proposed operating budget for 2020 is $316.2 million. The operating budget in 2010 was $201 million,” wrote Paul Mercer, president and CEO of the Ohio Credit Union League, and Miriah Lee, OCUL’s regulatory counsel. “The increase in budgeted NCUA spending in the years following 2010 through the proposed budget is over $115 million (a 57% increase in funding over the period, an increase we note is far greater than the inflation rate over the period)…We believe rationalized smaller annual percentage increases obscure a larger problem that longer spans of time plainly reveal; a large and ongoing increase in credit union funding for ever-expanding NCUA spending.”

‘Height of embarrassment’

Despite increased transparency regarding the budget in recent years, NCUA’s budget proposals can be seen as “a document that is surely cut and pasted from the recent past, same old same old,” wrote Victor Pantea, manager of marketplace alliances at the credit union service organization CU*Answers.

“In those years that you have taken the opportunity to publicly share the budget you have also failed to make any significant changes based on our comments before you vote on the budget only a few weeks later,” he continued. “You have never reported why projects and changes to examination protocols and tools are not delivered on a timely basis, or how much project delays or failures have cost our members.”

Along with questioning the long-term impact of the agency’s planned investments in personnel and technology, Pantea called out a lack of strategic planning in the budget and said that the board’s failure to mention the need for new charters was “the height of embarrassment.”

“The extra time and money spent to encourage and promote new charters is certainly in the budget, it’s just earmarked for some other, less worthy expense,” he added.

NCUA officials have attributed some of the budget increases to the costs associated with deploying a new examination system intended to better leverage technology to reduce examiners’ time on-site. Representatives from the Heartland Credit Union Association, the joint league serving CUs in Kansas and Missouri, suggested the agency could further improve the exam cycle – potentially without spending a penny and increasing parity with other federal banking regulators.

“As you are aware, credit unions remain eligible for an 18-month examination cycle only if their asset level is below $1 billion,” wrote HCUA President and CEO Brad Douglas. “In December 2018, the federal banking agencies issued a final rule to implement a provision giving banks holding under $3 billion in assets an examination only once every 18 months, leaving credit unions on an uneven playing field. Congress has delegated authority to NCUA to set the frequency of examinations for credit unions and we urge NCUA to extend the credit union asset threshold from $1 billion to $3 billion.”

Indiana Credit Union League President John McKenzie also suggested the board could save money and improve examinations by increasing coordination with state examiners in order to cut costs and improve efficiency of exams for state-chartered CUs subject to dual examinations.

“This could reduce the number of examiners needed for a joint examination and result in efficient ways to share information and examination findings. This would further allow NCUA to reduce overall personnel expenses,” he wrote.

Hitting back at Harper

Respondents also spoke up against board member Todd Harper’s

The responses to the new oversight plan were almost unanimously negative, and one executive pointed out what he sees as a disconnect between NCUA and the institutions it regulates.

Harper’s plan would add three new full-time employees to regulator’s roster, “so why is the NCUA so special that they do not feel the need to reduce their staffing number as the number of credit unions decrease?” asked Terry Tucker, operations manager and compliance officer at Pine Federal Credit Union in Little Rock, Ark. “Any other business would at least downsize through attrition if their workload decreased that much.”

Rather than move ahead with that proposal as it is, some CUs called on the agency to fine tune the plan, raising the threshold from $1 billion to $10 billion and limiting it to federal charters in order to reduce the number of institutions affected and cut down on the cost of implementation.

Bill Brooks, CEO of Mid-Atlantic FCU and a former examiner, suggested if the agency does move ahead with Harper’s plan, additional consumer compliance examinations should be done without adding additional staff. Brooks said he was “Not sure there are material issues that would warrant this expense not only monetary, but also time and aggravation!...More credit unions that focus on underserved will chose to close! So much for [NCUA Chairman Rodney] Hood's desire to expand service.”

This story was updated at 12:09 P.M. on Dec. 12, 2019.