EMERYVILLE, Calif.-A new survey finds that when it comes to consumer satisfaction, asset size and locations are less important to credit union members than to bank customers.

The survey, from myCUsurvey.com, found that consumers who join a credit union say they did so because they are interested in having a relationship with their financial institution, ranking that factor ahead of asset size and branches.

One finding that shouldn't shock too many in the CU community was that nearly 75% of all credit union members identified in the survey are age 50 or older. On the other hand, the study reinforced what other surveys have also discovered, that younger members-in particular those under age 35-are the least satisfied, and that growth opportunities for CUs lie in their ability to increase satisfaction among that younger demographic and promote member loyalty.

On the positive side, myCUsurvey revealed that member loyalty is tied to the in-branch experience-a factor which nearly 75% of respondents indicated as "excellent."

One of the major takeaways from the study, said myCUsurvey founder Dr. Jack Beida, is that credit unions will need to "ask themselves how to engage more effectively with members, especially younger members, to give them the experience they want and keep them coming back."

MyCUsurvey.com is a division of PinPoint Research Corp., a market research firm established in 1986 that conducts more than 20-million surveys annually. For the CU Member Satisfaction Survey, more than 5,000 credit union members were polled measuring factors such as branch satisfaction, service satisfaction and likelihood to recommend.

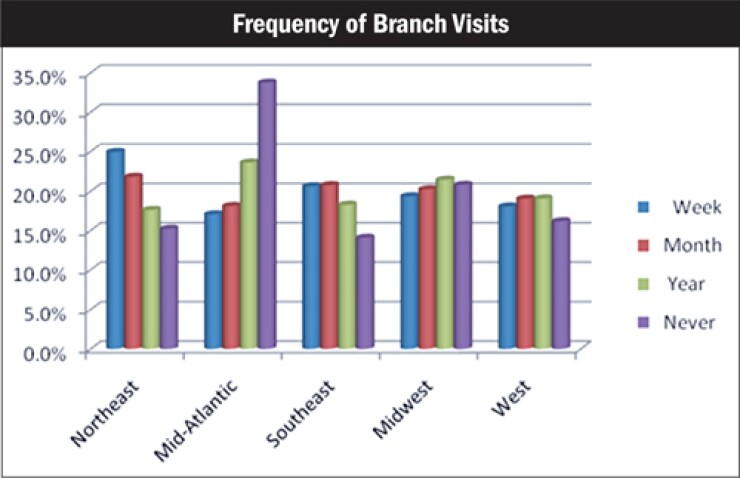

The white paper that offers analysis of the survey breaks down results into regional subcategories of the five NCUA geographic zones, allowing CUs to benchmark member satisfaction both at a regional and national level.