Credit unions could see their bottom lines start to take a hit as last year's refi boom begins to simmer down.

Mortgage refinancing activity went through the roof

The short answer is: it depends who you ask.

“We expect that refis will slow down in the second half of 2020,” said Joel Kan, AVP of industry and economist forecasting of the Mortgage Bankers Association, of which some CUs are members. “And the reason behind that is we’re reaching a point where we’re seeing fewer and fewer borrowers with rates high enough that would be worth refinancing.”

As reported, the refi boom also

The MBA Mortgage Finance Forecast slates the refinance share percentage at 32% for 2020, compared to 38% the year before. The same report predicts that by 2022, the refinance share percentage will only make up 24% of business.

But Mina Worthington, president and CEO of Solarity Credit Union, expects to see refi activity continue this year – at least up to a point. With that in mind, the credit union keeps any refis on its books. That way, she said, the $722 million-asset shop “can get ahead of the run-off as well in refinancing loans with existing members.”

The Yakima, Wash.-based institution has had a stronger start to the year than it did in 2019, which Worthington attributes to lower interest rates and a strong economy. Solarity booked about $113 million in mortgages last year, evenly split between purchases and refis. Worthington said she does not expect that ratio change much in 2020.

Even if rates keep dropping, the refi market “will remain pretty strong” in the year ahead, said Nicole James, SVP of retail services at RTN Federal Credit Union in Waltham, Mass.

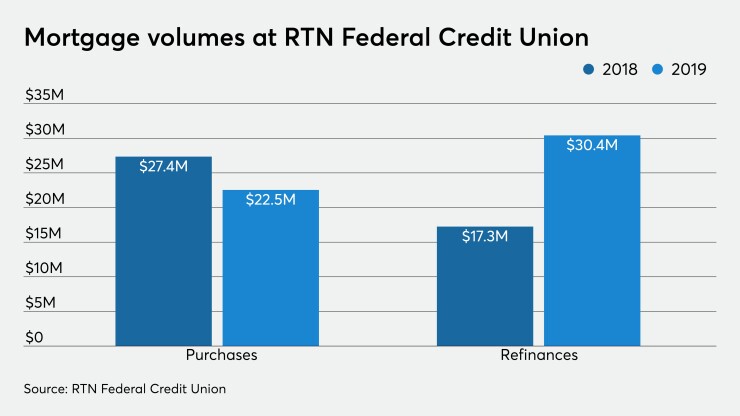

RTN refinanced 104 loans in 2019 to the tune of $30.4 million, up from 54 loans in 2018.

‘A hit’ coming

Many credit unions originate mortgages and then sell them to the secondary market, such as to government sponsored entities like Fannie Mae or Freddie Mac. That’s a strong moneymaker for the industry, said Steve Rick, chief economist at CUNA Mutual Group, noting that credit unions make millions through the gains of mortgage sales. But that could start to slow in 2020.

“Credit unions will see a hit to their bottom line as they won’t see as many refis and purchase mortgages,” he said.

At Solarity Credit Union, around 90% of mortgage loans are sold to Fannie Mae, but the credit union still services the loan – a member-service tactic many credit unions employ. Solarity officials also said about 50% of incoming business on the mortgage side is generated through direct referrals from Realtors and existing members. That kind of word-of-mouth marketing is likely to be especially important in the coming months if credit unions hope to boost loan volumes amid a dwindling refi market.

Even with refinance business slowing, there are other avenues of growth that credit unions can pursue, sources said. Millennials are speedily approaching the prime age to become homebuyers, and Rick suggested that could help buoy the housing market since as of last year that demographic

The industry also continues to make gains in market share. Credit unions only held about 2% of the mortgage market before the Great Recession, but today CUs account for about 9% of all mortgage originations, said Rick, citing National Credit Union Administration call reports and data from the Mortgage Bankers Association.

But there’s still plenty on the horizon keeping CU leaders awake at night, despite that good news.

“We have a ton of pre-approvals right now, so we’re looking forward to a strong 2020,” said RTN’s James. “I think the area that always brings a little bit of uncertainty is that as we get to the end of the year with an election, regardless of who wins, that always brings a little bit of uncertainty in the market, because the market is very obviously driven by rates.”