The Credit Union National Association on Wednesday released the 2016-2017 CUNA Staff Salary Report, which the trade group says provides "exhaustive" data on compensation trends for credit unions across the country.

It also updated the data for CUNA Compensation Analytics, a cloud-based tool that allows users to find and extract compensation benchmarking information from the report according to their self-selected specifications. The online search portal lets users pull data from the report according to asset size, region, number of full-time employees and amount of loans outstanding. The program presents its collected data in an easy-to-read table that can be easily exported into emails, reports or presentations, the trade group said.

Available in print and PDF format, the 2016-2017 CUNA Staff Salary Report accumulates data on nearly 100 job titles collected from more than 1,200 credit unions through an in-depth national survey. The report features hard numbers on all aspects of compensation, including base salaries, bonuses and incentives. Data in the report is organized categorically by asset size, location, membership size and a range of other factors.

"These two products are the centerpiece of our compensation resources offerings," Jon Haller, director of corporate and market research at CUNA, said in a statement. "Credit union professionals in need of guidance on the difficult compensation issues they will face in the coming year should seriously consider either or both of these resources, which are packed with data and insights for credit unions of every stripe."

Here are some highlights from the report:

- About 80% of credit unions anticipate providing salary increases in 2017 for management employees (including the CEO), while closer to 85% are planning increases for their nonmanagement employees. With only a few exceptions, anticipated 2017 salary increases for both management personnel and nonmanagement staff tend to increase as credit union asset size increases.

- Three in four credit unions provided some form of variable pay – bonuses (after-the-fact rewards for a job well done) and/or incentives (awards tied to preset performance criteria) to their full-time employees by year-end 2015. The prevalence of variable pay rises with asset size. While fewer than 40% of credit unions with $1 million to $5 million in assets provided some form of variable pay, the figure comes in at 90% or higher for those with assets of $100 million or more.

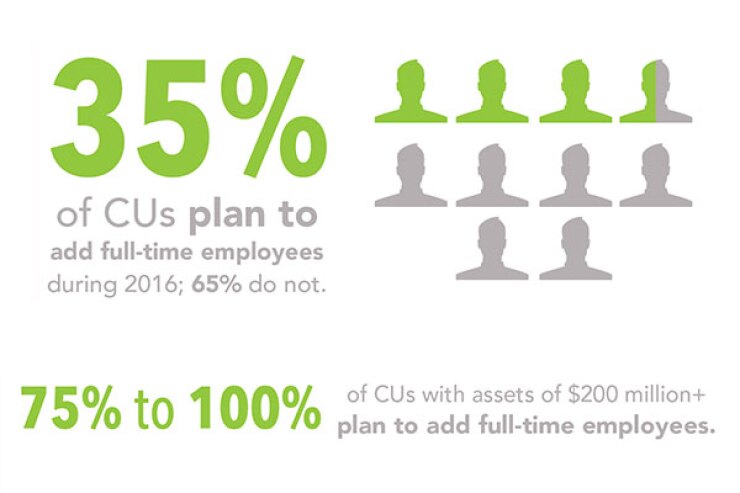

- Hiring intentions among credit unions continue to be strong. Thirty-five percent plan to add full-time employees to their payrolls by year-end 2016. On average, they plan to add 5.1 full-time employees. That rises with asset size, with credit unions with assets of $2 billion or more anticipating adding more than 30 additional full-time employees, on average.

- Two-thirds of credit unions had formal CEO succession plans as of early 2016, while an additional 13% expected to establish such plans by year's end. CEOs are expected to retire sometime during the next two years at approximately 10% of credit unions.

To learn more about and order the 2016-2017 CUNA Staff Salary Report, CUNA Compensation Analytics, and additional 2016-2017 CUNA Compensation Resources, visit